What Is The Food Stamp Income Limit

Looking for the food stamp income limit Indiana? Read on for more info

If you want to receive food stamps Indianapolis your households net monthly income needs to be less than the overall monthly income cap. These limits are announced by the state and are based on the average income of citizens in an area.

Net income is not the same as overall income. Because it takes taxes and expenses into consideration. You will need to contact your local food stamps office Indianapolis to find out if you meet the net income limit. But, you can compare your overall household income to these statistics to determine whether you are within the Indiana food stamp guidelines.

These numbers are given by the state of Indiana and are applicable between October 1, 2019, and September 30, 2020. And the Indiana EBT card phone number is 1-800-403-0864.

Lets take a look at a few household size examples:

One Person The overall monthly income cap is $1354 while the net monthly income cap is $1041. And the maximum benefit you can receive as a family of one is $194.

Two People The overall monthly income cap is $1832 while the net monthly income cap is $1410. And the maximum benefit you can receive as a family of one is $355.

Three People The overall monthly income cap is $2311 while the net monthly income cap is $1778. And the maximum benefit you can receive as a family of one is $509.

How Do You Count Household Size

When counting your household size you should count all the members of your family. This means anyone who lives with you and consumes the food you purchase. It does not always refer to all the people living in your house.

For example, tenants renting a portion or room are not included in your Indiana SNAP application. And neither are adult children, above the age of 22, responsible for buying their own food.

However, children below the age of 22 are always household members regardless of whether or not they are employed or purchase their own food. And can receive a food stamp card, Indiana.

Elderly citizens above the age of 60 are household members if you purchase food together but not if they manage their food expenses separately. Similarly, family members with disabilities count if you are responsible for feeding them, but not if they are self-sufficient.

How Can I Check The Balance Of The Card Glad You Asked

There are different ways of checking your Ohio benefits food stamps balance.

You can look at your last receipt where the Ohio food stamp status balance will be indicated. Likewise, beneficiaries can also call the customer service to ask for the remaining amount on the SNAP food stamps Ohio card as well as the last 10 transactions made.

Also Check: How Do I Get Food Stamps In Texas

Does Having Children Increase Your Chances Of Receiving An Indiana Ebt Card

Yes and no. Having a child will increase the size of your household with no change in your gross income so you will automatically receive more benefits. However, preference is not given to families with children. And pregnant women will not be getting additional food stamps.

If you have children you can apply for Women, Infants, and Children also known as WIC benefits. Call the helpline at 1-800-403-0864 to find out the Indiana WIC requirements. WIC eligibility Indiana extends to pregnant women, recent parents, and children under five years of age.

Cutbacks Of The Early 1980s

The large and expensive FSP proved to be a favorite subject of close scrutiny from both the Executive Branch and Congress in the early 1980s. Major legislation in 1981 and 1982 enacted cutbacks including:

- addition of a gross income eligibility test in addition to the net income test for most households

- temporary freeze on adjustments of the shelter deduction cap and the standard deduction and constraints on future adjustments

- annual adjustments in food stamp allotments rather than semi-annual

- consideration of non-elderly parents who live with their children and non-elderly siblings who live together as one household

- required periodic reporting and retrospective budgeting

- prohibition against using Federal funds for outreach

- replacing the FSP in Puerto Rico with a block grant for nutrition assistance

- counting retirement accounts as resources

- state option to require job search of applicants as well as participants and

- increased disqualification periods for voluntary quitters.

Electronic Benefits Transfer began in Reading, Pennsylvania, in 1984.

You May Like: Do Food Stamps Roll Over In Nc

Supplemental Nutrition Assistance Program

| Parts of this article need to be . Please help update this article to reflect recent events or newly available information. |

In the United States, the Supplemental Nutrition Assistance Program , formerly known as the Food Stamp Program, is a federal program that provides food-purchasing assistance for low- and no-income people. It is a federal aid program, administered by the United States Department of Agriculture under the Food and Nutrition Service , though benefits are distributed by specific departments of U.S. states .

SNAP benefits supplied roughly 40 million Americans in 2018, at an expenditure of $57.1 billion. Approximately 9.2% of American households obtained SNAP benefits at some point during 2017, with approximately 16.7% of all children living in households with SNAP benefits. Beneficiaries and costs increased sharply with the Great Recession, peaked in 2013 and have declined through 2017 as the economy recovered. It is the largest nutrition program of the 15 administered by FNS and is a key component of the social safety net for low-income Americans.

