If I Get More Benefits Than Im Due Will I Have To Repay The Extra Calfresh Benefits

Yes. If CalFresh determines that you received too much in CalFresh benefits, you will be required to pay those benefits back.

This is an over-payment.

Even if you did not cause the error that led to the overpayment, you will be required to pay back the overpayment.

If this happens, you will be notified in writing and provided options for repayment.

Repayment options include a reduction in your regular allotment each month until the balance has been paid.

To help prevent over-payments, please report your income and household information.

Food Stamps For The Elderly & Disabled

It has been mentioned in the above eligibility requirements that households containing an elderly or disabled individual are held to different requirements. This includes increased limits for both income and resources. In order to fall under the special eligibility requirements, the following definitions are used.

Elderly:

- Someone that is 60 years old or older.

Disabled:

- Receives benefits through SSI, social security disability, or blindness payments.

- Receives disability or blindness payments through a state program that follows the rules of SSI.

- Receives disability retirement benefits through a government agency due to a disability that is deemed permanent according to the Social Security Act.

- Eligible for Medicare or disabled according to SSI rules and receives annuity payments under the Railroad Retirement Act.

- A veteran who is disabled, homebound, or in need of consistent aid.

- The surviving spouse or child of a veteran who is considered permanently disabled and receiving VA benefits.

SNAP eligibility is extended to many non-citizens based on their immigration status. In order to be eligible for SNAP, you must fit in one of the following qualified alien categories.

In order for non-citizens to be eligible for SNAP, they must fit into one of the above categories as well as meet one of the following conditions.

What non-citizen groups are ineligible for SNAP based on their citizenship status? There are five groups that are considered ineligible.

Excludes all vehicles

What If I Am A College Student

To participate in SNAP, a student, in college at least half time, must meet the for SNAP and one of the following criteria:

- Be employed for an average of 20 hours per week and be paid for such employment or, if self-employed, be employed for an average of 20 hours per week and receive weekly earnings at least equal to the Federal minimum wage multiplied by 20 hours.

- Participate in a State or Federally financed work study program during the regular school year.

- Provide more than half the physical care for one or more dependent household members under the age of six or provide more than half the physical care of dependent household member who has reached the age of six but is under the age of 12 where adequate child care is not available.

- Enrolled full-time in an institution of higher education and is a single parent with responsibility for the care of a dependent child under age 12.

- Receive benefits from Family Assistance or federally-funded Safety Net Assistance .

- Receive Unemployment Benefits .

- Attend a SUNY or CUNY comprehensive college, technology college, or community college and are enrolled in a qualified career and technical education program.

- Attend any of the 10 Educational Opportunity Centers in New York State and are enrolled in a career and technical education program, remedial course, basic adult education, literacy, or English as a second language.

