Learn About Florida Food Stamps Requirements

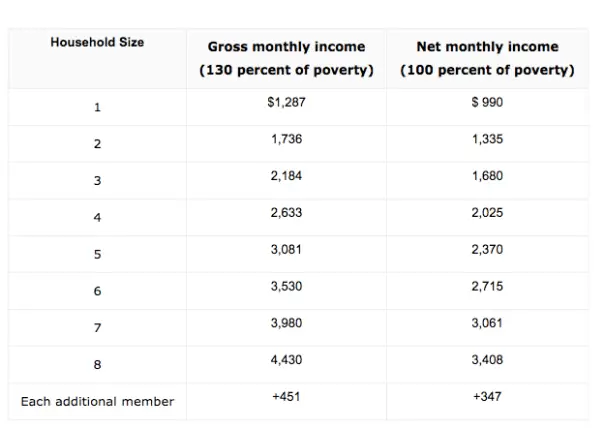

Florida food stamps eligibility requirements are based primarily on a households income and family size. Income limits are based on the nations federal poverty level . In general, families must not exceed a certain percentage of the FPL with their monthly income. These limits, however, will vary by family size and household demographics.

Applicants should also be aware of additional food stamp qualifications such as residency, citizenship and even work requirements. They should also remain aware of how to best maintain their eligibility after they begin to receive benefits. Read on for more information about how to qualify for food stamps.

Learn About Income Guidelines For Residents

Your eligibility for food stamps will also depend on your household income. To qualify, all households except those with inhabitants who are disabled or 60 years of age and older, are required to have gross and net income eligibility tests.

To meet eligibility, the maximum gross income must be lower than the threshold. Income guidelines are relative to the Federal Poverty Level , which considers the number of household members.

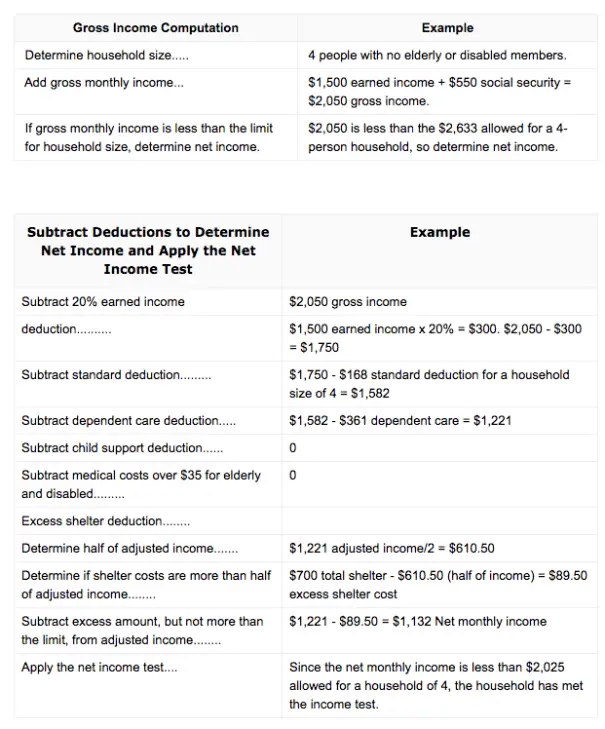

If your household surpasses the gross income determination test, then the net income is calculated by deducting certain allowances such as dependent care and child support and medical expenses in some cases.

According to the income guidelines , your household may also be subject to a resource limit. A resource is defined as an item that you could draw upon or sell to help you financially.

Your household will also have to meet a resource limit. If it contains a member who is disabled or at least 60 years old, the limit is $3,500. If not, the resource limit is $2,250.

Income guidelines stipulate three types of resources, which may affect eligibility and the amount of benefits received.

These include:

- Liquid resources, or all readily available funds, such as cash, money in savings and checking accounts, savings certificates or bonds, stock, trust deeds and funds in retirement accounts.

- Non-liquid resources like personal property, land, buildings and recreational properties.

- Excluded resources that are not in the above categories.

Maximum Monthly Amounts On Food Stamps

There is a maximum monthly allotment based on the size of the household. When determining your benefit allotment, they will take your net monthly income and multiply it by 30%. That number will then be subtracted from the maximum monthly allotment. The remaining amount is the total monthly allotment you will receive based on your application. This amount may change if your income or household size changes.

SNAP benefits are a specific money amount provided to recipients each month to go towards nutritional foods. Recipients are provided with an electronic benefits transfer card, and money is added to the card each month. You can check your balance by phone, and any unused funds at the end of the month remain on the card to be used to following month. Once allocated, benefits will not expire.

Benefits can be used to buy food and drinks at most grocery stores, convenient stores, gas stations, pharmacies that sell food, and farmers markets. Benefits cannot be used to buy alcohol, tobacco, medicine, hot food, food meant to be eaten in the store, or any non-food items.

