The Benefits Of The Self

The forms are available for free download. Of course, creating a template from scratch can be somewhat difficult and intimidating, that is why it is better to download an already built template rather than spending time on your computer trying to do the design yourself. You can also see Employment Verification Forms

It is important to understand that regardless of being self-employed, you will and you must still pay taxes much the same way an employed individual does. That is exactly why you need to fill the sample self-employment form, even more, understand that paying taxes is your obligation as an individual and as a business person.

How To Fill Out And Sign Work Calendar For Self Employment Online

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax, legal, business as well as other documents need a high level of protection and compliance with the legislation. Our templates are updated on a regular basis in accordance with the latest amendments in legislation. In addition, with us, all of the information you include in the Work Calendar For Self Employment is well-protected against loss or damage by means of industry-leading encryption.

The following tips will allow you to complete Work Calendar For Self Employment quickly and easily:

Our solution allows you to take the whole procedure of submitting legal documents online. Due to this, you save hours and eliminate unnecessary expenses. From now on, fill out Work Calendar For Self Employment from your home, business office, and even while on the move.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Connecticut State Department Of Social Services

*The DSS Willimantic Field Office is closed Tuesday, June 7. Please see 24/7 access to DSS section below. For a list of all field offices, please visit www.ct.gov/dss/fieldoffices.

*Has your contact information changed? Dont miss important news about your benefits. Please update your contact info online now! If youre a HUSKY A, B or D member, go to www.accesshealt.hct.com and sign in to your Access Health CT User Account. If youre a HUSKY C member, SNAP or cash assistance client, go to www.connect.ct.gov or www.mydss.ct.gov and sign in to your DSS MyAccount.

*24/7 access to DSS: You can apply for & renew services online through our ConneCT portal . Get case/benefit status, view notices, report changes, download budget sheets, upload & send documents & more! Our 24/7 Client Information Line gives you access to many service & eligibility needs . And check out MyDSS–our new mobile-friendly app–access your account anywhere, anytime, on any device .

*Our customers can access benefit and application information, 24/7, at www.connect.ct.gov and www.ct.gov/dss/apply or 1-855-6-CONNECT , except during system maintenance on Tuesday, 06/07/2022 from 7:00 p.m. to 9:30 p.m., during which ConneCT/MyDSS and PWA will experience a complete outage.

Also Check: Food Stamp Office In Somerset Ky

The Snap Program Is Important

The USDA SNAP program is greatly beneficial for American citizens. It keeps food on the table and often helps prevent starvation. As a hard-working self-employed person who pays taxes, if you qualify, you should definitely use them.

If you find out you do not qualify for food stamps, find a food bank in your area for another chance to get food at no cost to you.

Employment And Unemployment Technicalities

- You normally cannot be forced to apply for unemployment compensation if you have been unemployed more than 60 days. This saves you from having to apply for jobs where you work for someone else. It respects the aspect that you want to remain self-employed.

- If you are pregnant, disabled on SSI, parent to a child under 6 years of age, or you are 60 years of age or older, you are exempt from any federal work requirements to get food stamps.

