Food Stamps For The Elderly & Disabled

It has been mentioned in the above eligibility requirements that households containing an elderly or disabled individual are held to different requirements. This includes increased limits for both income and resources. In order to fall under the special eligibility requirements, the following definitions are used.

Elderly:

- Someone that is 60 years old or older.

Disabled:

- Receives benefits through SSI, social security disability, or blindness payments.

- Receives disability or blindness payments through a state program that follows the rules of SSI.

- Receives disability retirement benefits through a government agency due to a disability that is deemed permanent according to the Social Security Act.

- Eligible for Medicare or disabled according to SSI rules and receives annuity payments under the Railroad Retirement Act.

- A veteran who is disabled, homebound, or in need of consistent aid.

- The surviving spouse or child of a veteran who is considered permanently disabled and receiving VA benefits.

SNAP eligibility is extended to many non-citizens based on their immigration status. In order to be eligible for SNAP, you must fit in one of the following qualified alien categories.

In order for non-citizens to be eligible for SNAP, they must fit into one of the above categories as well as meet one of the following conditions.

What non-citizen groups are ineligible for SNAP based on their citizenship status? There are five groups that are considered ineligible.

Excludes all vehicles

What Are Allowable Deductions When Determining Net Income

In regards to eligibility, your net pay is what is considered for income. To figure out your net income, you must first start with your gross income and then deduct all allowable deductions. For SNAP eligibility, there are seven acceptable deductions. Not all of these may apply to every person, but if any of them apply to your household, they can be deducted prior to submitting your application for consideration.

The allowable deductions are:

Once these deductions are subtracted from your income, your eligibility can be considered. In order to determine your allotment, they will take 30% of the net income to subtract from the maximum allotment amount for your household size. The deductions play a significant role in both eligibility and the determination of benefits.

If you are unsure of whether or not a specific deduction applies to you, you can ask a representative at your local SNAP office. However, if you think it applies, it is best to figure it in. If it doesnt, they will make the appropriate adjustments when determining your benefits. The lower you can get your net income by subtracting deductions, the more likely you will be to qualify for SNAP benefits.

Eligible Food Items Under Snap

As per USDA rules, households can use SNAP benefits to purchase:

- Foods for the household to eat, such as:

- fruits and vegetables

Soft drinks, candy, cookies, snack crackers, and ice cream are classified as food items and are therefore eligible items. Seafood, steak, and bakery cakes are also food items and are therefore eligible items.

Energy drinks which have a nutrition facts label are eligible foods, but energy drinks which have a supplement facts label are classified by the FDA as supplements, and are therefore not eligible.

Live animals and birds may not be purchased but live fish and shellfish are eligible foods. Pumpkins are eligible, but inedible gourds and solely ornamental pumpkins are not.

Gift baskets containing both food and non-food items “are not eligible for purchase with SNAP benefits if the value of the non-food items exceeds 50 percent of the purchase price. Items such as birthday and other special occasion cakes are eligible as long as the value of non-edible decorations does not exceed 50 percent of the price.”

Don’t Miss: File For Food Stamps In Iowa

How To Check Your Application Status

Depending on your method of application, you can check your application status in the following ways:

- If you applied online, you can check your application status using Massachusettss DTA Connect website here.

- If you applied , you can call 1 382-2363 to check the status of your application.

- If you applied in person and provided all the necessary information and documentation, you will receive a determination the day you apply.

The Modernization Of The Thrifty Food Plan Is Long Overdue

As American grocery habits, food bills, and nutrition guidelines have transformed, the TFP has stayed the same: Its last revision was in 2006, and the estimate has only been adjusted for inflation since its inception in 1975.

The TFP has long been known to rely on unrealistic assumptions that undermine the true cost of a nutritious, practical diet. For example, the TFP has not historically considered the time or equipment required to cook when determining the set of foods included in the benefit. It does not meet federal nutrition guidelines or reflect what households actually eat and it fails to account for current economic realities or costs of living, as well as the costs of specific cultural foods or special dietary needs. Moreover, the national legacy of systemic racismincluding redlining and other practices that have created disparities in access to food and transportationmeans that these harmful assumptions can have a disproportionate impact on low-income people of color.

The 2021 reevaluation begins to correct some of TFPs unrealistic assumptions. Perhaps most importantly, the cost constraint no longer applies. Rather than shaping food plans for a healthy diet within the already limited cost of the TFP, the USDA determined what foods and beverages would be included and then calculated a newly estimated cost. The result is a long-overdue increase to TFP and SNAP purchasing power that better reflects families lived experiences and dietary needs.

