Who Is It For

- People who dont have a lot of money as long as they meet program rules.

- Most adults age 18 to 49 with no children in the home can get SNAP for only 3 months in a 3-year period. The benefit period might be longer if the person works at least 20 hours a week or is in a job or training program. Some adults might not have to work to get benefits, such as those who have a disability or are pregnant.

Learn About Texas Food Stamps Requirements

Your food stamps eligibility in Texas is based on a number of different factors. While some food stamp qualifications are the same for everyone, other requirements only apply to certain households. For example, the eligibility criteria may be different if you live in a household with a senior or person with disabilities. Moreover, there are a few different rules if you are an able-bodied adult without dependents.

This benefit, officially known as the Supplemental Nutrition Assistance Program , is provided by the Texas Health and Human Services Commission . SNAP receives federal funding, but ultimately, the HHSC determines if you are eligible for benefits in the state. Read below to learn how to qualify for SNAP in Texas and discover which requirements may apply to you.

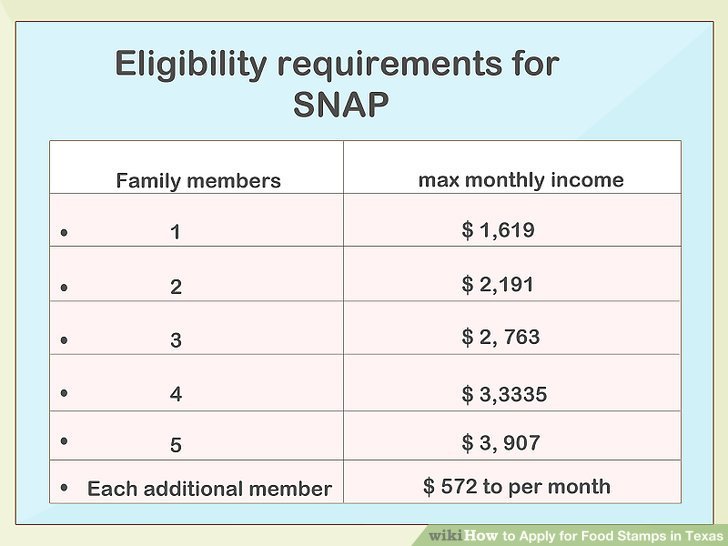

Food Stamp Income Requirements

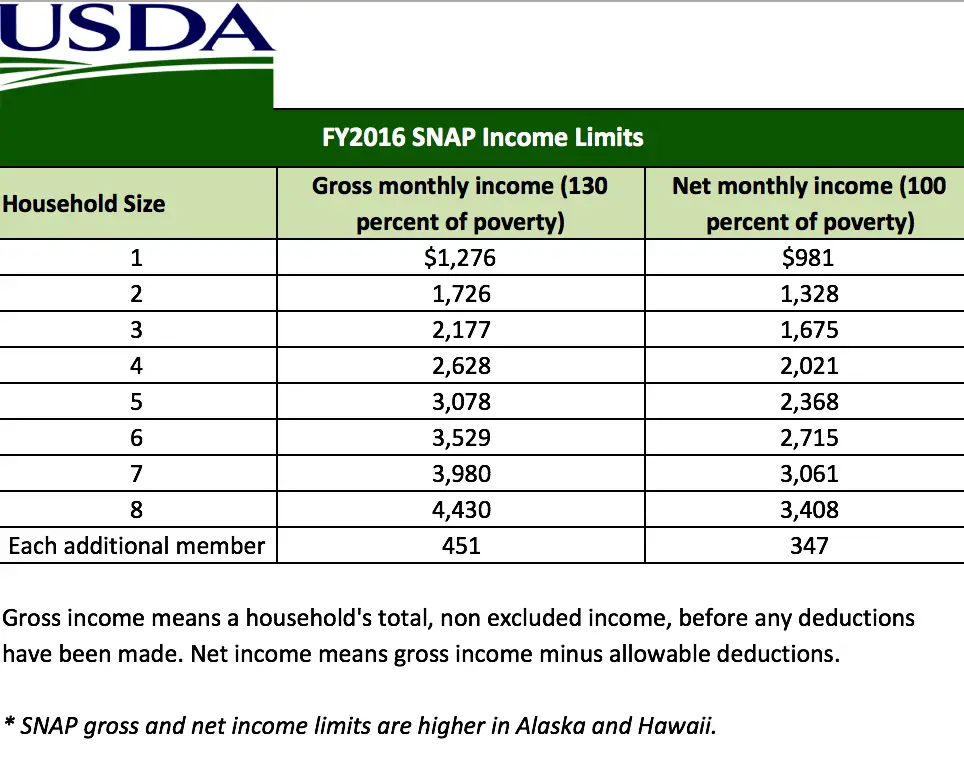

The SNAP program has eligibility standards for both gross and net monthly income. Most people will need to fit within both the gross and net income guidelines in order to be eligible. Exceptions to this include the elderly. For households including at least one person over the age of 60, only the net income standard is applied. Another exception is those receiving TANF and SSI.

The table below shows the maximum gross and net monthly income based on family size for SNAP eligibility. The gross income is the income you make prior to any deductions. Net income is after deductions. The only exceptions to the chart below are Alaska and Hawaii, which have higher income limits due to the significant increase in cost of living.

| Household Size |

|---|

| +$347 |

Read Also: How Do I Renew My Food Stamps Online In Arizona

Special Rules For Elderly Or Disabled

There are several exceptions and exemptions to the SNAP eligibility requirements if a household member is elderly or disabled.

Who is elderly?

In SNAP, you are elderly if you are 60 years or older.

Who is disabled?

In SNAP, you are disabled if you meet ONE of the following criteria:

- You receive Federal disability or blindness payments under the Social Security Act, including Supplemental Security Income or Social Security disability or blindness payments. OR

- You receive State disability or blindness payments based on SSI rules. OR

- You receive a disability retirement benefit from a governmental agency because of a permanent disability. OR

