Did Snap Give Extra Money

This increase which applies in all states and territories participating in SNAP amounts to about $28 more in SNAP benefits per person per month, or just over $100 per month in food assistance for a family of four. The American Rescue Plan Act, enacted in March 2021, extends this increase through September.

Exemptions To Calfresh Income Limits

If all members of your household are receiving TANF, SSI, or in some places general assistance, you do not have to meet the food stamps income test.

In addition, while most households must meet both the gross and net income tests, if you live in a household where there is an elderly person or a person who is receiving certain types of disability payments, then that household will only have to meet the net income test to qualify for California food stamps .

Do I Have To Go To The Calfresh Office For An Interview

As mentioned above, you may apply for CalFresh online through the California benefitscal.org website.

Interviews for food stamps applications are usually done over the phone.

However, If you do not have a phone, are unable to keep a phoneappointment, or would prefer an appointment in the office, you can request one.

Read Also: Does 7-11 Take Ebt

Supplemental Nutrition Assistance Program

How to Apply

The Supplemental Nutrition Assistance Program provides monthly benefits that help low-income households buy the food they need for good health. For most households, SNAP funds account for only a portion of their food budgets they must also use their own funds to buy enough food to last through the month.

Applying for SNAP Benefits:

Visit your local DFS office to get an application or download the Application for Assistance. .

Submit your application to your local DFS office in person, by mail, or fax.

After receiving your application, a DFS employee will contact you to schedule a phone or face-to-face interview with a benefit specialist.

How to Qualify

Qualifying for SNAP: Each application is reviewed pursuant to federal regulations and no two households are alike. There may be other regulations than what is listed below that apply which may impact your eligibility. Check the SNAP Income Limits.

Resources: Individuals who receive Supplemental Security Income or households who receive POWER/Tribal TANF are exempt from the resource limit. If your household includes a member who is age 60 or older or includes a member who is disabled has a resource limit of $3,750. All other households may have up to $2,500 in resources.

Resources are things like:

- Income producing property.

- Stocks, bonds, or mutual funds.

Benefit Amounts: The amount of SNAP a household receives depends on the number of people in your household and the total amount of net income .

Food Stamp Program Participation

Understanding the evidence of opportunity for increasing participation requires sufficient knowledge of how FSP participation is currently assessed.

While federally funded, the FSP is operated by states. The quality of state management varies the FSPQC sample is in part conducted to monitor and reduce the variance in accuracy of benefit assessment, and the Farm Security and Rural Investment Act of 2002 established a “high performance bonus” to reward states for “actions taken to correct errors, reduce the rates of error, improve eligibility determinations, or other activities that demonstrate effective administration as determined by USDA” . In recent years, attention has also been paid to variation across states in FSP participation rates, the ratio of recipients to persons believed to be eligible. The Department of Agriculture estimates that nationwide only 60 percent of persons eligible for FSP in 2004 actually received benefits . The department has announced a target national participation rate of 68 percent in 2010 . States varied enormously in estimated take-up rates in 2005, from a low of 40 percent in Wyoming to a high of 95 percent in Missouri .

Table 8. Estimated Food Stamp Program participation by SSI recipients, fiscal years 20012004| SSI recipients |

|---|

| NOTE: SSI = Supplemental Security Income. |

Also Check: Apply For Food Stamps In Oklahoma City

The Food Stamp Program

The FSP helps people buy food by providing grocery credit. The name is an anachronism today all recipient households receive the FSP benefit through the use of electronic benefit transfer cards. These are ATM-like debit cards that recipients use to purchase food from authorized grocery stores and supermarkets. The benefit is adjusted annually for changes in food costs. The FSP eligibility unit is the household, defined as an individual or group of people who live, buy food, and prepare meals together. This contrasts with SSI, which is determined on an individual, and not household, basis.

How Much Will I Get In Florida Food Stamps

You must meet all eligibility requirements including the Florida Food Stamps Income Limit, in order to be approved for benefits. The amount of money you will get each month depends on your household size.

