What Happens If You Make An Honest Mistake On Your Taxes

If you made a mistake on your tax return, you need to correct it with the IRS. To correct the error, you would need to file an amended return with the IRS. If you fail to correct the mistake, you may be charged penalties and interest. You can file the amended return yourself or have a professional prepare it for you.

How Much Do You Have To Make To Qualify For Food Stamps In Texas

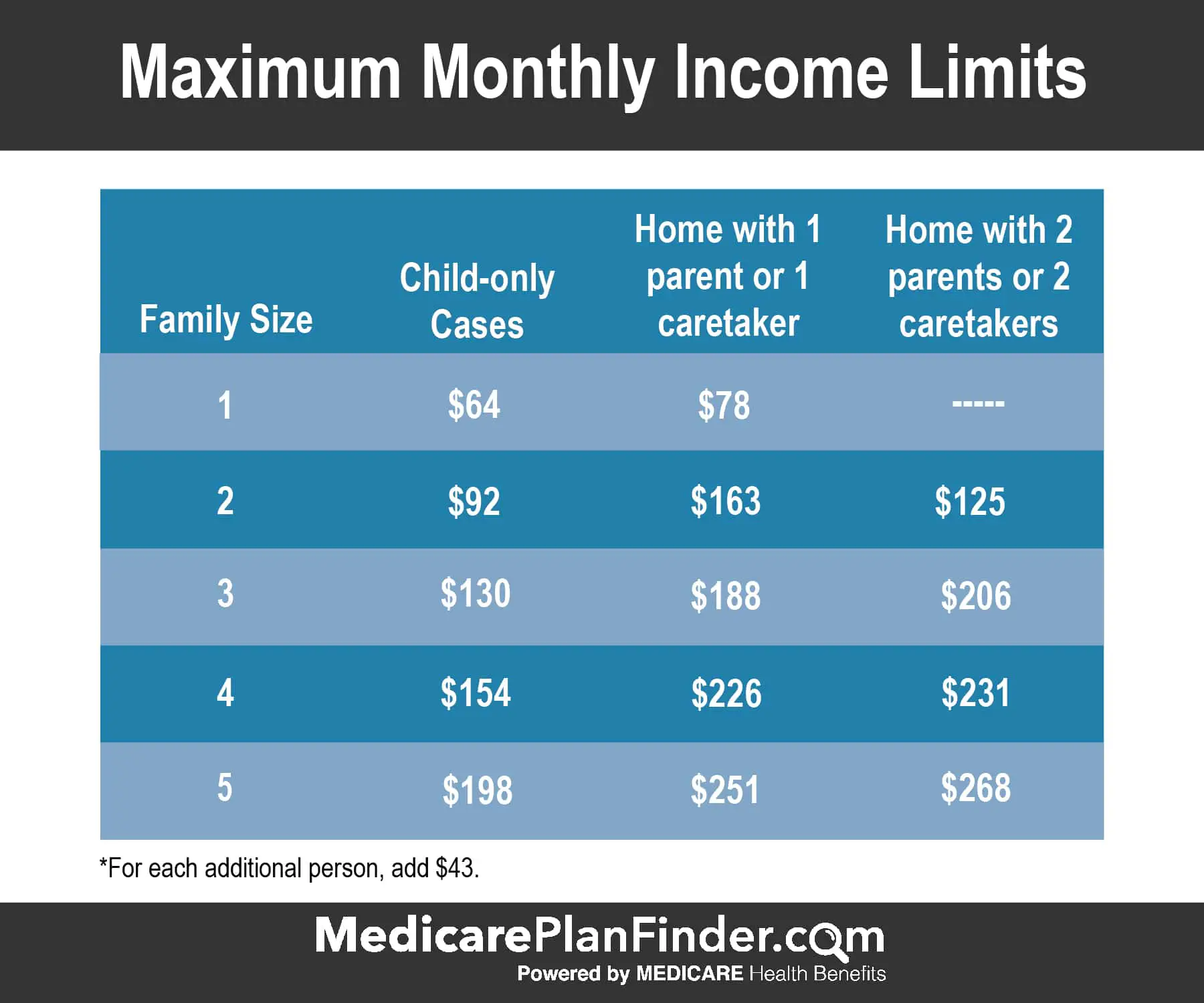

How Much Income Do You Need To Get Supermarket Brands In Texas? The following is the maximum monthly income allowed on food stamps in Texas as it depends on the size of your household.

