How To Calculate Your Net Income

Net income for the CalFresh Income Limits is your households total gross monthly income minus any allowable expenses.

All allowable expenses should be subtracted from your gross monthly income. To find out what all of the allowable deductions are, continue reading below.

Deductions Allowed for Net Income in 2021

To calculate your net monthly income, you must deduct approved household expenses. Here are the expenses that can be deducted from your households gross income:

- 20% deduction from earned income.

- A standard deduction of $167 for households with 1 to 3 people and $178 for households with 4 or more people.

- Dependent care deduction when needed for work, training, or education.

- A deduction for elderly or disabled members medical expenses that exceed $35 a month .

- Deduct any legally owed child support payments.

- Homeless Households shelter costs deduction of $152.06.

- A deduction for excess shelter costs that exceed more than half of the households income . This deduction cannot exceed $569 unless one of your household members is elderly or disabled. Allowable excess shelter costs include:

- Mortgage or rent payments

- Household utilities including electricity, water, fuel for heat, and a basic phone line

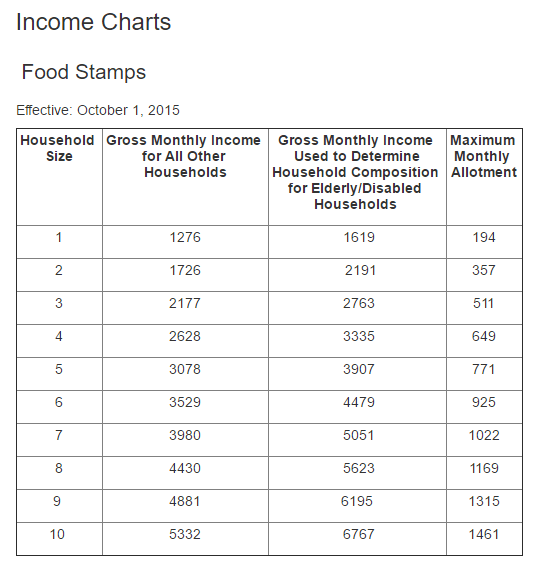

Florida Food Stamps Income Limit

The Florida food stamps income limit is the biggest factor in deciding whether your SNAP application will be approved or not.

In order to use the SNAP income limit chart, you must first calculate your total monthly gross income for your household.

Your total gross income is compared to a percentage of the federal poverty level to determine if you qualify for Florida food stamps.

Once you know your households total gross income, expenses like childcare, medical expenses and housing costs and subtracted to calculate your total net income.

Your households total net income is used to determine how much you will receive in FL SNAP benefits each month.

Now that you know it works, you can use the Florida food stamps income limit chart to determine if your household qualifies for food assistance benefits.

In addition, we will walk you through the steps to successfully calculate your gross and net monthly income including standard and allowable deductions for your household.

Snap Resources And Income Limits

SNAP benefits require households to meet tests that measure resources and income. Some of these changed temporarily or were waived during the coronavirus pandemic, so check with your state to make sure what the current standards are. For the 48 contiguous states and the District of Columbia, the requirements are:

Read Also: Emergency Food Stamps And Cash Aid

Applying For Food Stamps

Minnesotas Food Support website recommends contacting your local county human services agency to request an application or complete an interview over the phone. You can also find your local county office website by visiting the NorthStar website. If you want to call and request more information, you can contact the hotline at 431-4050 or 1-800-657-3698. You can also download and print a Combined Application Form . Once you turn in the application, you will complete an interview with a representative with your local county office. You may conduct this interview in person or over the phone. On your application, you will need to provide some basic information and details about your household, income, citizenship and assets. These factors determine your eligibility for food stamp benefits. If you need emergency help, it is recommended that you visit a county office right away or call the food support hotline at 431-4050 or 1-800- 657-3698. In some cases, you can receive food support within 24 hours or 7 days. In other cases, you will have to wait for your application to be processed by your local county office.