The Food Stamp Program And Income

Next, we turn to the contribution of FSP benefits to household income. For this purpose we continue separate analysis by age and further differentiate between recipients living alone or with spouses only and SSI recipients living with others. Table 3 provides a sense of the reliability of estimates for various subgroups by reporting sample sizes and the estimated number of SSI recipients for various subgroups in 2004. Some of the subgroups are so small that the results are meaningless. However for subgroup samples that are large, results can be viewed with considerable confidence.

Table 3. SSI recipients in food stamp recipient households, by living arrangements and benefits, fiscal year 2004| SSI recipient characteristic |

|---|

| NOTES: SSI = Supplemental Security Income OASDI = Old-Age, Survivors, and Disability Insurance. |

| a. Too few observations for meaningful calculations. |

| SSI recipient |

|---|

| NOTE: SSI = Supplemental Security Income. |

| a. Too few observations for meaningful calculations. |

| SSI recipient characteristic |

|---|

| NOTES: SSI = Supplemental Security Income OASDI = Old-Age, Survivors, and Disability Insurance. |

Also Check: What Income Is Eligible For Food Stamps

Who Is Eligible To Participate In The Program

- People who live together and buy food and prepare meals together are grouped as a household for SNAP. Husbands and wives, and children under age 22 living with their natural, adoptive or stepparents must be considered as one household.

- Household members that wish to be included must be U.S. citizens or legal aliens.

- Household members that wish to be included must furnish or apply for a social security number.

- Income and resource guidelines listed in this overview must be met.

- Able-bodied household members who are age 16 through 59 must register for work, and may be required to participate in a SNAP Employment and Training Program unless a specified exemption is met.

The Food Stamp Program

The FSP helps people buy food by providing grocery credit. The name is an anachronism today all recipient households receive the FSP benefit through the use of electronic benefit transfer cards. These are ATM-like debit cards that recipients use to purchase food from authorized grocery stores and supermarkets. The benefit is adjusted annually for changes in food costs. The FSP eligibility unit is the household, defined as an individual or group of people who live, buy food, and prepare meals together. This contrasts with SSI, which is determined on an individual, and not household, basis.

Also Check: How To Sign Up For Food Stamps In Tennessee

How To Renew Your Food Stamps In Washington

Enrollees who want to continue receiving SNAP must file a WA food stamps renewal application to the DSHS. Claimants may choose to:

- Renew food stamps online.

- Apply by completing the interactive Automated Client Eligibility System Application for Benefits.

- File a paper application to request reenrollment.

After petitioners file their renewal requests, they will need to submit proof that they still qualify for SNAP. Generally, claimants have until the end of their current claims to provide the DSHS with all the documents the department requests. In some instances, the department will also give the applicants a 10-day time frame to fully submit their proofs of program eligibility. However, claimants who miss these deadlines will likely need to completely reapply for food stamps benefits.

What Items Can I Buy With Ohio Foodstamps The Answer Might Surprise You

The following food items can be bought using your EBT card based on the Ohio food stamps guidelines:

- Fresh produce lie vegetables and fruits

- Poultry, meat, and fish

- Cereals, grains, and bread

- Non-alcoholic beverages

The Ohio food stamps apply also to plants and seed that can be grown to produce edible items.

According to the Ohio food stamps guidelines, the items below cannot be bought using the EBT card :

- Tobacco, cigarettes, wine, liquor, beer,

- Supplements, vitamins, and medicines

- Non-food grocery items like toiletries, cleaning products, pet food, and cosmetics, among others

Read Also: Can I Renew My Food Stamps Online

In Addition To The Income Guidelines What Else Changed On October 1 2021

At the beginning of every federal fiscal year, the United States Department of Agricultures Food and Nutrition Service adjusts maximum Supplemental Nutrition Assistance Program benefits, deductions and income eligibility standards. These adjustments are known as the SNAP Cost of Living Adjustment .

The SNAP COLA is based on changes in the cost of living and takes effect on October 1st of each year. Please read the following to learn about all the changes, some already reflected on this page as well as additional elements of the COLA, that became effective on .

Eligible Food Items Under Snap

As per USDA rules, households can use SNAP benefits to purchase:

- Foods for the household to eat, such as:

- fruits and vegetables

Soft drinks, candy, cookies, snack crackers, and ice cream are classified as food items and are therefore eligible items. Seafood, steak, and bakery cakes are also food items and are therefore eligible items.

