Quick Guide On How To Complete Self Employment Ledger Template Form

Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online.

SignNow’s web-based program is specifically created to simplify the arrangement of workflow and enhance the entire process of qualified document management. Use this step-by-step instruction to fill out the Self employment ledger form template form quickly and with perfect accuracy.

How To Use A Manual Self

A self-employment ledger can be digital or handwritten, and youll need to fill it out throughout the year alongside keeping any online or physical receipts and invoices.

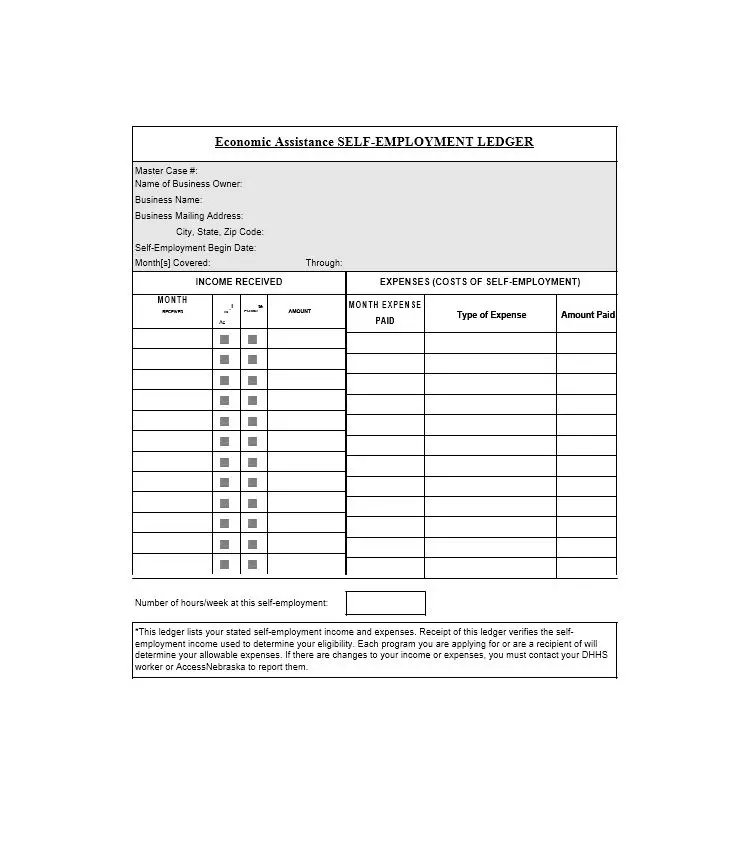

Step 1. Open a spreadsheet or download a self-employment ledger template

Step 2. Create a column for Income and Expenses

Step 3. Under Income add three columns: Date, Invoice, and Service/Product

Step 4. Under Expenses, add four columns: Date, Cost, Type of Expense, Intent

Step 5. Calculate the total income and total expenses at the bottom of the spreadsheet

Step 6. Save all your receipt and fill in your spreadsheet throughout the year

Its a good idea to keep your ledger somewhere you can easily access it. If youre on a computer, make sure to keep it in an organized folder online and save it in your bookmarks so you can reach it at any time. If you prefer pen and paper, keep it in your home office near your desk, so you know exactly where to find it. Youll also want to keep a folder with all your receipts .

Tips On How To Complete The Self Employment Ledger Template Form On The Internet:

By making use of SignNow’s comprehensive service, you’re able to complete any needed edits to Self employment ledger template form, generate your customized digital signature within a few fast steps, and streamline your workflow without the need of leaving your browser.

Create this form in 5 minutes or less

Also Check: Edg Number Texas

Quick Guide On How To Complete Self Employment Ledger Example

Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online.

SignNow’s web-based application is specially made to simplify the management of workflow and improve the entire process of competent document management. Use this step-by-step guideline to fill out the Ledger document documentation documentation form swiftly and with excellent accuracy.