Housing grants for single mothersHow to find government grants for single parents?Before contacting an agency about scholarships for single mothers, you should collect the relevant details.Check with the Department of Housing and Urban Development to see if you qualify. HUD offers tips for buying or renting a home.A single mother can contact her housing association to find affordable housing.What resources are available for single

Donât Miss: How To Sign Up For Food Stamps In Tn

What Does Ach Credit Mean

ACH Credit is a promise to arrange a payment from your bank account to the agency being paid. Unlike ACH debit, which authorizes Pay.gov to request a payment immediately upon processing, you control when the payment is deducted by giving your bank with instructions after youve created the promise on Pay.gov.

Also Check: How Many Hours Can You Work And Still Get Unemployment

Also Check: Apply For Food Stamps Charlotte Nc

How Long Will The Increase In Food Stamps Last

The increased assistance will be available indefinitely to all 42 million SNAP beneficiaries. The increase coincides with the end of a 15% boost in SNAP benefits that was ordered as a COVID-19 pandemic protection measure, which expired on Sept. 30.

Are They Giving Out Emergency Food Stamps

Provide SNAP households with emergency allotments.States can give SNAP households emergency supplementary benefits all states have used this option.The Biden Administration reversed this policy, and beginning April 2021 all households in states with these benefits have received emergency allotments of at least $95.)

Also Check: How To Order Food On Amazon With Ebt

Excess Shelter Deduction For Snap Ebt

The excess shelter deduction when calculating your households monthly net income applies to shelter costs that are more than half of the households income after other deductions.

Allowable shelter costs include:

- Some states allow a set amount for utility costs instead of actual costs.

Maximum Shelter Deduction for Pennsylvania SNAP Benefits

The amount of the shelter deduction is capped at $597 unless one person in the household is elderly or disabled.

For a household with an elderly or disabled member all shelter costs over half of the households income may be deducted.

For more help determining if you are eligible to receive Pennsylvania food stamps,check out our completePennsylvania SNAP Eligibility Guide.

What Are Deductions And How Do They Affect Snap Eligibility

There are seven allowable deductions that you can consider when determining your net pay. To figure out your net income, you have to figure out which allowable deductions apply to your situations and deduct them from your gross income. The difference is your net income.

Each state outlines employment requirements as part of SNAP eligibility. These requirements include:

- Registering for work – some states will require you to provide proof that you are actively applying for work on a weekly basis.

- Not voluntarily quitting your job If you are unemployed, you need to prove that it was not your choice.

- Not purposely reducing your hours If your hours are cut making you income eligible, you will need to prove that the cut in hours was beyond your control.

- Taking a job if offered

- Participating in state-offered employment and training programs.

SNAP benefits will be discontinued if any of these employment requirements are not followed. There are people exempt from the employment requirements. This includes children, seniors, pregnant women, and individuals that are exempt from working for health reasons.

Employment requirements apply to applicants determined to be Able-Bodied Adults without Dependents . Under the Personal Responsibility and Work Opportunity Reconciliation Act of 1996, ABAWDs are limited to 3 months of SNAP benefits over a 36-month period unless they are doing at least one of the following:

