How Do I Apply For Snap

There are several options for applying. Only one member of the households needs to apply for the total household, but everyone living in the household needs to be included on the application along with their income. Most states provide an online application to start the process. See the States website section for a link to your states website. If your state does not provide an online application or you do not have access to a computer, you can go to your local state or county office to apply.

As part of the application process, you will need to go to your local state or county office for a face-to-face interview. If you are not able to go to the local office or apply online, you can designate an authorized representative. This is someone you give authority to represent you. You have to designate the person in writing to be official. This person can be a friend or relative.

The entire process generally involves filling out an application, going in for a face-to-face interview, and providing verifications for needed information such as income, residency, and expenses. If because of age or disability, an applicant is unable to go to the office and cannot appoint a representative, the interview may be waived at the discretion of the local office. However, if the interview is waived, the applicant will have to have a phone interview or consent to a home visit instead.

Florida Snap Standard Deduction Amount

When determining your eligibility for Florida food stamp benefits, you will subtract a standard deduction from your total household income. The standard deduction amount is based on two factors your household size and location.

To find out how much your standard deduction will be, use the SNAP Standard Deduction Chart for fiscal year 2022 provided below:

| Florida SNAP Standard Deductions for Fiscal Year 2022 |

| Effective October 1, 2021 September 30, 2022 |

| Household Size |

| $1,500 earned income + $550 social security = $2,050 gross income. | |

| If gross monthly income is less than the limit for household size, determine net income. | $2,050 is less than the $2,871 allowed for a 4-person household, so determine net income. |

Definition Of A Household

When determining eligibility, you need to provide information on all members of the household. A household, for this situation, is defined as all individuals that live together and purchase and prepare meals together. Likewise, you may have people living with you that are not considered part of your household. For example, if you rent a room to someone that does not purchase or prepare food with you, they are not part of your household. However, whatever they pay you for rent has to be counted under income.

There are two exceptions to this definition. The first is a household that includes a husband, wife, and children under 22 years of age. This group will be considered a household even if they purchase and prepare meals separately. The second exception is elderly or disabled individuals that are unable to purchase and prepare their meals independently and live with others that do.

Don’t Miss: Can I Buy Emergen C With Food Stamps

Determining Eligibility For Food Stamps

To qualify for your SNAP benefits, your household must meet certain prerequisites and requirements. Yet what exactly qualifies as a household?

A household includes all those who reside with you, purchases, and prepares food with you. When considering resources and income, it is the sum of all the members of your household, not just the head of the household.

Under federal guidelines to be eligible for food stamps, a householdâs resources and earnings must essentially meet these three requirements, according to the Social Security Administration:

Snap Benefits: How To Qualify Apply And How Much To Expect

The March 2021 American Rescue Plan expanded the generosity and loosened the requirements of the SNAP program to help food-insecure Americans get through the COVID-19 pandemic.

SNAP, which provides money for food monthly to low-income individuals and families, is a program of the U.S. Agriculture Department and administered by state and local agencies. The average SNAP benefit per household in 2021 was $210.07 a month, according to USDA Food and Nutrition Service.

But many Americans, long before the coronavirus, have benefited from the nearly six decade-old program, originally known as Food Stamps. Its a bridge for millions of Americans a year to better times, and even can lift people out of poverty. In 2019 alone, about 38 million, or one in nine, Americans used SNAP. In 2021, that was up to 42 million as the American Rescue Plan went into effect.

Traditionally, more than half of SNAP recipients are families with children. Nearly half of SNAP beneficiaries 42% pre-pandemic are working families with an income, who cant make ends meet.

You May Like: How Do I Apply For Food Stamps In Wisconsin

Can I Get Food Stamps If I Dont Pay Rent

Calculating the value of your food stamps is complex. But if you don’t pay rent and wonder if you are eligible for food stamps benefits, it all depends on the situation and circumstance around why you don’t pay rent. There are a variety of reasons as to why someone who does not pay rent may need SNAP benefits. This may include homeless individuals, college students, or those who live with friends or family.

So if you don’t pay rent, do you qualify for food stamps benefits? In most cases, you can. Although there are a few exclusions, and that you probably will not receive as much benefit as those who do pay for rent, for the most part, you can receive food stamps even if you do not pay for rent.