How To Create An Esignature For The Self Employment Ledger Template Form Right From Your Smart Phone

Mobile devices like smartphones and tablets are in fact a ready business alternative to desktop and laptop computers. You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. Therefore, the signNow web application is a must-have for completing and signing self employment ledger on the go. In a matter of seconds, receive an electronic document with a legally-binding eSignature.

Get self employment ledger form signed right from your smartphone using these six tips:

The whole procedure can take a few seconds. As a result, you can download the signed self employment ledger template form to your device or share it with other parties involved with a link or by email. Because of its universal nature, signNow works on any device and any operating system. Choose our eSignature tool and forget about the old days with efficiency, affordability and security.

Don’t Miss: Food Stamp Office On Masters Dr

The Way To Complete The Self Employment Ledger Pdf Documentation Form On The Web:

By using SignNow’s comprehensive solution, you’re able to perform any needed edits to Self employment ledger documentation form, generate your customized digital signature in a few quick actions, and streamline your workflow without leaving your browser.

Create this form in 5 minutes or less

The Snap Program Is Important

The USDA SNAP program is greatly beneficial for American citizens. It keeps food on the table and often helps prevent starvation. As a hard-working self-employed person who pays taxes, if you qualify, you should definitely use them.

If you find out you do not qualify for food stamps, find a food bank in your area for another chance to get food at no cost to you.

You May Like: Kansas Food Stamp Card

How To Get Food Stamps Or Snap Benefits When Self

I research information from public agencies and organizations to help low-income people get benefits that make their lives a little easier.

Food stamps for the self-employed or contractors.

Working for yourself is not only a test of wits and skills but often just plain survival. Many self-employed people do not earn consistent wages but earn per project. This means that if they do not have a contract or a project to work on, they do not get paid, and they can go hungry.

Luckily, the USDA food stamp program, also known as SNAP, allows the self-employed to get food benefits as well. People within 100% of the poverty guidelines can get a monthly food stamp benefit maximum of approximately $175 per person. Income guidelines are also more relaxed if you happen to have a disabled family member or a person over 60 years of age in your home.

In addition, once you get approved for food stamps, you’ll generally be eligible for Medicaid national healthcare. In the past, it was very difficult for self-employed people to get these two benefits, but the U.S. and state governments have made it easier in the past few years.

Instructions And Help About Self Employment Ledger

hello ok when you click the link you’ll be brought to my Google Drive and if you look in the top right hand corner you’ll see if you’re logged into Google Drive or it will say login now if you have a gmail at gmail address then you automatically have Google Drive so this is a spreadsheet these are the same instructions I’m going over the spreadsheet starts here which you’ll see in other videos the 3 steps now to save your copy you just go file you won’t have all of these options here you’ll only have the option to make a copy and that will make a copy in your Google Drive or you can go download as and you can choose Excel or if you want an open spreadsheet or CSV file whatever you use go ahead and click one of those options and it will automatically create a copy if you’re not logged in in the right corner you can log in first or it will prompt you to log in after you click make a copy all right and then the next videos we’ll get started with step 1 see you then

You May Like: How To Apply For Food Stamps In Dallas Texas

Very Important: Know The Work Requirements In Your Area

The rules allowing people to get food stamps without work are expiring or have expired across most of the country. If you live in a county or state that requires you to work to get food stamps and you are between the ages of 18 to 49, your self-employment will generally fill this requirement if:

- You make 30 times hourly federal minimum wage per week before expenses

If you do not fulfill this requirement or have a different exemption, you could be forced to apply for jobs after three months on SNAP benefits if you are an able-bodied adult without dependents aged 18 to 49.

The closer you are to the poverty guidelines, the more likely you are to get the maximum monthly SNAP benefit.

How To Add A Signature On Your Self Employment Ledger 2002

Though most people are in the habit of signing paper documents by handwriting, electronic signatures are becoming more common, follow these steps to add a signature for free!