Recommended Reading: Orange County Florida Food Stamps

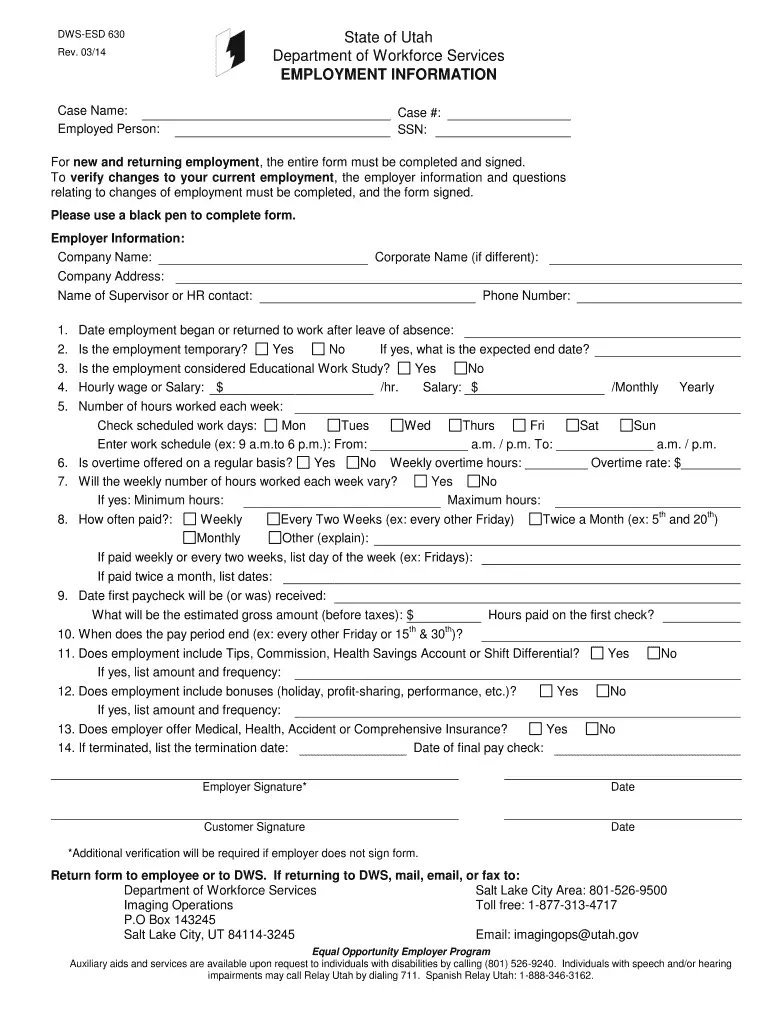

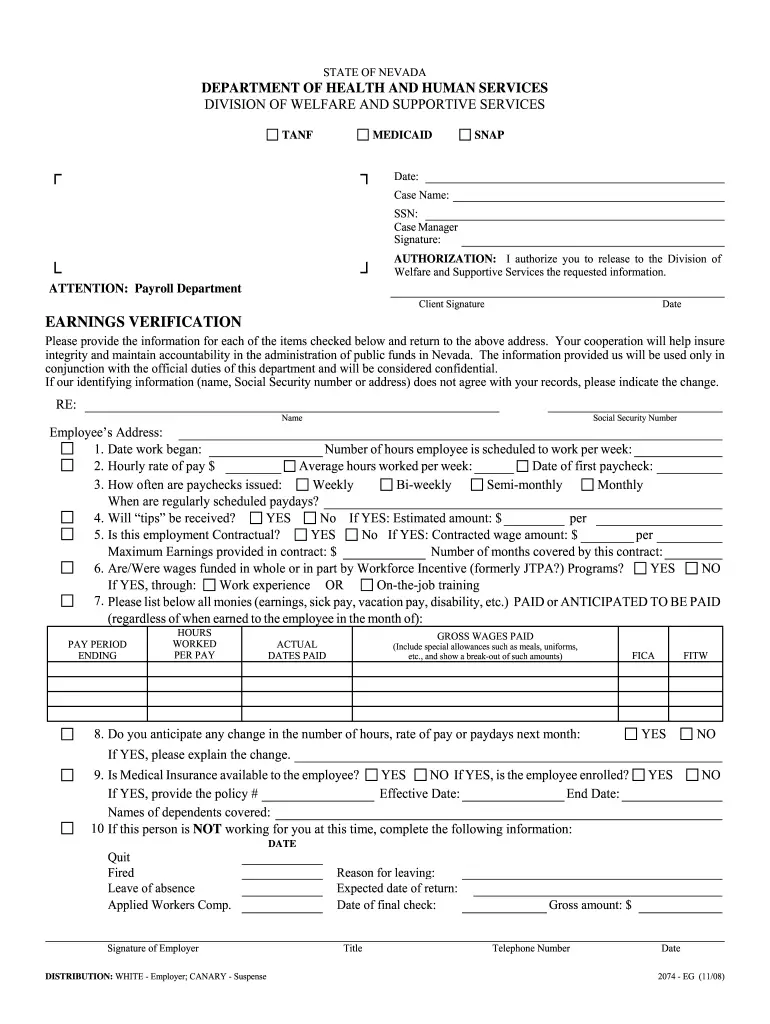

Iii Statement Of Verification

Name Of Employee. The testimony provided shall require that the full name of the Employee be presented to the first line.

Employer Name. Supplement the language used with the legal name of the Employer. This should appear as it was recorded in the return address above.

Employee Start Date. Deliver a record on the calendar date when the Employee began his or her position with the Employer.

Calfresh / Self Employment Statement

Hello, is there anyone out there who can help me fill out my self employment sworn statement? It’s my first time on CalFresh and I don’t want to accidentally get myself into trouble by filling out the paperwork wrong.

First off, since Covid happened, I had to go back to my job as a babysitter. I get paid cash and my hours fluctuate depending on my clients’ schedules.

It’s asking me for Daily Income and Daily Expenses, , and vehicle mileage? That’s all in regards to my job right? How would I report all of that stuff if all I do is babysit?

Also, what does “If receiving CalWORKS, and/or CalFresh, AND you chose to use 40% of your gross income as expenses, you do not need to list or verify your expenses” mean?

At the end, it only asks for my signature right? Just mine? I’m a little confused on the “Signature of witness to mark, interpreter, or other person completing form”.

I’m sorry for all the question, it’s confusing to me.

Any and all help is much appreciated, thank you so much.

You May Like: Food Stamps Income Limit Georgia

Whats The Purpose Of Self

The purpose of reporting is to help you determine your earnings for the period you earn the money. You can use the accrual method to write your report. In this case, you record the payment in the fiscal period, regardless of the time you receive a payment. The same goes for business expenses you must account them in the same fiscal period your business incurs them. You can also see Employee Declaration Forms.