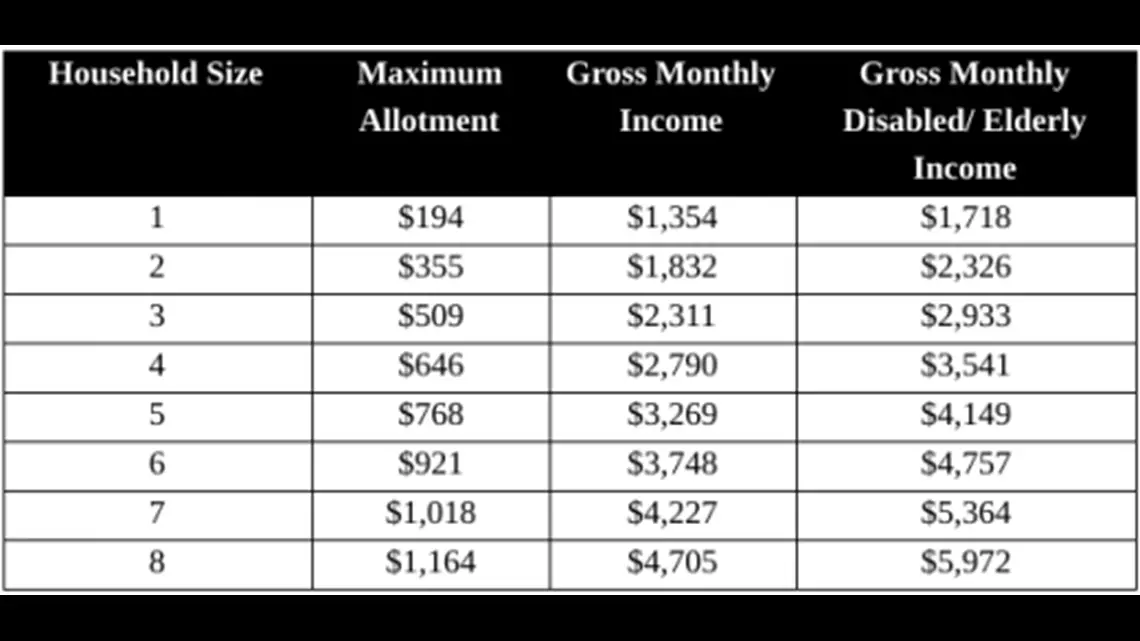

See the chart below for the maximum amount you may get based on the number of people in your household.

| Maximum SNAP Benefit Amount by Household Size for Florida | |

| Effective October 1, 2021 September 30, 2022 | |

| Household Size | |

| Each Additional Household Member: | +$188 |

Now you know the Income requirements for food stamps in Florida. If you qualify for food stamps and want to apply, or see below for detailed instructions on how to apply for the nutrition assistance program or SNAP/Food Stamps.

Recommended Reading: Lexington Food Stamp Office

How To Calculate Net Income

Now that you have your households monthly gross income, you can use that number to calculate your net income. Use the chart below to calculate your monthly net income and determine if your household is eligible for Florida SNAP EBT benefits.

Please not that there may be exceptions to the net income calculation. These exceptions apply to household members that are elderly or disabled. For more information or immediate help, in your county.

| How to Calculate SNAP Net Income | |

| Net Income Calculation: | |

| Determine if shelter costs are more than half of adjusted income | $700 total shelter $602 = $98 excess shelter cost |

| Subtract excess amount, but not more than the limit, from adjusted income | $1,204 $98 = $1,106 net monthly income |

| Apply the net income test | Since $1,106 is less than $2,209 allowed for a 4-person household, this household has met the income test. |

Income Limits For Households That Include People With Disabilities

Households that include at least one person with a disability can have more income than households without disabilities and still get SNAP. If your household includes a member who is elderly or has a disability, you have to meet meet a net income limit. That means that to see if you qualify, you take your gross income and subtract various deductions.

The most common deductions for households that include a disabled person or elderly person are:

- A standard $177 deduction

- Court-ordered child support for someone outside the household

- Unreimbursed medical expenses above $35 per month, and

- Deductions for rent, mortgage expenses, property taxes, home insurance, and utility costs. The eligibility worker calculates the amount of this deduction.

To figure out if you’ll qualify, you can subtract these deductions from your household’s gross income and compare the resulting number to the chart below. Make sure to compare it to the net income limit for a household your size. If you qualify, your net income amount will also impact how much you get in benefits.

There are some additional deductions, so if you aren’t sure about how to figure out your net income, Chat with a Hub expert.

SNAP: Monthly Net Income Limits for People with Disabilities| People in your Household | |

|

For each additional person over 8… |

Add $378 |

Note: Some people with disabilities have people who help them with buying and preparing food. You do not have to include them in your household when you apply for SNAP.