- You receive an annuity under the Railroad Retirement Act and are eligible for Medicare or are considered disabled under SSI. OR

- You are a veteran who is totally disabled, permanently homebound, or in need of regular aid and attendance. OR

- You are the surviving spouse or child of a veteran who is receiving VA benefits and is considered permanently disabled.

There are several exceptions and exemptions to the SNAP procedures if a household member is elderly or disabled.

A person is considered elderly for SNAP purposes if they are 60 years or older.

What Deductions Are Allowed For Net Income

To calculate your households net income, you have to subtract allowable deductions from your households gross income.

The following deductions are allowed for SNAP:

- A 20-percent deduction from earned income.

- A standard deduction of $167 for household sizes of 1 to 3 people and $178 for a household size of 4 .

- A dependent care deduction for the out-of-pocket childcare or other dependent care expenses that are necessary for a household member to work or participate in education or training

- Medical expenses for elderly or disabled members that are more than $35 for the month if they are not paid by insurance or someone else.

- In some states, a child support deduction for any legally obligated child support that a member of the household pays

- In some states, a standard shelter deduction for homeless households of $152.06.

- Excess shelter costs as described below.

Also Check: Apply For Food Stamps Lexington Ky

How Do I Apply For Snap

There are several options for applying. Only one member of the households needs to apply for the total household, but everyone living in the household needs to be included on the application along with their income. Most states provide an online application to start the process. See the States website section for a link to your states website. If your state does not provide an online application or you do not have access to a computer, you can go to your local state or county office to apply.

As part of the application process, you will need to go to your local state or county office for a face-to-face interview. If you are not able to go to the local office or apply online, you can designate an authorized representative. This is someone you give authority to represent you. You have to designate the person in writing to be official. This person can be a friend or relative.

The entire process generally involves filling out an application, going in for a face-to-face interview, and providing verifications for needed information such as income, residency, and expenses. If because of age or disability, an applicant is unable to go to the office and cannot appoint a representative, the interview may be waived at the discretion of the local office. However, if the interview is waived, the applicant will have to have a phone interview or consent to a home visit instead.