What Can I Buy With Food Assistance Benefits

You can use your benefits to buy most food products. Prohibited items include alcoholic beverages tobacco vitamins and/or medicines hot food products that are made to be eaten immediately and non-food items . You are not allowed to sell or trade food assistance benefits, buy non-food items with your benefits, or use your benefits to buy food for someone who is not a member of your household.

Recommended Reading: Can You Renew Your Food Stamps Online

How To Apply For Food Stamps

The Supplemental Nutrition Assistance Program is a federally funded program to provide food assistance to low-income individuals and families. SNAP is funded by the federal government and administered through the states. Many states also work with other local agencies to provide ongoing nutritional education and training to SNAP recipients.

You can apply for food stamps online in most states, or at a local state or county office. Once the initial application is filled out, you will follow up with a face-to-face interview, and you will be required to provide verification of your income and expenses. If you are elderly or physically unable to travel to the office for the interview, you can apply for a waiver. If granted, the face-to-face interview will be replaced with a phone interview or home visit.

When applying for SNAP, they look at the income, resources, and size of the household. For this situation, a household is defined by people that live together and purchase and prepare food together. When looking at income and resources, it is the total of all members of the household, not just the head of household.

Here is the step-by-step process to apply for food stamps.

Does A Car Payment Affect Food Stamps

When you register for your SNAP benefits, your caseworker will determine your qualifications based on your earnings, your household members, and the number of cashable assets, according to USDA. An asset that is considered cashable includes cars that members of the household owns. Although USDA sets the principles and guidelines for the worth of the asset, states are given the liberty to essentially determine to either execute these regulations or disregard them.

According to USDAâs vehicle policy, up to approximately $4,650 of a vehicleâs value is excluded from assets. For example, this means that if your vehicleâs worth is $5,000, only $350 of that total is considered to be a resource.

Yet there have been some instances where the vehicleâs entire worth has been exempt, including if you use the vehicle to reside in if the car is used to help make money, if you use it to transfer a disabled family member, or if the equity value is $1,500 or less.

However, many states exclude cars as an asset. According to World Work, they exempt vehicles as a resource regardless of what the household uses it for or what it worths. States that have total exemption include Alabama, California, Connecticut, Mississippi, and New Jersey.