Read Also: Can I Use Ebt For Albertsons Delivery

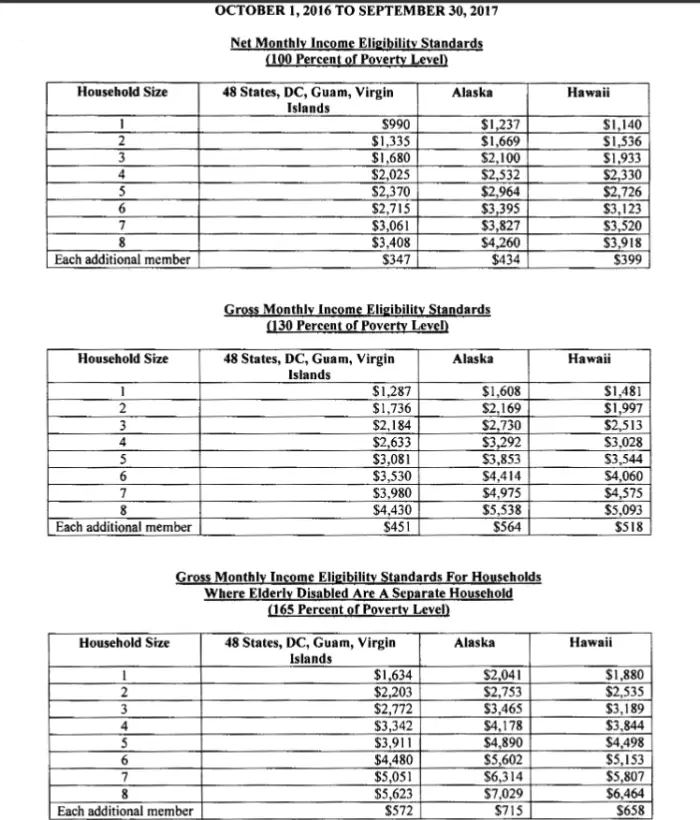

The Limits Are Higher In Alaska And Hawaii

In Hawaii, income limits range from $20,318 per year for one-person households to $69,732 for households with eight recipients. Thats about $1,69 to $5,811 per month. After that, its $7,059 per year for each additional person.

In Alaska, the annual income limit ranges from $22,087 for one person to $75,777 for eight people.

Also Check: If I Get Food Stamps Can I Get Medicaid

How Much In Food Stamps Am I Entitled To

The amount you get in SNAP benefits is based on your income and eligible deductions. The minimum benefit amount for households with just one or two people is $23 each month. The maximum benefit amounts are provided in the table above.

People who get SNAP/food stamps but not cash assistance and are in a welfare Employment and Training Program are eligible for the same special allowances that cash assistance recipients get. They can get help to pay for childcare, transportation, and school expenses like books. Ask your caseworker if you are interested in participating in an Employment & Training Program.

Extra benefits during the pandemic:

Starting April 2020, Congress approved additional benefits for SNAP households during the pandemic for as long as there is an emergency declaration in place. Pennsylvania SNAP households not qualified to receive the maximum monthly benefit will either get a second emergency allotment every month to bring them up to the max, or $95, whichever amount is greater. Learn more about these emergency allotments.

- SNAP households in PA who had been denied emergency allotments during any months from Sep. 2020 to Apr. 2021 are eligible for settlement funds from a lawsuit, which the state began to distribute in April 2021.

Also Check: Website To Apply For Food Stamps In Georgia

Income Limits For Households Without Disabilities

If nobody in your household has a disability or is elderly, SNAP looks at your householdâs gross income to determine whether or not you qualify. Your gross income is your earned income plus your unearned incomebefore taxes or other deductions are made.

Compare your familyâs gross income to the table below to see if you qualify. Make sure to compare it to the gross income limit for a household your size.

|

People in your Household |

|---|

What If I Am A College Student

To participate in SNAP, a student, in college at least half time, must meet the for SNAP and one of the following criteria:

- Be employed for an average of 20 hours per week and be paid for such employment or, if self-employed, be employed for an average of 20 hours per week and receive weekly earnings at least equal to the Federal minimum wage multiplied by 20 hours.

- Participate in a State or Federally financed work study program during the regular school year.

- Provide more than half the physical care for one or more dependent household members under the age of six or provide more than half the physical care of dependent household member who has reached the age of six but is under the age of 12 where adequate child care is not available.

- Enrolled full-time in an institution of higher education and is a single parent with responsibility for the care of a dependent child under age 12.

- Receive benefits from Family Assistance or federally-funded Safety Net Assistance .

- Receive Unemployment Benefits .

- Attend a SUNY or CUNY comprehensive college, technology college, or community college and are enrolled in a qualified career and technical education program.

- Attend any of the 10 Educational Opportunity Centers in New York State and are enrolled in a career and technical education program, remedial course, basic adult education, literacy, or English as a second language.

Also Check: What Is The Food Stamp Income Limit In Texas

What Is The Food Stamp Income Limit In California

In this guide, I will explain Californias food stamp income limit.