Recommended Reading: Whats The Cut Off For Food Stamps

Immigrant Status And Eligibility

The 2002 Farm Bill restores SNAP eligibility to most legal immigrants that:

- Have lived in the country for 5 years or

- Are receiving disability-related assistance or benefits or

- Have children under 18

Certain non-citizens, such as those admitted for humanitarian reasons and those admitted for permanent residence, may also be eligible for SNAP. Eligible household members can get SNAP benefits even if there are other members of the household that are not eligible.

Food Stamp Act Of 1964

The Food Stamp Act of 1964appropriated $75 million to 350,000 individuals in 40 counties and three cities. The measure drew overwhelming support from House Democrats, 90 percent from urban areas, 96 percent from the suburbs, and 87 percent from rural areas. Republican lawmakers opposed the initial measure: only 12 percent of urban Republicans, 11 percent from the suburbs, and 5 percent from rural areas voted affirmatively. President Lyndon B. Johnson hailed food stamps as “a realistic and responsible step toward the fuller and wiser use of an agricultural abundance”.

Rooted in congressional logrolling, the act was part of a larger appropriation that raised price supports for cotton and wheat. Rural lawmakers supported the program so that their urban colleagues would not dismantle farm subsidies. Food stamps, along with Medicaid/Medicare, Head Start, and the Job Corps, were foremost among the growing anti-poverty programs.

President Johnson called for a permanent food-stamp program on January 31, 1964, as part of his “War on Poverty” platform introduced at the State of the Union a few weeks earlier. Agriculture Secretary Orville Freeman submitted the legislation on April 17, 1964. The bill eventually passed by Congress was H.R. 10222, introduced by Congresswoman Sullivan. One of the members on the House Committee on Agriculture who voted against the FSP in Committee was then Representative Bob Dole, of Kansas.

The major provisions were:

Recommended Reading: How To Sign Up For Food Stamps In Tennessee

Can I Get Food Stamps If I Dont Pay Rent

Calculating the value of your food stamps is complex. But if you don’t pay rent and wonder if you are eligible for food stamps benefits, it all depends on the situation and circumstance around why you don’t pay rent. There are a variety of reasons as to why someone who does not pay rent may need SNAP benefits. This may include homeless individuals, college students, or those who live with friends or family.

So if you don’t pay rent, do you qualify for food stamps benefits? In most cases, you can. Although there are a few exclusions, and that you probably will not receive as much benefit as those who do pay for rent, for the most part, you can receive food stamps even if you do not pay for rent.

However, there are certain circumstances sometimes where you wonât be able to receive SNAP benefits if you do not pay rent. This is because there are housing situations where it will make you unqualified for food stamps either if you pay for rent or not. It is important to make note of these situations.

According to USDA, some individuals who are not eligible for food stamps if they donât pay rent includes:

â Young adults living with their parents do not qualify

If you are a young adult who resides with your parentâs home, you usually will not be eligible for food stamps benefits since you are usually required to be included as part of your parentâs household food stamp.

â Borders are considered an exception and are not eligible for benefits

An Increase To Snap Benefits Will Also Help To Reduce Poverty Alleviate Hunger Improve Well

More than 90 percent of SNAP benefits reach households at or below the federal poverty level. Even at its current inadequate amounts, SNAP is credited with lifting millions of people above the federal poverty line each year. Yet by better aligning SNAP benefit amounts to peoples lived realities, policymakers can help strengthen this anti-poverty impact.

Due to Americas long history of structural racismincluding factors such as racial wage gaps, occupational segregation, and a lack of adequate safety netsBlack, Native American, and Latino households are more likely than white households to experience food insecurity and poverty. This, in turn, means these groups are also disproportionately affected by low SNAP benefits.

Research clearly demonstrates that increases to SNAP benefits are associated with and improvements to overall well-being. For children in particular, access to adequate SNAP benefits is tied to a lower risk of nutritional deficiencies and health conditions, as well as higher educational attainment and labor market outcomes.

And finally, increasing SNAP benefits strengthens the program as a source of economic stimulus: Every $1 invested in SNAP during a downturn generates up to $1.80 of economic activity.