Energy drinks which have a nutrition facts label are eligible foods, but energy drinks which have a supplement facts label are classified by the FDA as supplements, and are therefore not eligible.

Live animals and birds may not be purchased but live fish and shellfish are eligible foods. Pumpkins are eligible, but inedible gourds and solely ornamental pumpkins are not.

Gift baskets containing both food and non-food items “are not eligible for purchase with SNAP benefits if the value of the non-food items exceeds 50 percent of the purchase price. Items such as birthday and other special occasion cakes are eligible as long as the value of non-edible decorations does not exceed 50 percent of the price.”

You May Like: Apply For Food Stamps In Oklahoma City

The College Student Hunger Act Of 2019

Senator Elizabeth Warren and Congressman Al Lawson introduced The College Student Hunger Act of 2019 on July 17, 2019, in an attempt to extend SNAP benefits for college students in need. The idea was to include both Pell Grant-eligible students and independent students. Warren and Lawson both believe that students have a right to both food and education, and the goal was to alleviate financial tension. This bill has been endorsed by several organizations including Bread for the World. Specifically, the Act would allow Pell-Grant eligible and independent students to qualify for benefits, lowers the 20 hours/week work requirement to 10 hours/week, and requires the Department of Education to notify Pell Grant eligible students of their SNAP eligibility. The student hunger pilot program will test different ways students can use SNAP benefits such as directly at the dining hall or indirectly to help pay for student meal plans.

How To Use Ohio Direction Card Its Simple All You Need To Do Is

You can use the EBT card at any food retailer that accepts the Direction card. These stores normally have signs at their doors saying that the the Ohio EBT apply or accepted in their stores.

When buying outside Ohio, search for the Quest logo. You should take note that the Ohio food stamp guidelines still apply if you use your card outside the state.

Do not try to charge more than what the remaining balance in your Direction card. Otherwise, the card may not work.

Don’t Miss: Apply For Food Stamps Over The Phone

How Much Food Assistance Will I Get Ohio Snap Income Guidelines Right Here

How much you will receive in Ohio SNAP benefits depends on your family size and maximum gross monthly income in accordance to Ohio income guidelines for food stamps.

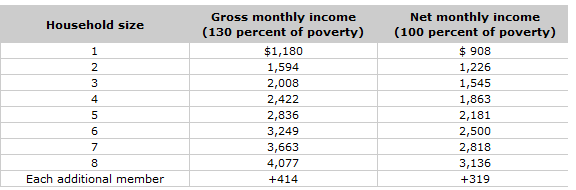

Find out what is the income limit for food stamps based on the 130 percent of the federal poverty level:

- If your family size is 1 with an Ohio food stamps income limit of $1316 then you can receive up to $192

- If your family size is 2 with an Ohio food stamp income limits of $1784 then you can receive up to $353

- If your family size is 3 with an Ohio food stamps income limit of $2252 then you can receive up to $505

- If your family size is 4 with an Ohio food stamps income limits of $2720 then you can receive up to $642

- If your family size is 5 with an Ohio food stamp income limits of $3188 then you can receive up to $762

- If your family size is 6 with income limits for food stamps in Ohio of $ 365 then you can receive up to $914

Case workers can better explain the food stamps income guidelines Ohio should you need additional clarification.

Food Stamp Act Of 1977

Both the outgoing Republican Administration and the new Democratic Administration offered Congress proposed legislation to reform the FSP in 1977. The Republican bill stressed targeting benefits to the neediest, simplifying administration, and tightening controls on the program the Democratic bill focused on increasing access to those most in need and simplifying and streamlining a complicated and cumbersome process that delayed benefit delivery as well as reducing errors, and curbing abuse. The chief force for the Democratic Administration was Robert Greenstein, Administrator of the Food and Nutrition Service .

In Congress, major players were Senators George McGovern, Jacob Javits, Hubert Humphrey, and Bob Dole, and Congressmen Foley and Richmond. Amid all the themes, the one that became the rallying cry for FSP reform was “EPR”eliminate the purchase requirementbecause of the barrier to participation the purchase requirement represented. The bill that became the law did eliminate the purchase requirement. It also:

- eliminated categorical eligibility

In addition to EPR, the Food Stamp Act of 1977 included several access provisions:

The integrity provisions of the new program included fraud disqualifications, enhanced Federal funding for States’ anti-fraud activities, and financial incentives for low error rates.

EPR was implemented January 1, 1979. Participation that month increased 1.5 million over the preceding month.

Don’t Miss: How To File For Food Stamps In Washington State