Read Also: How Do I Get Food Stamps In Texas

Florida Food Stamps Income Limit

The Florida food stamps income limit is the biggest factor in deciding whether your SNAP application will be approved or not.

In order to use the SNAP income limit chart, you must first calculate your total monthly gross income for your household.

Your total gross income is compared to a percentage of the federal poverty level to determine if you qualify for Florida food stamps.

Once you know your households total gross income, expenses like childcare, medical expenses and housing costs and subtracted to calculate your total net income.

Your households total net income is used to determine how much you will receive in FL SNAP benefits each month.

Now that you know it works, you can use the Florida food stamps income limit chart to determine if your household qualifies for food assistance benefits.

In addition, we will walk you through the steps to successfully calculate your gross and net monthly income including standard and allowable deductions for your household.

How To Calculate Net Income

Now that you have your households monthly gross income, you can use that number to calculate your net income. Use the chart below to calculate your monthly net income and determine if your household is eligible for Florida SNAP EBT benefits.

Please not that there may be exceptions to the net income calculation. These exceptions apply to household members that are elderly or disabled. For more information or immediate help, in your county.

| How to Calculate SNAP Net Income | |

| Net Income Calculation: | |

| Determine if shelter costs are more than half of adjusted income | $700 total shelter $602 = $98 excess shelter cost |

| Subtract excess amount, but not more than the limit, from adjusted income | $1,204 $98 = $1,106 net monthly income |

| Apply the net income test | Since $1,106 is less than $2,209 allowed for a 4-person household, this household has met the income test. |

Also Check: Grocery Stores That Take Food Stamps

How Do I Apply For Snap

There are several options for applying. Only one member of the households needs to apply for the total household, but everyone living in the household needs to be included on the application along with their income. Most states provide an online application to start the process. See the States website section for a link to your states website. If your state does not provide an online application or you do not have access to a computer, you can go to your local state or county office to apply.

As part of the application process, you will need to go to your local state or county office for a face-to-face interview. If you are not able to go to the local office or apply online, you can designate an authorized representative. This is someone you give authority to represent you. You have to designate the person in writing to be official. This person can be a friend or relative.

The entire process generally involves filling out an application, going in for a face-to-face interview, and providing verifications for needed information such as income, residency, and expenses. If because of age or disability, an applicant is unable to go to the office and cannot appoint a representative, the interview may be waived at the discretion of the local office. However, if the interview is waived, the applicant will have to have a phone interview or consent to a home visit instead.

Supplemental Nutrition Assistance Program

The Supplemental Nutrition Assistance Program helps low-income households buy nutritious food. It is also called the Food Assistance Program within the state of Florida.

A SNAP household is normally a group of people who live together and buy food and prepare meals together. If your household passes SNAP’s eligibility rules, the amount of benefits you receive will depend on the number of people in your household and how much monthly income is left after certain expenses are deducted. An applicant must be a U.S. citizen or have a qualified noncitizen status. Asset limits only apply to households with a member disqualified for breaking Food Assistance Program rules felony drug trafficking, running away from a felony warrant, or not participating in a work program. If at least one person is age 60+ or disabled, the limit goes up to $3,000 in countable assets.

Recommended Reading: Does 7 Eleven Take Food Stamps

Determine Florida Food Stamps Eligibility

If you want to apply for Florida SNAP program benefits, you will need to meet the program eligibility requirements.

Here is a quick review of the Florida food stamps eligibility rules:

To get Florida food stamps, you must:

- Live in the state of Florida

- Provide proof of citizenship or have a qualified non-citizen status

- Provide proof of your Social Security number or proof that you have applied for a Social Security number

- Meet income and financial resource limits

- Meet work requirements and

- Cooperate with child support enforcement .

Food Stamps Program Updates & Requirements

Stimulus Package Update: The U.S. Secretary of Agriculture has announced more flexibility for the Supplemental Nutrition Assistance Program and removed some roadblocks that would typically exist within the process of attaining food assistance.

The waiver will help enable children, seniors and participants with disabilities to be able to get food during this global pandemic in an easier way.

The legislation, passed a few weeks ago, will allow SNAP participants to receive two supplemental payments of benefits during this time of quarantine if they do not currently receive the maximum amount of benefits each month.

Under the new waiver, the USDA is giving individual states the option to let parents/guardians acquire the food that they need for their families or children without the need for the children to be present. Typically, the children are required to be present to receive meals from the Child Nutrition Programs.

Since the USDA realized that this may not be feasible for most families during this pandemic, they have teamed up with local and state authorities to ensure program operators are continuing to feed the families in need. More flexibilities include:

You May Like: What Are The Requirements To Get Food Stamps In Texas

Florida Food Stamps Income Limit Questions

We hope our post on the Florida Food Stamps Income Limit for 2021-2022 was helpful to you! If you need additional help determining your eligibility for food stamps or submitting your application for Florida SNAP, please let us know in the comments section below.