Recommended Reading: Free Phones For People On Food Stamps

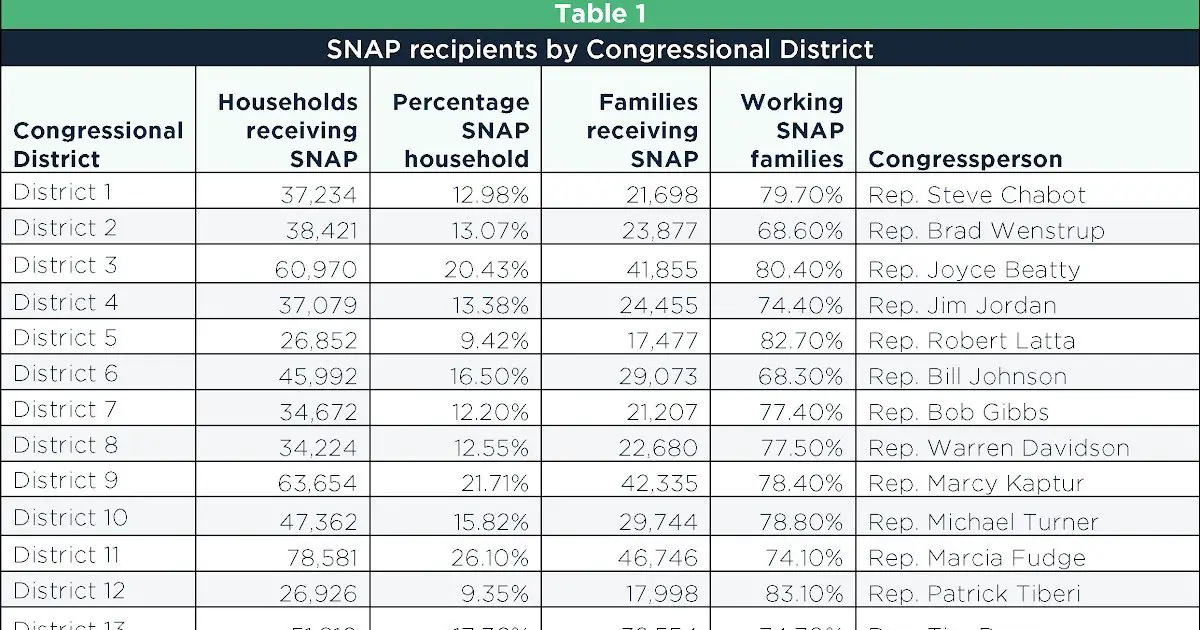

The Prevalence Of Food Stamp Receipt

Table 2 illustrates the use of both resources, SSI and the FSP. The data for each year are separately tabulated by SSI recipient age group. The SSI recipient counts in the first row for each group are from Social Security administrative records and are averages for the months of the fiscal year. These are exact counts of payments made. The counts in the second row are derived from FSPQC sampling probabilities. “Prevalence” is just the ratio of the estimated total number of SSI recipients living in units receiving food stamps divided by the total number of recipients in the relevant age class . Thus we estimate that 939,106 elderly SSI recipients lived in FSP recipient households in 2006 this was 63.6 percent of all SSI recipients in the group. Although the denominators for these statistics are from administrative data and are effectively known with certainty, the FSP recipient counts are sample based and therefore subject to sampling errors. However, since the samples are quite large, confidence intervals around the sample-based recipient estimates are small, so the precision of the prevalence estimates is high.

| SSI recipient characteristic |

|---|

| 63.6 |

| NOTES: SSI = Supplemental Security Income FSP = Food Stamp Program. |

| Ninety-five percent confidence intervals in parentheses are shown in percentage points. |

Legally Owed Child Support Payments

This reduction in child support you are legally obliged to pay for children who do not live in your household, which is not counted under the gross income test and thus a deduction in figuring out your net income.

Your payments for child support is only not countable if you have an administrative order, court order, or any other enforceable legal separation contract of agreement that states that you must pay this amount of money.

If you pass the gross income test, in addition to paying the child support from your earned income, the amount you have compensated will be added back into the sum of your earnings for an increase in your allowed 20% income.

Also Check: Apply For Food Stamps And Medicaid Online

Can I Get Food Stamps If I Dont Pay Rent

Calculating the value of your food stamps is complex. But if you don’t pay rent and wonder if you are eligible for food stamps benefits, it all depends on the situation and circumstance around why you don’t pay rent. There are a variety of reasons as to why someone who does not pay rent may need SNAP benefits. This may include homeless individuals, college students, or those who live with friends or family.

So if you don’t pay rent, do you qualify for food stamps benefits? In most cases, you can. Although there are a few exclusions, and that you probably will not receive as much benefit as those who do pay for rent, for the most part, you can receive food stamps even if you do not pay for rent.

However, there are certain circumstances sometimes where you wonât be able to receive SNAP benefits if you do not pay rent. This is because there are housing situations where it will make you unqualified for food stamps either if you pay for rent or not. It is important to make note of these situations.

According to USDA, some individuals who are not eligible for food stamps if they donât pay rent includes:

â Young adults living with their parents do not qualify

If you are a young adult who resides with your parentâs home, you usually will not be eligible for food stamps benefits since you are usually required to be included as part of your parentâs household food stamp.

â Borders are considered an exception and are not eligible for benefits

Apply For New York City Snap Benefits

If you have reviewed the New York City SNAP Eligibility Guidelines and believe you may qualify for EBT benefits, the next step is to submit your New York City SNAP application.

To apply, there are four ways you can submit your NYC SNAP Application online, over the phone, in-person, and by mail.

See below for details:

Also Check: Alabama Food Stamp Income Limits 2020

Income Requirements For Food Stamps

As an applicant, there are specific income requirements for SNAP that you are responsible for meeting. You may be wondering, What are the income requirements for food stamps? First, you need to report your gross and net monthly incomes for your household. Next, you need to disclose any assets and expenses your family has. Since SNAP is only awarded to low-income families and individuals, you must earn less than a certain amount of income each month. If your household earns too much, you may be disqualified from receiving benefits.

Determine Snap Benefit For Household

According to the table above, the maximum SNAP benefit in 2021 for a family of three is $535.

Therefore, the maximum benefit minus the household contribution equals about $482.

As a result, the familys estimated monthly Florida SNAP benefit amount is $482.

This is the amount we estimate they will be getting each month on their Florida EBT card.

However, to get the exact amount your family will get in Florida SNAP benefits, you will have to apply and have your situation reviewed by a caseworker.

Heres how to apply for SNAP in Florida:

The Florida Food Assistance helps low-income individuals and families buy food needed for good health.

If you meet the program guidelines, you will get a special debit card .

Each month, your food stamps benefits are loaded onto your Florida EBT card, which you can use to purchase approved food items at grocery stores and most farmers markets.

Florida SNAP program is fun by the Florida Department of Children and Families .

You May Like: How To Apply For Food Stamps In Los Angeles

The Deductions That Count

The difference between the value of the FSP benefit calculated on the basis of the FBR and standard deduction alone and the much more substantial actual contribution uncovered in the FSPQC data is attributable to allowed deductions. For SSI recipients, two deductions are likely to be important: excess medical and housing costs. Table 6 reports the prevalence of each type of deduction among FSP recipient households that include SSI recipients. Prevalence is the estimated proportion of SSI/FSP recipients in the living arrangement class for which deduction occurs in some amount. The tabulations in Table 6 are divided by recipient age and living arrangements.

