How To Determine If You Qualify For Food Stamps In Ohio

The Ohio Office of Family Assistance will ultimately determine if you are eligible for food stamps.

The only issue with this is that it requires some time and effort in order to fill out an application for Ohio food stamp benefits. You could spend hours filling out the Ohio SNAP application as well as gathering the necessary documents.

It is important to note that the Ohio SNAP calculator doesnt function as an official tool of the Ohio Department of Job and Family Services but it is the fastest way to assess whether its worth the effort to fill out a SNAP application to get benefits from the food stamps program in Ohio.

How To Calculate Florida Food Stamps Amount

Heres how to calculate how much you will receive in SNAP benefits in Florida based on your income and allowable deductions.

This example is provided by the CBPP.

Consider a family of three with the that has:

- One full-time, minimum-wage worker

- Dependent care costs of $77 a month

- Shelter costs of $964 per month

Heres how you will calculate how much that family will get in Florida food stamps each month:

The expenses that can be deducted from your gross income include:

- 20% deduction from Earned Income

- Standard deduction of $177 for households with 1 to 3 people and $184 for households with 4 or more people

- Dependent care deduction when needed for work, training, or education

- A deduction for elderly or disabled members medical expenses that exceed $35 a month

- Any legally owed child support payments can be deducted

- Homeless Households shelter costs deduction of $159.73.

- A deduction for excess shelter costs that exceed more than half of the households income .

The Food Stamp Program

The FSP helps people buy food by providing grocery credit. The name is an anachronism today all recipient households receive the FSP benefit through the use of electronic benefit transfer cards. These are ATM-like debit cards that recipients use to purchase food from authorized grocery stores and supermarkets. The benefit is adjusted annually for changes in food costs. The FSP eligibility unit is the household, defined as an individual or group of people who live, buy food, and prepare meals together. This contrasts with SSI, which is determined on an individual, and not household, basis.

You May Like: What Do You Need To Sign Up For Food Stamps

What Happens If You Did Not Qualify For Ohio Food Stamps

The SNAP Screener is merely an assessment of the possibility that youll be eligible for the Supplemental Food Assistance Program in Ohio. Even if the Ohio food stamp calculator states that you qualify for SNAP benefits this does not mean you are guaranteed to receive benefits. There could be a mistake with the calculator. The Ohio Office of Family Assistance is the only program that can approve you for food stamps.

If the SNAP benefits calculator determines that youre not eligible for food stamps theyll give you two options to locate assistance with food products:

- Links for Feeding America website. You will find food pantries in not only Ohio but any other state in the US.

- A hyperlink to the . This website provides details such as information about food pantries in your local area, as well as information regarding SNAP and other nearby grocery stores that take the EBT card.

Exemptions To New York Snap Income Limits

If all members of your household are receiving TANF, SSI, or in some places general assistance, you do not have to meet the food stamps income test.

In addition, while most households must meet both the gross and net income tests, if you live in a household where there is an elderly person or a person who is receiving certain types of disability payments, then that household will only have to meet the net income test to qualify for New York food stamps .

Also Check: New York State Food Stamp Application

Food Stamp Program Participation

Understanding the evidence of opportunity for increasing participation requires sufficient knowledge of how FSP participation is currently assessed.

While federally funded, the FSP is operated by states. The quality of state management varies the FSPQC sample is in part conducted to monitor and reduce the variance in accuracy of benefit assessment, and the Farm Security and Rural Investment Act of 2002 established a “high performance bonus” to reward states for “actions taken to correct errors, reduce the rates of error, improve eligibility determinations, or other activities that demonstrate effective administration as determined by USDA” . In recent years, attention has also been paid to variation across states in FSP participation rates, the ratio of recipients to persons believed to be eligible. The Department of Agriculture estimates that nationwide only 60 percent of persons eligible for FSP in 2004 actually received benefits . The department has announced a target national participation rate of 68 percent in 2010 . States varied enormously in estimated take-up rates in 2005, from a low of 40 percent in Wyoming to a high of 95 percent in Missouri .