Read Also: Can I Renew My Food Stamps Online

The Food Stamp Program Benefit

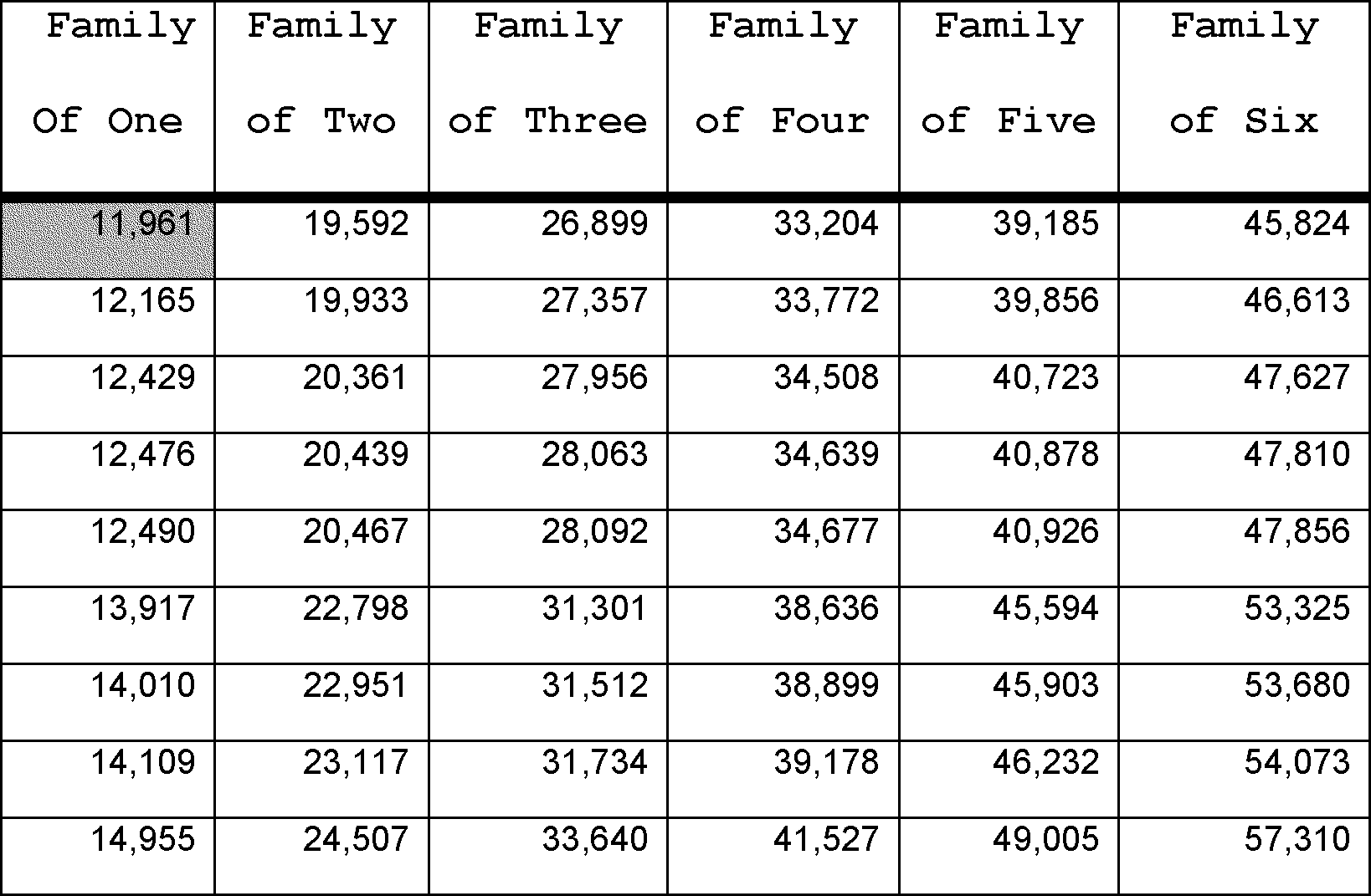

Once eligibility is established, participating households are expected to be able to devote 30 percent of their counted monthly cash income to food purchases. The FSP benefit then makes up the difference between 30 percent of countable income and a maximum benefit level that is derived from a model budget developed by the U.S. Department of Agriculture, called the Thrifty Food Plan . Because both the TFP and the allowable standard deduction vary by household size, benefits vary as well. The maximum benefit schedule is detailed in Table 1. Few households receive the maximum benefit, because most have countable income.