However, there are certain circumstances sometimes where you wonât be able to receive SNAP benefits if you do not pay rent. This is because there are housing situations where it will make you unqualified for food stamps either if you pay for rent or not. It is important to make note of these situations.

According to USDA, some individuals who are not eligible for food stamps if they donât pay rent includes:

â Young adults living with their parents do not qualify

If you are a young adult who resides with your parentâs home, you usually will not be eligible for food stamps benefits since you are usually required to be included as part of your parentâs household food stamp.

â Borders are considered an exception and are not eligible for benefits

Legally Owed Child Support Payments

This reduction in child support you are legally obliged to pay for children who do not live in your household, which is not counted under the gross income test and thus a deduction in figuring out your net income.

Your payments for child support is only not countable if you have an administrative order, court order, or any other enforceable legal separation contract of agreement that states that you must pay this amount of money.

If you pass the gross income test, in addition to paying the child support from your earned income, the amount you have compensated will be added back into the sum of your earnings for an increase in your allowed 20% income.

Recommended Reading: Apply For Food Stamps And Medicaid Online

How To Use The Montana Ebt Card

How long does it take to get a Montana EBT card? is a question many petitioners ask once they learn they need this card to access their SNAP benefits. EBT, which stands for Electronic Benefits Transfer, indicates the way in which petitioners receive their funds from the DPHHS each month. No physical transference of cash is necessary, and petitioners may use their Montana EBT card like any other debit card.

The EBT card looks and functions just like a bank-issued card. As a result, enrollees may use these cards at grocery stores cash registers, as long as the facilities are authorized to accept EBT. Petitioners can also use their EBT cards to buy fresh produce at farmers markets. However, before beneficiaries begin using these cards at grocery markets, they should check to make sure their preferred stores accept SNAP. Candidates should also check their EBT card balance beforehand to ensure they have enough funds in their accounts to cover their purchases.

Claimants often wonder what they can buy with their SNAP card. Generally, enrollees may purchase all kinds of:

- Fruits.

- Snack foods.

What Income Is Not Counted For Snap

When caseworkers determine your eligibility, one important thing they will look at is your household monthly income. Your household monthly income plays a big part in deciding if you are qualified for the benefits, and also the number of food stamps benefits you will be qualified for. This means income will certainly depend on the number of members of your household, and you will have to provide information about them.

According to Mass Legal Help, not all income will count towards your SNAP benefits. Some of the income that does not count for SNAP from Mass Legal Help may include:

â VISTA, Youthbuild, and AmeriCorps allowances, earnings, or fees for individuals that are, in any other case, eligible.

â Earnings of a kid under the age of 18 who are attending secondary college at least half of the time.

â Lump-sum bills â together with inheritances, tax credits, damage awards, one-time severance pay, or different one-time payments

â Reimbursements â the amount of money you get back to pay again for costs, such as schooling-associated costs and medical costs

â Senior Community Service Employment Program stipends paid to older employees doing community service jobs part-time

â Anything you do not receive as cash, including free housing or food, or expenses that are paid straight to a landlord or utility company made by a relative, friend or agency that has no legal obligation to do so

â Up to $300 in three months from private charities

You May Like: Alameda County Social Services Food Stamps

What Happens After I Submit My Snap Application

After you submit your SNAP application, you will have a confidential interview with a caseworker.

Usually, you must appear in person for this interview but the in-person interview requirement can be waived under certain circumstances.

See below for more details.

During the interview, the caseworker will request any additional documentation needed to establish eligibility.

Once your eligibility for SNAP is established, you will receive an Electronic Benefit Transfer card .

You can use the EBT card to purchase food at any approved grocery store throughout the state.

Does A Car Payment Affect Food Stamps

When you register for your SNAP benefits, your caseworker will determine your qualifications based on your earnings, your household members, and the number of cashable assets, according to USDA. An asset that is considered cashable includes cars that members of the household owns. Although USDA sets the principles and guidelines for the worth of the asset, states are given the liberty to essentially determine to either execute these regulations or disregard them.

According to USDAâs vehicle policy, up to approximately $4,650 of a vehicleâs value is excluded from assets. For example, this means that if your vehicleâs worth is $5,000, only $350 of that total is considered to be a resource.