Overall, the purpose of self-employment verification claim and business income report is to help your business earnings. Also, the report provided helps to show that you have paid the relevant income taxes as dependent on your business profits and the terms and conditions of business income tax payment.

Remaining Eligible For Food Stamps

- You will usually be required to re-certify your eligibility for food stamps/SNAP at least every six months. So pay attention to your income, keep your records up, and report any major income changes to the government. If you make too much in income for any amount of months without first reporting it, you will most likely owe any overpay on the food stamps back.

How food stamps help Americans.

You May Like: Apply For Food Stamps Kansas

How To Make An Esignature For The Self Employment Ledger Documentation Form On Ios

To sign a self employment ledger documentation right from your iPhone or iPad, just follow these brief guidelines:

After its signed its up to you on how to export your ledger document: download it to your mobile device, upload it to the cloud or send it to another party via email. The signNow application is just as effective and powerful as the web solution is. Connect to a smooth connection to the internet and begin completing documents with a legally-binding electronic signature within a few minutes.

Food Stamp Guidelines For The Self

Self-employment has its perks. Setting your own schedule, enjoying a host of tax write-offs and pursuing your career of choice are common benefits for self-employed people. However, self-employment means your income is not guaranteed. When experiencing financial hardship, consider applying for food stamp assistance until your income stabilizes.

Read Also: Does Heb Accept Food Stamps

Quick Guide On How To Complete Self Employment Ledger Example

Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online.

SignNow’s web-based application is specially made to simplify the management of workflow and improve the entire process of competent document management. Use this step-by-step guideline to fill out the Ledger document documentation documentation form swiftly and with excellent accuracy.

How To Get Food Stamps Or Snap Benefits When Self

I research information from public agencies and organizations to help low-income people get benefits that make their lives a little easier.

Food stamps for the self-employed or contractors.

Working for yourself is not only a test of wits and skills but often just plain survival. Many self-employed people do not earn consistent wages but earn per project. This means that if they do not have a contract or a project to work on, they do not get paid, and they can go hungry.

Luckily, the USDA food stamp program, also known as SNAP, allows the self-employed to get food benefits as well. People within 100% of the poverty guidelines can get a monthly food stamp benefit maximum of approximately $175 per person. Income guidelines are also more relaxed if you happen to have a disabled family member or a person over 60 years of age in your home.

In addition, once you get approved for food stamps, you’ll generally be eligible for Medicaid national healthcare. In the past, it was very difficult for self-employed people to get these two benefits, but the U.S. and state governments have made it easier in the past few years.

You May Like: Food Stamps Okc

How To Generate An Electronic Signature For The Self Employment Ledger Documentation Form On Android Os

In order to add an electronic signature to a self employment ledger documentation, follow the step-by-step instructions below:

If you need to share the ledger document with other people, you can easily send the file by e-mail. With signNow, you are able to eSign as many papers in a day as you require at an affordable price. Begin automating your signature workflows right now.

How To Apply For Food Stamps When Self

You May Like: Arizona Social Services Food Stamps

Very Important: Know The Work Requirements In Your Area

The rules allowing people to get food stamps without work are expiring or have expired across most of the country. If you live in a county or state that requires you to work to get food stamps and you are between the ages of 18 to 49, your self-employment will generally fill this requirement if:

- You make 30 times hourly federal minimum wage per week before expenses

If you do not fulfill this requirement or have a different exemption, you could be forced to apply for jobs after three months on SNAP benefits if you are an able-bodied adult without dependents aged 18 to 49.

The closer you are to the poverty guidelines, the more likely you are to get the maximum monthly SNAP benefit.

Iv Specifics Of Employment

Employee Name. The name of the Employee requires a reproduction in the confirmation statement. Seek out the first line in the second paragraph to verify the Employees identity

Job Title Or Position. The position or the title that the Employee holds with the Employers Company must be included in this paragraph. Furnish it to the available space.

Job Status. The employment status that the Employee holds should also be discussed. Indicate if he or she is a Full Time or Part-Time Employee by selecting the first or second checkbox presented .

Supporting Information. Report the number of hours a week the Employee works to further define his or her employment status. In most states, a Full-Time Employee will be expected to work a minimum of thirty-five to forty hours per week while a Part-Tim Employee will be scheduled for less than thirty-five hours of payable work hours per week

Employee Earnings. The compensation paid to the Employee requires a definition for the purpose of this letter. Report the dollar amount paid to the Employee for the position he or she holds. This may be reported at a rate of your choosing which must be kept consistent as this statement progresses.

Yearly Salary. If the Employee earns the dollar amount once a year, then leave the previous check boxes unmarked and select only the Annual salary definition.

Don’t Miss: Food Stamp Calculator Alabama