Table 8. Estimated Food Stamp Program participation by SSI recipients, fiscal years 20012004| SSI recipients |

|---|

| NOTE: SSI = Supplemental Security Income. |

Ssi Participation And State Food Stamp Program Management

There is indirect evidence that supports the hypothesis that the prevalence of FSP participation could be increased, at least in some states. Despite the technical issues raised above, there is general agreement that variation across states in estimated FSP participation does bear some relationship to state effectiveness in FSP promotion.6 If this is the case, it is interesting to see if interstate variation in food stamp receipt among households that include SSI recipients is related to variation in estimated aggregate state participation rates. If states with high aggregate participation rates also show exceptional participation by households that include SSI recipients, this would suggest that management makes a difference and that outreach procedures followed in high participation states should be studied and, if appropriate, imitated.

Note that if households with SSI recipients constituted a large fraction of all FSP eligible households, any connection between aggregate FSP take-up and prevalence among households with SSI recipients would be virtually tautological. However, the FNS estimate of the number of persons eligible for the FSP in an average month in 2004 is five times greater than the total number of SSI recipients , so it would be possible for variation in aggregate FSP take-up to occur independently of program participation among households that include SSI recipients.

Don’t Miss: Buy Baby Formula With Food Stamps

Eligibility Test : Assets Calculation

The asset test is the final test you must pass.

Assets in your family must be below certain limits. A household without a member who has a disability or is elderly must have assets of $ 2,250 or less. The assets of a household with an elderly or disabled person must be less than $3,500.

For food stamps, what constitutes property?

In general, assets include assets that might be available to buy food at home, such as money in a bank account.

Household assets, personal assets, and retirement savings are not included in this calculation. Automobiles are also excluded. Individual states have the option of relaxing asset limits. A number of them have done so. For more information about asset requirements in your state, contact the food stamp agency.

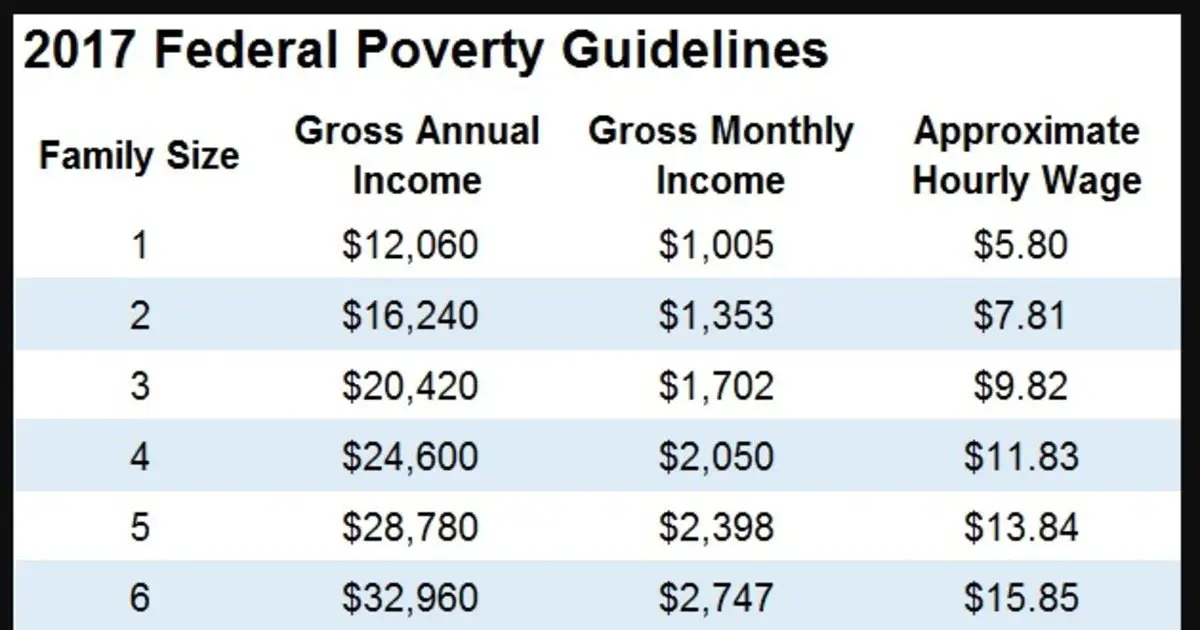

According to the Department of Health and Human Services , the food stamp income limit is determined by a percentage of the National Poverty Guidelines. Here is a list of the most recent poverty guidelines followed by the full food stamp income limit.

Determine Snap Benefit For Household

According to the table above, the maximum SNAP benefit in 2021 for a family of three is $535.

Therefore, the maximum benefit minus the household contribution equals about $482.