If you found this article helpful, we encourage you to please share it with someone using the Share this button below.

In the meantime, be sure to check out our other articles on Florida SNAP EBT:

What To Know About Floridas Food Stamps Program During The Pandemic

The number of people needing assistance to get food is growing in Florida as unemployment climbs amid the economic meltdown caused by the coronavirus pandemic.

In Florida, the federal Supplemental Nutrition Assistance Program, commonly referred to as SNAP and once known as food stamps, is administered through the states Department of Children and Families.

In recent weeks, the state has worked to waive some of the programs requirements and to temporarily increase recipients maximum benefits.

Working to handle a deluge of people, the department has also expanded customer call center hours.

Heres what you need to know:

How does SNAP work?

Floridians making a gross income of less than or equal to 200 percent above the federal poverty line could potentially be eligible for SNAP. For a single person, that would equate to a gross income of $2,082 or less a month. The states website lays out full criteria and reasons why a person may be ineligible.

SNAP recipients get an electronic benefits card, similar to a debit card, that can be used to buy food grocery items. It cannot be used for things like alcohol, cigarettes or hot foods. In Florida, different recipients get their benefits on different days.

How have benefits changed since the pandemic?

And, following the federal Families First Coronavirus Act, Gov. Ron DeSantis moved to temporarily waive work requirements for those participating in the program.

How many people are we talking about here?

How do I apply?

Don’t Miss: Can You Buy Formula With Food Stamps In Florida

I Need Food Stamps Now It Is An Emergency

Some households may get Expedited Services, as per federal rules that is food assistance benefits within 7 calendar days if your household has less than $150 in monthly gross income and liquid resources of $100 or less or your rent/mortgage and utilities are more than your households combined monthly income and liquid resources, or a member of your household is a migrant or seasonal farmworker. In order to get expedite assistance, if you qualify, provide all required information and proof as soon as possible. You can always contact the local DCF Office for more information.

What Time Will My Food Stamps Post To My Florida Ebt Card

In Florida, Food Stamp Benefits are deposited into EBT Card accounts from the 1st to the 28th of every month.

When your payment is deposited depends on the 9th and 8th digits of your case number , dropping the 10th digit. Here is the schedule:

Food stamps benefits are available by 6 am on the payment day.

| If the 9th and 8th digit of your Case number is | Benefits are deposited on the |

| 00-03 | |

| 28th of the month |

*Cash benefits are made available on the 1st through the 3rd day of every month.

Once your benefits are deposited into your account, you can begin using them with your Florida EBT card to purchase eligible food items. For a full list of approved food items, see the Food Stamps Eligible Food List here.

Recommended Reading: Food Stamps For College Students California

Ssi Participation And State Food Stamp Program Management

There is indirect evidence that supports the hypothesis that the prevalence of FSP participation could be increased, at least in some states. Despite the technical issues raised above, there is general agreement that variation across states in estimated FSP participation does bear some relationship to state effectiveness in FSP promotion.6 If this is the case, it is interesting to see if interstate variation in food stamp receipt among households that include SSI recipients is related to variation in estimated aggregate state participation rates. If states with high aggregate participation rates also show exceptional participation by households that include SSI recipients, this would suggest that management makes a difference and that outreach procedures followed in high participation states should be studied and, if appropriate, imitated.

Note that if households with SSI recipients constituted a large fraction of all FSP eligible households, any connection between aggregate FSP take-up and prevalence among households with SSI recipients would be virtually tautological. However, the FNS estimate of the number of persons eligible for the FSP in an average month in 2004 is five times greater than the total number of SSI recipients , so it would be possible for variation in aggregate FSP take-up to occur independently of program participation among households that include SSI recipients.

If You Receive Snap Overpayments

There are three different kinds of SNAP overpayments:

If DCF claims that your household received more food stamps than you should have been given but you believe that you were not overpaid, you have the right to appeal the decision within ninety days.

If you were overpaid benefits, you are still obligated to pay back DCF for the amount of overpayment even if the overpayment was DCFs error. An accidental overpayment does not benefit your household, because it must always be paid back. If you have noticed an overpayment in your SNAP benefits that you believe to be DCFs error, notify them immediately. It cannot benefit you in the long run.

If you do not appeal or if you agree with the overpayment, DCF can do several things to collect the amount that you owe:

- If you are getting SNAP benefits now, DCF will lower your monthly benefits. The amount they will take depends on the type of overpayment you have.

- If you are not getting SNAP benefits, DCF will try to get you to agree to a repayment plan. If you do not agree, they can take your federal tax refund. In some situations, they can also take part of other benefits you get, like Social Security.

Also Check: Can I Renew My Food Stamps Online