- A box will pop up, click Add new signature button and you’ll have three optionsType, Draw, and Upload. Once you’re done, click the Save button.

- Move and settle the signature inside your PDF file

Read Also: Kansas Food Stamps What Can You Buy

Heres How To Track Your Income And Expenses With Lili

Step 1. Categorize transactions in real-time

Swipe left or right to categorize work expenses from personal expenses .

Step 2. Upload pictures of your receipts

Go to All Transactions to take a photo of your receipt, both personal and work-related, right in the Lili Banking app.

Step 3. Create and send invoices

With Lili Pro, you can manage all your invoices and receive payments in one place.

Step 4. Download your Income & Expense Report

Go to Statements and Sheets, then choose which period youd like to download. You can email the file or airdrop it to your laptop or computer.

Planning for taxes doesnt have to be time-consuming and frustrating hey, it could almost be fun. Who doesnt like to swipe right? Take the easy way in with Lilis Tax Optimizer. As a freelancer or self-employed contractor, knowing how to manage your income and expenses is a valuable part of the job. Now that you know how to track both with Lili, youll save time and money when it comes to filing your taxes and feel confident youve got your business under control.

What Counts As Self

The first step to applying for food stamps as a self-employed person is to determine how your state defines self-employment, as this can differ from state to state. For example, Oregon considers someone to be self-employed if the business he works for considers him an independent contractor. If that’s not the case, the food stamp applicant must meet at least four other criteria out of a longer list of options. Examples include not having to complete a W-4 form or not having federal income taxes withheld from paycheck. In Alaska, applicants must meet five criteria. A few of these include not being eligible for worker’s compensation, earning income from her own business, and not having federal income taxes withheld.

Video of the Day

Read Also: Washington State Food Benefits

How To Create An Electronic Signature For The Self Employment Ledger Template Form Online

Are you looking for a one-size-fits-all solution to eSign self employment ledger? signNow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. All you need is smooth internet connection and a device to work on.

Follow the step-by-step instructions below to eSign your self employment ledger form:

After that, your self employment ledger template form is ready. All you have to do is download it or send it via email. signNow makes eSigning easier and more convenient since it provides users with numerous additional features like Add Fields, Invite to Sign, Merge Documents, and so on. And due to its cross-platform nature, signNow works well on any gadget, desktop computer or mobile phone, regardless of the operating system.

How To Create An Esignature For The Self Employment Ledger Documentation Form In Chrome

The guidelines below will help you create an eSignature for signing self employment ledger documentation in Chrome:

Once youve finished signing your ledger document, decide what you wish to do after that – save it or share the file with other people. The signNow extension provides you with a selection of features for a much better signing experience.

Recommended Reading: Oklahoma Snap Application Online

Why Its Essential To Track Your Income And Expenses

Maybe youre asking yourself: why do I need a self-employment ledger? Chalk it up to record keeping. As a freelancer, youll need to know exactly how much money youre earning a monthand how much youre spending. Having a reliable self-employment ledger will help you better manage your finances and optimize your tax refund. By keeping a self-employment ledger, youll be able to show proof of all your earnings and expenses when it comes down to tax season. And with every eligible business expense, your taxes go down!

Whether filing taxes yourself or working with an accountant, having one organized place with all your expenses will make the process much faster, saving you valuable time and money.

On the flip side, inaccuracies in your financial records can make life more difficult when dealing with the IRS. So you want to make sure that youre doing this accurately and keep proof of all your income and expenses, so you dont get hit with tax penalties or inflated bills.

How To Create An Electronic Signature For Putting It On The Self Employment Ledger Documentation Form In Gmail

Below are five simple steps to get your self employment ledger documentation eSigned without leaving your Gmail account:

The sigNow extension was developed to help busy people like you to reduce the stress of signing forms. Start putting your signature on ledger document using our tool and become one of the numerous satisfied clients whove previously experienced the key benefits of in-mail signing.

Recommended Reading: Alabama Food Stamp Requirements