As a result, the familys estimated monthly Florida SNAP benefit amount is $482.

This is the amount we estimate they will be getting each month on their Florida EBT card.

However, to get the exact amount your family will get in Florida SNAP benefits, you will have to apply and have your situation reviewed by a caseworker.

Heres how to apply for SNAP in Florida:

Recommended Reading: What’s The Guidelines For Food Stamps

Determine Florida Food Stamps Eligibility

If you want to apply for Florida SNAP program benefits, you will need to meet the program eligibility requirements.

Here is a quick review of the Florida food stamps eligibility rules:

To get Florida food stamps, you must:

- Live in the state of Florida

- Provide proof of citizenship or have a qualified non-citizen status

- Provide proof of your Social Security number or proof that you have applied for a Social Security number

- Meet income and financial resource limits

- Meet work requirements and

- Cooperate with child support enforcement .

Washington Food Stamps Requirements

Applicants must meet the Washington food stamps requirements before they can collect Basic Food benefits in the state. Examples of these prerequisites include:

- Citizenship or qualifying immigration status: Petitioners need to be U.S. citizens or legal residents to receive SNAP.

- Washington residency: The requirements for food stamps indicate that applicants need to live in the state to collect benefits through the program.

- Monthly income: Claimants need to earn monthly gross and net income amounts that are within the states predetermined income threshold.

- Household assets: Applicants may not possess household assets that total less than $2,250. For households with at least one family member who is disabled or elderly, this limit rises to $3,500.

- Work requirements: Food stamps eligibility rules state that claimants who are physically able to work must be employed. Alternatively, applicants who are not working must be enrolled in approved training programs and actively searching for work.

Also Check: How To Apply For Food Stamps In Ct

How Much Money Can You Make And Still Get Food Stamps

The information in this article is current as of February 10, 2022.

If you go grocery shopping for your household, its no surprise to you that food prices have gone up. Even considering inflation, the food price increase from 2019 to 2020 was 75% above average.

This number doesnt sound great if youre already on a tight budget. You may be wondering how you can put food on the table for your family. Theres even a chance youre curious to know, How much can you make and still get food stamps?

Food stamps, now known as SNAP, are an incredibly beneficial tool to help you pay for your familys groceries. Below weve created a guide explaining what to expect and how much you can make to still qualify for SNAP. Keep reading to learn more.

Ohio Food Stamp Calculator: How To Determine Snap Eligibility

It is the Ohio Food Stamp Calculator is an instrument you can utilize to determine whether you could be eligible for benefits from SNAP in Ohio. It also estimates the number of food stamps youll get in the event that you be eligible for benefits from SNAP.

Although this isnt an officially-approved Ohio Office of Family Assistance tool it is a useful tool to assist in deciding on whether or not to apply for benefits from SNAP in Ohio. The process for filling out an application to SNAP is long and takes a lot of effort. Using this Ohio food stamps calculator can help you to determine if applying for SNAP benefits is worth your time.

Don’t Miss: How Can I Apply For Emergency Food Stamps

How Much Do Households Receive In Benefits

The average SNAP recipient received about $127 a month in fiscal year 2018. The SNAP benefit formula targets benefits according to need: very poor households receive larger benefits than households closer to the poverty line since they need more help affording an adequate diet. The benefit formula assumes that families will spend 30 percent of their net income for food SNAP makes up the difference between that 30 percent contribution and the cost of the Thrifty Food Plan, a diet plan the U.S. Agriculture Department establishes that is designed to be nutritionally adequate at a very low cost.

A family with no net income receives the maximum benefit amount, which equals the cost of the Thrifty Food Plan for a household of its size . For example, a family of three with $600 in net monthly income receives the maximum benefit minus 30 percent of its net income , or $324.

| TABLE 1 | |

|---|---|

| $762 | $506 |

Note: Estimated average benefits are calculated using fiscal year 2019 income eligibility standards and deductions and FY 2017 SNAP Quality Control Household Characteristics income and expense data, inflation-adjusted to FY 2019.

Read Also:

Being Approved For Food Stamp Benefits

When you are found eligible for SNAP benefits, you will receive an Electronic Benefit Transfer card. Your benefits are automatically loaded onto the card each month. The card will work like a debit card with funds deducted from the account with each purchase. The card can only be used at stores that are approved to accept them.