Yet there have been some instances where the vehicle’s entire worth has been exempt, including if you use the vehicle to reside in if the car is used to help make money, if you use it to transfer a disabled family member, or if the equity value is $1,500 or less.

However, many states exclude cars as an asset. According to World Work, they exempt vehicles as a resource regardless of what the household uses it for or what it worths. States that have total exemption include Alabama, California, Connecticut, Mississippi, and New Jersey.

Recommended Reading: How To Check Your Food Stamp Balance

The Emergency Food Assistance Program

What is TEFAP?

TEFAP is a federal nutrition assistance program that helps supplement the diets of low-income Ohioans by providing food at no cost to them. This food is distributed through many of Ohio’s food pantries, soup kitchens and shelters.

Who is eligible to get TEFAP food?

You are eligible to receive food from TEFAP if your total household income is below 200 percent of the federal poverty guidelines.

Where can I apply?

Find the distribution location nearest you . This map will help you find the food bank responsible for your area, and the food bank will then direct you to the nearest food pantry, soup kitchen or shelter. You must sign a statement certifying your income at the food pantry.

Calculating Net Income With Allowable Deductions

Step 1

Subtract any Allowable Deductions

After you have determined which allowable deductions apply to your household, subtract those from your total gross monthly income. Doing this will give you the total net monthly income for your household.

If you need additional help doing this, use the example below:

| Determine if shelter costs are more than half of adjusted income | $700 total shelter $605 = $95 excess shelter cost |

| Subtract excess amount, but not more than the limit, from adjusted income | $1,210 $95 = $1,115 net monthly income |

| Apply the net income test | Since $1,115 is less than $2,146 allowed for 4-person household, this household has met the income test. |

Step 2

Determine if your Net Monthly Income is Eligible

Now that you have your net monthly income, you can see if your income is eligible for California food stamp benefits. Use the chart and follow the steps below to determine your eligibility.

| Household size |

Note: The allotments described here are for households in California

Check out the example for a SNAP benefit calculation below:

Read Also: How Do You Apply For Food Stamps In Texas

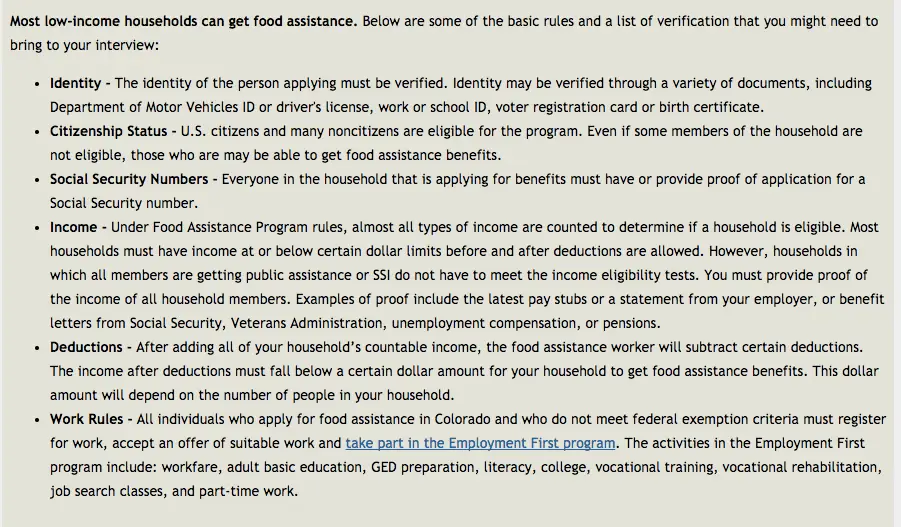

Deductions To Gross Income

The Alabama Department of Human Resources makes certain deductions from gross income to arrive at the household’s net income. The standard deduction ranges from a minimum of $142 for households with one to three members to a maximum of $205 for households with six or more people. The earned income deduction is for those who derive income from a job and is 20 percent of the monthly gross earned income. If the income is from self-employment, that income is subject to a 40 percent deduction as a cost-of-business deduction. Households with disabled or elderly members may receive a deduction for out-of-pocket medical expenses if such expenses exceed $35 monthly. Childcare expenses and court-ordered child-support payments may be deductible as well. The costs of maintaining a residence, such as rent or mortgage payments, utilities, homeowner’s insurance and property taxes, may also be allowable deductions.