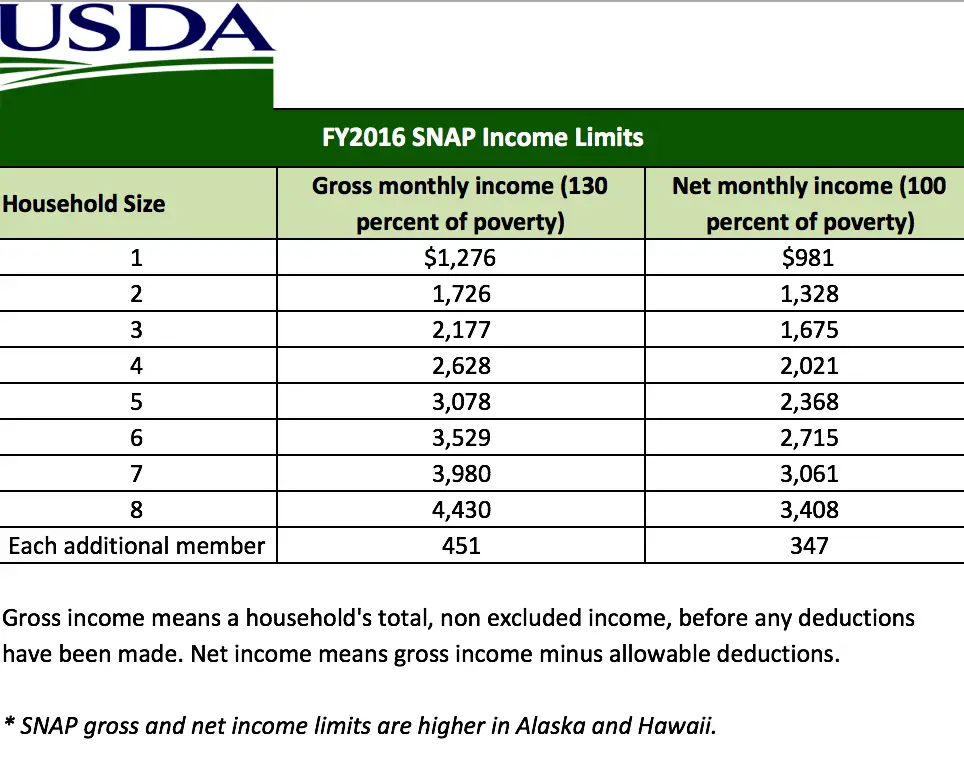

Table 1. Maximum monthly Food Stamp Program allotment and income limits, by household size, 2004| Household |

|---|

| a. Values differ for Alaska, Hawaii, Guam, and the U.S. Virgin Islands. |

| b. Gross income is the household’s total nonexcluded income before any deductions. Net or countable income is gross income less allowable deductions. |

Calculation of the FSP benefit is highly dependent on the nature and amount of deductions for the household unit. Consequently, benefit calculation is best illustrated by example. We begin with a simple illustration of eligibility and benefit determination pertinent to SSI recipients and then highlight variants.

Details About The Largest Increase To Snap Benefits In The Programs History

In October 2021, millions of people who use the Supplemental Nutrition Assistance Program will see an increase to the benefits that help them feed themselves and their families. This change was made possible by a seemingly obscure process: the reevaluation of the U.S. Department of Agricultures Thrifty Food Plan.

Also Check: How To Know If I Am Eligible For Food Stamps

Can I Get Food Stamps If I Am On The Gi Bill

Military veterans and others who are taking advantage of the GI Bill program are sometimes curious if GI Bill money or BAH income is counted towards the income requirements for SNAP. The answer is yes, BAH income is typically counted towards your gross income when determining if you are eligible for food stamps. As such, your GI Bill benefits do contribute to your income, even though that income is temporary and not taxed. Receiving BAH does not stop you from being eligible for food stamps outright, it is just included in the income calculation.

SNAP Overview

The federal food stamp program is now called the Supplemental Nutrition Assistance Program . SNAP is the largest domestic program available to nutritional assistance, and it is available for low-income individuals and families that meet the eligibility requirements. The federal food and nutrition service works with a wide range of other organizations including state agencies, nutrition educators, and neighborhood organizations to provide SNAP recipients with nutrition assistance and information.

The local agencies provide aid for people while they are going through the application process, and once people are approved, these agencies help them to access their benefits. The goal of this program is to provide monetary assistance with food while the members of the household are actively looking for work or working in positions that do not pay enough to cover food and living costs.

Benefits

Example of Benefits Allotment

The College Student Hunger Act Of 2019

Senator Elizabeth Warren and Congressman Al Lawson introduced The College Student Hunger Act of 2019 on July 17, 2019, in an attempt to extend SNAP benefits for college students in need. The idea was to include both Pell Grant-eligible students and independent students. Warren and Lawson both believe that students have a right to both food and education, and the goal was to alleviate financial tension. This bill has been endorsed by several organizations including Bread for the World. Specifically, the Act would allow Pell-Grant eligible and independent students to qualify for benefits, lowers the 20 hours/week work requirement to 10 hours/week, and requires the Department of Education to notify Pell Grant eligible students of their SNAP eligibility. The student hunger pilot program will test different ways students can use SNAP benefits such as directly at the dining hall or indirectly to help pay for student meal plans.

Don’t Miss: Can You Buy Formula With Food Stamps In Florida