To qualify for SNAP benefits, you must fall below certain income guidelines. Those range from $2,266 to $7,772, depending on your household size. California food stamps are only available to low-income families, and the income qualification is based on specific income guidelines.

How much money your household can make will be determined by the number of people living with you

Essentially, the more people you have to feed each month, the greater your monthly earnings can be.

In this article, we will break down what the California SNAP income limit is according to household size.

Also Check: Can You Use Ebt For Online Groceries

Mi Food Stamps Income Limit Questions

We hope our post on the MI Food Stamps Income Limits for 2022 was helpful to you! If you need additional help determining your eligibility for food stamps or submitting your application for Michigan SNAP, please let us know in the comments section below.

If you found this article helpful, we encourage you to please share it with someone using the Share this button below.

In the meantime, be sure to check out our other articles on Michigan SNAP EBT:

Read Also: How Can I Find Out My Food Stamp Card Number

Pennsylvania Snap Standard Deduction Amount

When determining your eligibility for Pennsylvania food stamp benefits, you will subtract a standard deduction from your total household income. The standard deduction amount is based on two factors your household size and location.

To find out how much your standard deduction will be, use the SNAP Standard Deduction Chart for fiscal year 2022 provided below:

| Pennsylvania SNAP Standard Deductions for Fiscal Year 2022 |

| Effective October 1, 2021 September 30, 2022 |

| Household Size |

| $1,500 earned income + $550 social security = $2,050 gross income. | |

| If gross monthly income is less than the limit for household size, determine net income. | $2,050 is less than the $2,871 allowed for a 4-person household, so determine net income. |

What Do You Do If You Havent Filed Your Taxes In 10 Years

If you dont file and pay taxes, the IRS has no time limit on collecting taxes, penalties, and interest for each year you did not file. Its only after you file your taxes that the IRS has a 10-year time limit to collect monies owed. State tax agencies have their own rule and many have more time to collect.

Read Also: Can You Collect Unemployment And Social Security

Also Check: How Do I Get Food Stamps In Massachusetts

Who Is Eligible To Participate In The Program

- People who live together and buy food and prepare meals together are grouped as a household for SNAP. Husbands and wives, and children under age 22 living with their natural, adoptive or stepparents must be considered as one household.

- Household members that wish to be included must be U.S. citizens or legal aliens.

- Household members that wish to be included must furnish or apply for a social security number.

- Income and resource guidelines listed in this overview must be met.

- Able-bodied household members who are age 16 through 59 must register for work, and may be required to participate in a SNAP Employment and Training Program unless a specified exemption is met.

Pa Food Stamps Income Limit Questions

We hope our post on the Pennsylvania Food Stamps Income Limit for 2022 was helpful to you! If you need additional help determining your eligibility for food stamps or submitting your application for Pennsylvania SNAP, please let us know in the comments section below.

If you found this article helpful, we encourage you to please share it with someone using the Share this button below.

In the meantime, be sure to check out our other articles on Pennsylvania SNAP EBT:

Don’t Miss: Phone Number For The Food Stamp Office

Adjusting Returns For Unemployment

Generally, unemployment compensation is taxable. But in March, the American Rescue Plan waived taxes on the first $10,200 in unemployment income, or $20,400 for a couple who both claimed the benefit, for those who made less than $150,000 in adjusted gross income in 2020 in light of the coronavirus pandemic.

Passage of the law came after some people had already filed their 2020 returns, leaving those taxpayers wondering if theyd need to submit an amended return. The IRS later confirmed it would adjust returns and automatically send refunds to eligible taxpayers.

The first of those payments went out in May. The IRS has since sent roughly 8.7 million unemployment compensation refunds totaling some $10 billion.

The agency will continue to adjust returns and send refunds through the summer, it said. It started the readjustment process with the simplest returns and is now moving through more complex ones.

Most people do not have to take any action or file an amended return to get a refund if they overpaid on unemployment compensation, according to the IRS. Some taxpayers who had their 2020 returns readjusted may not get a refund because the IRS first applied their overpayment to outstanding taxes or other debts owed at the state or federal level.

Find Out If You Or Your Children Are Eligible For The Wic Program

-

If youre applying for yourself, you must be at least one of the following:

The Arizona Medicaid Income Limit is calculated as a percentage of the Federal Poverty Line.