Don’t Miss: Apply For Food Stamps Lexington Ky

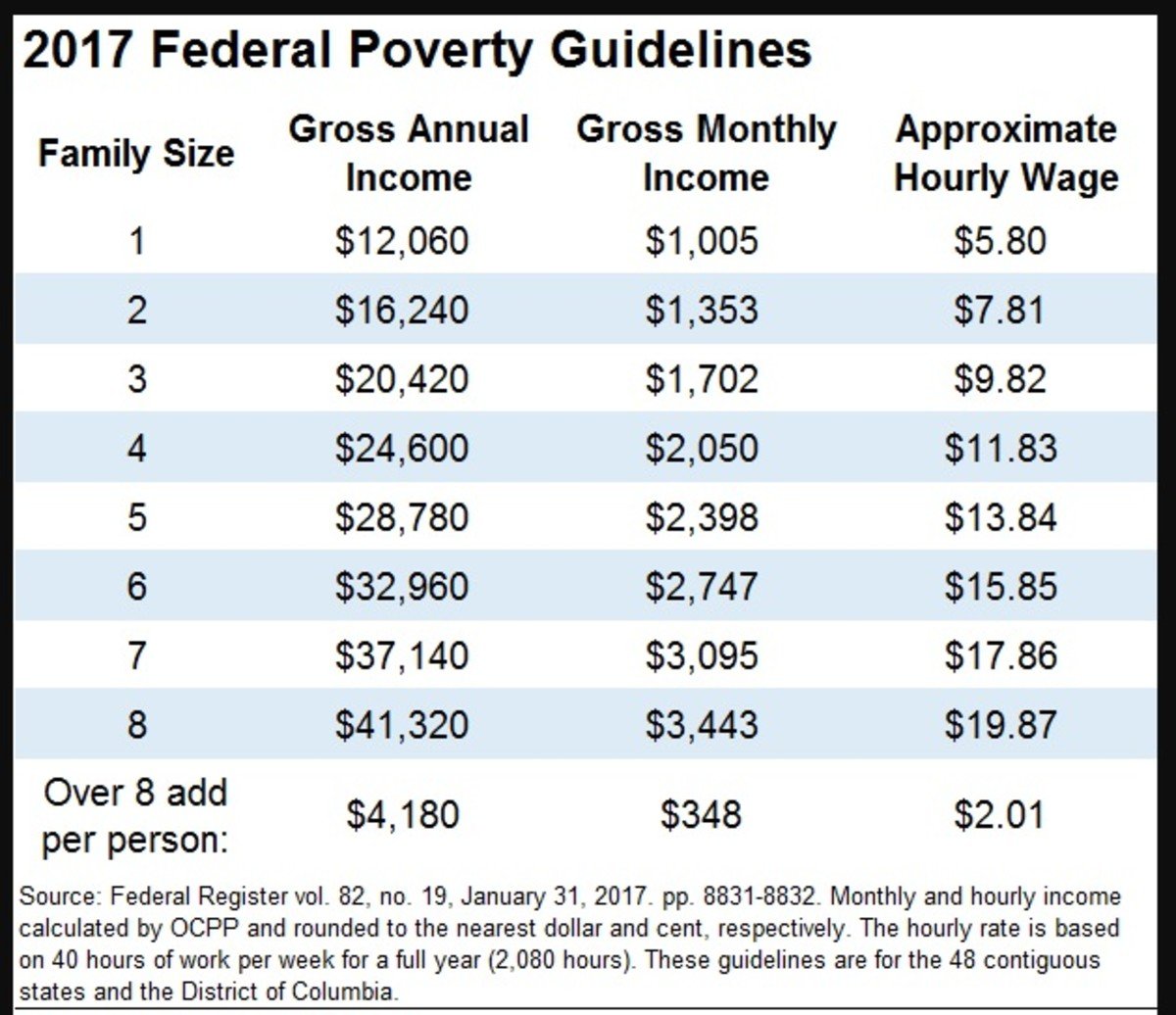

Florida Food Stamps Income Limit

The Florida food stamps income limit is the biggest factor in deciding whether your SNAP application will be approved or not.

In order to use the SNAP income limit chart, you must first calculate your total monthly gross income for your household.

Your total gross income is compared to a percentage of the federal poverty level to determine if you qualify for Florida food stamps.

Once you know your households total gross income, expenses like childcare, medical expenses and housing costs and subtracted to calculate your total net income.

Your households total net income is used to determine how much you will receive in FL SNAP benefits each month.

Now that you know it works, you can use the Florida food stamps income limit chart to determine if your household qualifies for food assistance benefits.

In addition, we will walk you through the steps to successfully calculate your gross and net monthly income including standard and allowable deductions for your household.

Maximum Monthly Amounts On Food Stamps

There is a maximum monthly allotment based on the size of the household. When determining your benefit allotment, they will take your net monthly income and multiply it by 30%. That number will then be subtracted from the maximum monthly allotment. The remaining amount is the total monthly allotment you will receive based on your application. This amount may change if your income or household size changes.