A1423 Dependent Care Deduction

Revision 15-4 Effective October 1, 2015

The maximum dependent care deduction is up to and including:

- $200 a month for each child under age 2,

- $175 a month for each child age 2 or older, and

- $175 a month for each adult with disabilities.

An earned income deduction is allowed for the actual cost of unreimbursed payments up to and including the maximum amount when the individual incurs an expense for:

- the care of a child or adult with disabilities and/or

- transportation of a child to and/or from day care or school.

The expense must be both necessary for employment and incurred by an employed person who is included in the Temporary Assistance for Needy Families budget group or would be included except the person is disqualified for a reason listed in A-1362.2, TANF Budgeting for a Household Member Disqualified for Noncompliance with SSN, TPR, Failure to Timely Report a Certified Child’s Temporary Absence, Intentional Program Violation, Being a Fugitive or a Felony Drug Conviction. The expense for household members meeting these requirements is allowed, even if there are other adults in the household who could care for the children.

The deduction in the budgetary and recognizable needs tests is allowed.

You May Like: Apply For Food Stamps Lexington Ky

Snap Benefits: How To Qualify Apply And How Much To Expect

The March 2021 American Rescue Plan expanded the generosity and loosened the requirements of the SNAP program to help food-insecure Americans get through the COVID-19 pandemic.

SNAP, which provides money for food monthly to low-income individuals and families, is a program of the U.S. Agriculture Department and administered by state and local agencies. The average SNAP benefit per household in 2021 was $210.07 a month, according to USDA Food and Nutrition Service.

But many Americans, long before the coronavirus, have benefited from the nearly six decade-old program, originally known as Food Stamps. Its a bridge for millions of Americans a year to better times, and even can lift people out of poverty. In 2019 alone, about 38 million, or one in nine, Americans used SNAP. In 2021, that was up to 42 million as the American Rescue Plan went into effect.

Traditionally, more than half of SNAP recipients are families with children. Nearly half of SNAP beneficiaries 42% pre-pandemic are working families with an income, who cant make ends meet.

How Much Food Stamps Will I Recieve

The total amount of food stamps benefits your household gets each month is based on your income and number of people in your household.

The federal government expects SNAP households to spend about 30 percent of their own resources on food.

Therefore to determine how much in food stamps you will receive if you apply, you have to multiply your households net monthly income by 0.3.

After that, subtract the result from the maximum monthly allotment for your household size using the table below

Note: The total amount of SNAP benefits your household gets each month is called an allotment.

Food Stamps Maximum Monthly Allotment Based on Household Size

| People in Household | |

|---|---|

| Each additional person | +$146 |

Note: The allotments described here are for households in the 48 contiguous States and the District of Columbia.

The allotments are different in Alaska, Hawaii, Guam, and the U.S. Virgin Islands.

Read Also: Can You Get Enfamil On Food Stamps

Food Stamps Program Requirement Information

Eligibility for Food Stamps depends upon a number of factors. To qualify, applicants must meet personal and financial requirements specified by the program. Income guidelines allow the state to identify and offer benefits to households in need.

Eligibility for food stamps is reserved for individuals and families who are struggling to purchase nutritious food.

Learning who is eligible for benefits is the first step in the application process for food stamps.

C1315 Irs Monthly Income Thresholds

Revision 21-2 Effective April 1, 2021

Each year, the Internal Revenue Service establishes income thresholds for earned and unearned income. People whose income exceeds the federal income tax filing threshold are expected by the IRS to file a federal income tax return under federal law. The IRS monthly income thresholds are used to determine if a persons income must be counted when calculating Modified Adjusted Gross Income financial eligibility, as explained in A-1341, Income Limits and Eligibility Tests, for Medical Programs, Step 3.

Determining whether a person is expected to be required to file a federal income tax return is determined by comparing the specified income types to the IRS thresholds in the following table.

| Type of |

|---|

Also Check: Lexington County Food Stamp Office

Food Stamps Program Updates & Requirements

Stimulus Package Update: The U.S. Secretary of Agriculture has announced more flexibility for the Supplemental Nutrition Assistance Program and removed some roadblocks that would typically exist within the process of attaining food assistance.