Table 6. Food Stamp Program income deductions for SSI recipients, fiscal year 2004| SSI recipient characteristic |

|---|

| NOTE: SSI = Supplemental Security Income. |

| Total |

|---|

| NOTES: SSI = Supplemental Security Income FSP = Food Stamp Program. |

| a. Excludes California. |

Again, we consider trends. Chart 2 shows the results of extending the calculation of the prevalence of effective excess housing cost deduction over time. For all groups, prevalence is greater in 2006 than in 2001, and in all cases the difference is statistically significant.

Calculating Net Income With Allowable Deductions

Step 1

Subtract any Allowable Deductions

After you have determined which allowable deductions apply to your household, subtract those from your total gross monthly income. Doing this will give you the total net monthly income for your household.

If you need additional help doing this, use the example below:

| Determine if shelter costs are more than half of adjusted income | $700 total shelter $605 = $95 excess shelter cost |

| Subtract excess amount, but not more than the limit, from adjusted income | $1,210 $95 = $1,115 net monthly income |

| Apply the net income test | Since $1,115 is less than $2,146 allowed for 4-person household, this household has met the income test. |

Step 2

Determine if your Net Monthly Income is Eligible

Now that you have your net monthly income, you can see if your income is eligible for New York food stamp benefits. Use the chart and follow the steps below to determine your eligibility.

| Household size |

Note: The allotments described here are for households in New York.

Check out the example for a SNAP benefit calculation below:

Don’t Miss: Access Florida Food Stamps Phone Number

Does Rent Affect Food Stamps

Your rent as well as mortgage have a significant impact on determining the eligibility of your food stamps. However, the formula to calculate food stamps benefits is complicated, so it depends on your household and may not apply to everyone. But typically, the higher the costs of your housing are, the higher the value of your food stamps will be.

According to Mass Legal Help, if you are not paying for rent or utilities and receiving them for free, your food stamps amount will be reduced. Yet if you pay for any amount, even if it is just a small amount, the food stamps will alter.

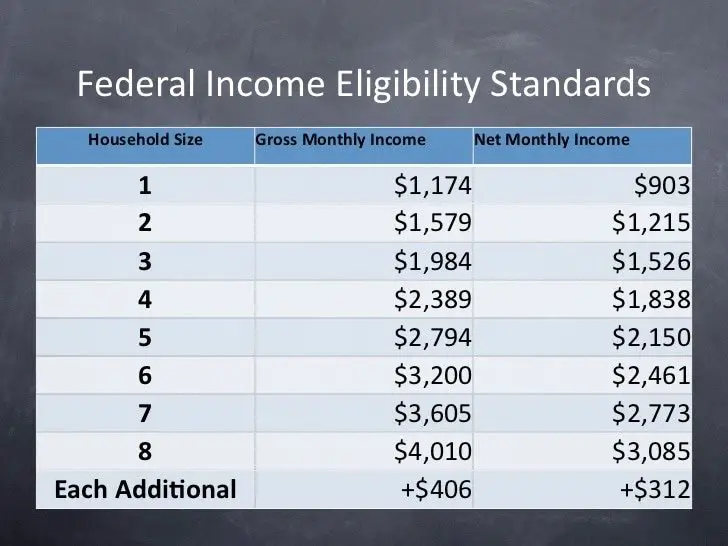

Food Stamp Income Requirements

The SNAP program has eligibility standards for both gross and net monthly income. Most people will need to fit within both the gross and net income guidelines in order to be eligible. Exceptions to this include the elderly. For households including at least one person over the age of 60, only the net income standard is applied. Another exception is those receiving TANF and SSI.

The table below shows the maximum gross and net monthly income based on family size for SNAP eligibility. The gross income is the income you make prior to any deductions. Net income is after deductions. The only exceptions to the chart below are Alaska and Hawaii, which have higher income limits due to the significant increase in cost of living.

| Household Size |

|---|

| +$347 |

Read Also: Income Guidelines For Food Stamps In Texas

When Income Changes

While emphasizing nutrition, the FSP provides real income support, offsetting income decline with increased benefits and reducing these benefits when income rises. For most families, especially those with income based on wages, income changes from month to month. In principle this should mean monthly variation in the FSP benefit as well. In practice, requiring adjustment for small changes in income is administratively inefficient. Instead FSP regulations require reporting only changes in gross monthly income from earnings in excess of $100 and from other sources in excess of $50. Adjustments to changes less than those amounts occur periodically when eligibility is reassessed. Some states operate “Combined Application Projects” or CAPs . Under the CAP demonstrations, SSI recipients living alone without other income can file a shortened Food Stamp application without having a face-to-face interview at the FSP office. Benefit amounts are either standardized or calculated automatically based on a standard shelter and medical expense deduction. An application constructed from the SSA interview is transferred to the FSP office electronically. As of mid-2007, 11 states were operating CAPs in some locations.4CAP cases are expected to experience little month-to-month income change, reducing the need for frequent review and redetermination.