To qualify, you must meet the Arizona Medicaid Income limits listed below.

Here is the Federal Poverty Level for 2021.

| 2021 Federal Poverty Levels for the 48 Contiguous States & D.C. |

| Household Size |

Additionally, to be eligible for Medicaid, you cannot make more than the income guidelines outlined below:

- Children up to age 1 with family income up to 147 percent of FPL

- Any child age 1-5 with a family income up to 141 percent of FPL

- Children ages 6- 18 with family income up to 133 percent of FPL

- CHIP for children with family income up to 200 percent of FPL

- Pregnant women with family income up to 156 percent of FPL

- Parents of minor children with family income up to 106 percent of FPL

- Individuals who are elderly, blind, and disabled with family income up to 88% of the FPL

- Adults without dependents under Medicaid expansion with income up to 133% of the FPL

Recommended Reading: Online Grocery Shopping That Accepts Ebt

Recommended Reading: Sam’s Club Pay With Ebt Online

Coronavirus Relief Fund Grants

Learn about the taxability of grants funded by the CARES Act Coronavirus Relief Fund, including grants awarded by the Massachusetts Growth Capital Corporation , the Commonwealth, or municipalities.

My business received a grant awarded by the MGCC, or another Commonwealth or municipal grant funded by the CARES Act Coronavirus Relief Fund. Is this grant taxable income?

Yes. Federal law requires that grants to businesses be included in gross income. The IRS has specifically stated that if governments use CARES Act Coronavirus Relief Fund payments to establish grant programs to support business, businesses receiving such grants must include the grant amount in their federal gross income. Because these grants are taxable under federal law, they are also taxable under Massachusetts law.

Can I deduct business expenses paid with grants awarded by the MGCC, or with other Commonwealth or municipal grants funded by the CARES Act Coronavirus Relief Fund?

Yes. Whether you are subject to the personal income tax or the corporate excise, if your expenses are deductible on your federal return, they are also deductible on your Massachusetts return.

Debt Relief Subsidies Paid by the Small Business Administration

I report my business income on a personal income tax return. My business received a loan qualifying for debt relief subsidies paid by the Small Business Administration pursuant to Section 1112 of the CARES Act. Are these debt relief subsidies taxable income?

Why Michigan Is Seeing A Spike In Amended State Returns

The Michigan income tax return uses the adjusted gross income from your federal return and reflects the change in rules relating to jobless benefits for 2020.

Michigans Treasury Department received around 45,000 amended state returns through late May. Thats up significantly from around 26,000 amended returns received at this time last year and about 20,000 amended returns received in 2019.

The majority of those amended returns are for the unemployment exclusion reason, said Ron Leix, a Michigan Department of Treasury spokesperson.

Out of the 45,000 received so far, we have processed all except 1,600. We have a dedicated team that is specializing in getting the amended returns out the door as efficiently as possible, he said.

Leix said the state has been waiting for additional IRS guidance to see if Michigan could provide the unemployment tax treatment automatically for those who already filed their returns before the American Rescue Plan was enacted.

It wasnt good taxpayer service to ask those impacted taxpayers to wait so we asked those who already filed their returns to file an amended return, he said.

That way they could receive a refund or pay less in taxes.

Read Also: Can I Get Food Stamps If I Am Unemployed

Read Also: How To Apply Online For Food Stamps In Nc

How To Apply For North Carolina Food Stamps

There are four ways you can apply for food stamps in North Carolina online, in-person, by mail or via phone. Before we go through each of the four ways to apply for NC food stamps, lets review what you will need to apply. Its important that you gather all the necessary documents prior to applying for North Carolina food stamp benefits.

Here is a list of information and documentation you will need to complete your North Carolina SNAP Application:

- Drivers License

- Date of Birth or Birth Certificate

- Income information such as pay stubs from a job, child support or any other sources.

- Resource or asset information such bank accounts , vehicles, homes, land or life insurance.

- Housing expenses, such as rent or utilities.

- Health Insurance information

- Verification of participation in other social services programs such as Medicaid or Work First Family Assistance.

Once you have gathered this information, you can now begin the North Carolina Food Stamps application process.