The waiver will help enable children, seniors and participants with disabilities to be able to get food during this global pandemic in an easier way.

The legislation, passed a few weeks ago, will allow SNAP participants to receive two supplemental payments of benefits during this time of quarantine if they do not currently receive the maximum amount of benefits each month.

Under the new waiver, the USDA is giving individual states the option to let parents/guardians acquire the food that they need for their families or children without the need for the children to be present. Typically, the children are required to be present to receive meals from the Child Nutrition Programs.

Since the USDA realized that this may not be feasible for most families during this pandemic, they have teamed up with local and state authorities to ensure program operators are continuing to feed the families in need. More flexibilities include:

A14281 Allowable Medical Expenses

Revision 21-2 Effective April 1, 2021

Deductions are allowed for the following medical expenses:

Note: When determining transportation costs, the person may choose to use 56 cents per mile instead of keeping track of actual expenses.

Deductions are not allowed for the following medical expenses:

- the costs of policies that do not specifically cover medical costs

- food supplements that can be purchased with SNAP, such as Ensure and baby formula, even if prescribed by a physician

- paid or past due expenses billed prior to the initial certification period

- medical marijuana, even if prescribed by a physician or

- herbal products. Examples include: melatonin, valerian root, echinacea, flaxseed, ginseng, ginkgo, St. John’s wort and garlic.

Also Check: Can You Get Enfamil On Food Stamps

Preparing For The Texas Food Stamps Interview

The HHSC may call upon petitioners to participate in a Texas food stamps interview should the department have any additional questions regarding claimants applications. When necessary, these conversations take place after the HHSC has received petitioners materials and the department contacts claimants when they are ready to speak with them. These conversations take place either in person or over the phone. Many claimants worry, What do you need for the food stamps interview? These conversations are required for specific and various reasons, so there is not one homogenous way to prepare for an interview.

Applicants may also wonder about the questions asked during the food stamps interview in TX. The SNAP interviews are only necessary when the HHSC needs to clarify specific points regarding petitioners qualifications for SNAP. Generally, these topics relate to family demographics, collective income totals or applicants identities. Therefore, petitioners can expect to discuss these topics with HHSC representatives.

Claimants may also wonder what is required for food stamps interviews. In general, petitioners should bring with them or have ready any documentation that supports their claims. For example, candidates should come prepared with proof of pay, photo identification cards, tuition or day care bills, if applicable. These documents can be helpful to petitioners who need to prove different aspects of their candidacy to the DHHS.

Does The Extra 600 A Week Count As Income

But the $600 a week in extra federal unemployment stimulus, created by the CARES Act and available through July 31, doesnt count as income in determining Medicaid eligibility. It may also be for TANF, depending on the state, though most states do count the $600 federal supplement as income, Wagner said.

Recommended Reading: How Do I Renew My Food Stamps Online In Arizona

Food Stamps Texas Requirements

The Food Stamp Employment and Training program helps people with low incomes and resources to buy the food they need. Food Stamps benefits can be spent to purchase groceries in grocery stores and in supermarkets.

The Texas Food Stamp Program is managed by the local Texas Department of Human Services officers.

To get Food Stamps benefits a person must have to apply as a household. A household can be of two types:

The Food Stamps Texas requirements need to be fulfilled by the recipients varies in different situations. There are two main income tests for determining Food Stamps Texas eligibility. One is the Gross Monthly Income Test and the other one is the Net Monthly Income Test.

The primary one of the Food Stamps Texas requirements is the familys income and resources must be less than the Food Stamps Program Income. Usually if a familys resources are less than $100.00 and their monthly income is less than $150.00, they are quite sure to get Food Stamps Texas. Families, which have lower incomes than what they pay in monthly necessities, also get help from Food Stamps Texas. The amount of money a family gets though food stamps has no relation with the number of family members and the number of members do not matter on whether the family is approved to get food stamps or not.