SNAP benefits are a specific money amount provided to recipients each month to go towards nutritional foods. Recipients are provided with an electronic benefits transfer card, and money is added to the card each month. You can check your balance by phone, and any unused funds at the end of the month remain on the card to be used to following month. Once allocated, benefits will not expire.

Benefits can be used to buy food and drinks at most grocery stores, convenient stores, gas stations, pharmacies that sell food, and farmers markets. Benefits cannot be used to buy alcohol, tobacco, medicine, hot food, food meant to be eaten in the store, or any non-food items.

Recommended Reading: How To Apply For Medicaid And Food Stamps In Texas

Work Requirements For Food Stamps

There generally are not expressed food stamps minimum income limits you need to meet each month once you are enrolled in the program. However, there are work requirements you are responsible for adhering to as a beneficiary. The detailed rules of these SNAP work requirements can vary from one state to another. However, states usually require that enrollees be actively searching for jobs if they are unemployed. You also must accept any suitable employment offers you receive in order to qualify for food stamps.

If you are unemployed, you may also wonder, Would I qualify for food stamps if I do not work for several weeks or months? Regarding this topic, SNAP officials set special rules for able bodied adults without dependents . If you fall into this category, you are required to work at least 20 hours a week. Otherwise, you cannot receive SNAP for more than three months in a 36-month period.

However, you may be able to qualify for food stamps and not meet these requirements if you are a:

- Senior citizen.

- Candidate who is exempt for mental or physical reasons.

How To Calculate How Much I Will Receive In Food Stamps

If you’re having problems making ends meet, food stamps can be a lifesaver. Food stamps, now referred to as the Supplemental Nutrition Assistance Program or SNAP, is a food assistance program run by the United States Department of Agriculture. To find out if your eligible, and if so for how much, can be determined with a few calculations.

Read Also: Food Stamp Office Harwin

The Food Stamp Program And Income

Next, we turn to the contribution of FSP benefits to household income. For this purpose we continue separate analysis by age and further differentiate between recipients living alone or with spouses only and SSI recipients living with others. Table 3 provides a sense of the reliability of estimates for various subgroups by reporting sample sizes and the estimated number of SSI recipients for various subgroups in 2004. Some of the subgroups are so small that the results are meaningless. However for subgroup samples that are large, results can be viewed with considerable confidence.

Table 3. SSI recipients in food stamp recipient households, by living arrangements and benefits, fiscal year 2004| SSI recipient characteristic |

|---|

| NOTES: SSI = Supplemental Security Income OASDI = Old-Age, Survivors, and Disability Insurance. |

| a. Too few observations for meaningful calculations. |

| SSI recipient |

|---|

| NOTE: SSI = Supplemental Security Income. |

| a. Too few observations for meaningful calculations. |

| SSI recipient characteristic |

|---|

| NOTES: SSI = Supplemental Security Income OASDI = Old-Age, Survivors, and Disability Insurance. |

Is Calfresh Public Charge

Here are some things to know about CalFresh and Public Charge:

- You will NOT become a public charge because you are getting CalFresh.

- If you get CalFresh, it will NOT hurt your chances of getting a green card.

- You will NOT lose your green card because you are getting CalFresh.

- Applying for CalFresh will NOT affect your immigration status.

- You will NOT be denied U.S. citizenship because you get CalFresh benefits.

- Public charge rules do not apply to programs like CalFresh, WIC, and school lunch programs.

- All children born in the U.S. can get CalFresh benefits if they qualify. It does not matter where their parents were born.

- Even if sponsored non-citizens refuse CalFresh benefits, the rest of their household can still get benefits.

For complete details about CalFresh and public charge, see our post on Is CalFresh considered a Public Charge?

Recommended Reading: Tomball Food Stamp Office

Managing The Food Stamp Program

Although the federal government pays most FSP costs and sets most of the regulations, the program is operated by states, generally through local welfare offices.

Payment accuracy is evaluated annually by a joint federal/state review of a sample of cases drawn from each state’s recipient list. This “quality control” sample is sufficiently large to provide reliable information on the people receiving food stamps, the rate at which administrators make errors in benefit determination, and the amounts of payments involved. States can be charged for the benefit cost of error rates in excess of national averages. In practice such penalties are often waived when enforced, states pay by investing the fine in programs to improve performance. The QC system creates incentive for promoting accurate collection of data on income, including SSI receipt. States can and do check on SSI status by using the Social Security Administration’s State Data Exchange program to investigate benefit status for all members of applicant households.