Also Check: How To Get Food Stamps In Nh

How To Apply For Food Stamps

The Supplemental Nutrition Assistance Program is a federally funded program to provide food assistance to low-income individuals and families. SNAP is funded by the federal government and administered through the states. Many states also work with other local agencies to provide ongoing nutritional education and training to SNAP recipients.

You can apply for food stamps online in most states, or at a local state or county office. Once the initial application is filled out, you will follow up with a face-to-face interview, and you will be required to provide verification of your income and expenses. If you are elderly or physically unable to travel to the office for the interview, you can apply for a waiver. If granted, the face-to-face interview will be replaced with a phone interview or home visit.

When applying for SNAP, they look at the income, resources, and size of the household. For this situation, a household is defined by people that live together and purchase and prepare food together. When looking at income and resources, it is the total of all members of the household, not just the head of household.

Here is the step-by-step process to apply for food stamps.

How Do I Apply For New York Snap

How you apply depends on whether you live in NYC or upstate.

For NYC residents, heres how to apply:

First, you can apply online on ACCESS HRA. to be taken there.

Also, you can call the SNAP Information line at 718-557-1399 to have an application mailed to you.

Additionally, you can pick up an application at a NYC SNAP center.

You can also print out an application and drop off at a SNAP center. to download an application.

When your application is completed, you can fax it to 917-639-1111.

For all other New York state residents, heres how to apply:

Online:

You can apply online for NY SNAP at myBenefits.ny.gov.

In person:

Additionally, you can apply in person at a local department of social services and SNAP Centers locations.

For a list of department of social services offices near you, .

In writing:

Furthermore, you can print and mail or fax the SNAP Application to your local department of social services.

to download an application.

Don’t Miss: How Do I Cancel My Food Stamps

How Much Do I Have To Earn To Get Food Stamps

Before you apply for a food stamp assistance you must know that what is the minimum income to qualify for food stamps or what is the minimum income to get food stamps

Find out if you meet the asset requirements by calculating your gross income, net income, and net worth by following the steps below. Below you will also find an example of how to calculate how much food stamps you will receive based on your household income. To be eligible for coupons, a households income and resources must meet three requirements:

Excess Shelter Deduction For Snap Ebt

The excess shelter deduction when calculating your households monthly net income applies to shelter costs that are more than half of the households income after other deductions.

Allowable shelter costs include:

- Some states allow a set amount for utility costs instead of actual costs.

Maximum Shelter Deduction for Pennsylvania SNAP Benefits

The amount of the shelter deduction is capped at $597 unless one person in the household is elderly or disabled.

For a household with an elderly or disabled member all shelter costs over half of the households income may be deducted.

For more help determining if you are eligible to receive Pennsylvania food stamps,check out our completePennsylvania SNAP Eligibility Guide.

Also Check: How Much Is Food Stamps In Ny

Maximum Food Stamps Benefits For 2020

The chart below will show you the Maximum Allotment Amount for SNAP benefits in 2020-2021. This is the maximum amount your household could receive in food stamp benefits each month.

| Maximum SNAP Benefit Amount by Household Size for Georgia |

| Effective October 1, 2020 September 30, 2021 |

| Household Size |

| $153 |

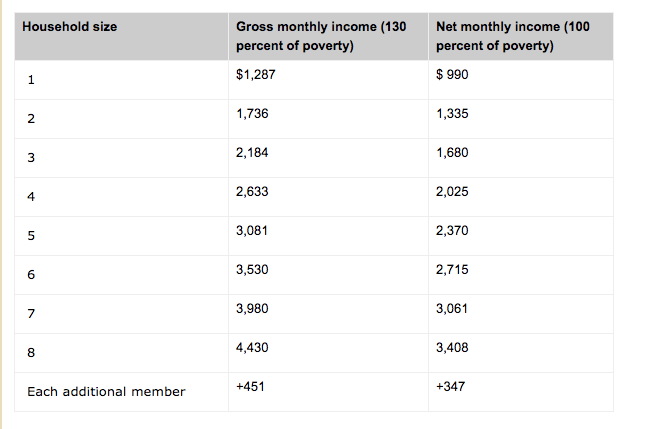

Eligibility Test : Gross Monthly Income Of An Individual Or Family

To qualify for Food Stamp benefits, you must first meet the gross income requirement.

Recommended Reading: Sam’s Club Scan And Go Food Stamps