Also Check: How To Know If I Am Eligible For Food Stamps

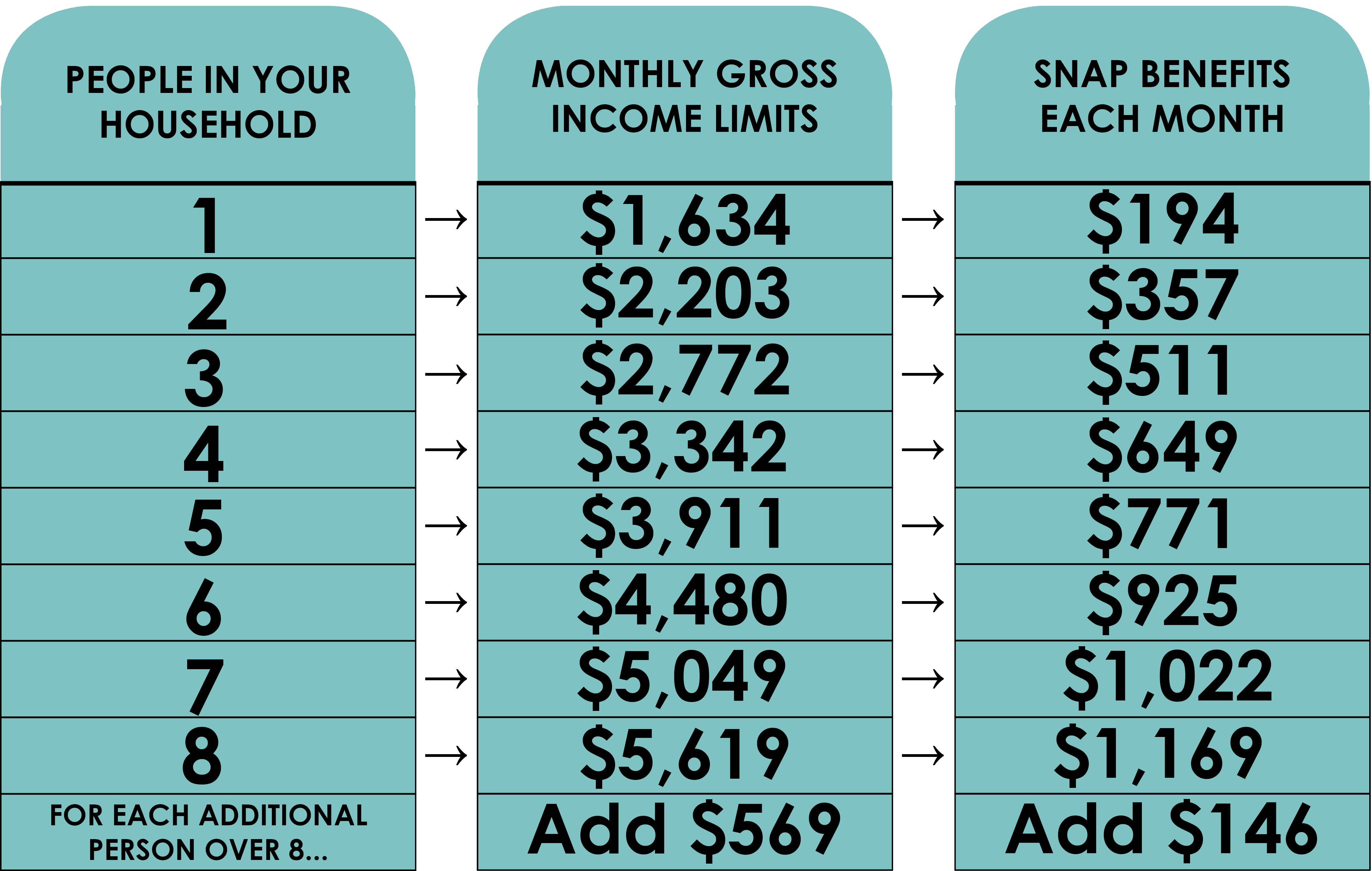

What Benefits Can You Expect If Youre Eligible For Snap

The amount you receive each month in benefits is called your allotment. This is the amount of money being provided for you to buy food based on your income and household size. There is one formula used to determine your allotment.

First, there are predetermined maximum allotments a household can receive. These amounts are based solely on household size. The following table shows the current maximum amounts.

| People in the household | |

|---|---|

| Each additional person | $146 |

Another important factor is the actual amount of income taken into consideration for eligibility. It is expected that a household will spend roughly 30% of their net income on food during a months time. While this is not an exact figure and some households may regularly spend more or less than 30%, that is the standard used to figure eligibility.

Therefore, your net income is multiplied by 0.3 in order to come up with your 30% amount. That amount is then subtracted from the maximum monthly allotment allowed for your household size. The difference is what you get each month in benefits. Here are a few examples to demonstrate how this formula works.

Example 1:

Net monthly income of $1800

$1800 x 0.3 = $540

Maximum allotment for a family of 5 = $771

$771 – $540 = $231

Net monthly income of $2200

$2200 x 0.3 = $660

Maximum allotment for a family of 4 = $649

$649 – $660 = -$11

Although the difference is only off by $11, this family would not be approved for SNAP benefits.

Florida Snap Standard Deduction Amount

When determining your eligibility for Florida food stamp benefits, you will subtract a standard deduction from your total household income. The standard deduction amount is based on two factors your household size and location.

To find out how much your standard deduction will be, use the SNAP Standard Deduction Chart for fiscal year 2022 provided below:

| Florida SNAP Standard Deductions for Fiscal Year 2022 |

| Effective October 1, 2021 September 30, 2022 |

| Household Size |

| $1,500 earned income + $550 social security = $2,050 gross income. | |

| If gross monthly income is less than the limit for household size, determine net income. | $2,050 is less than the $2,871 allowed for a 4-person household, so determine net income. |

Read Also: How Do I Apply For Food Stamps In Louisiana

What If I Am A College Student

To participate in SNAP, a student in college or at least half-time must meet the income eligibility for SNAP and one of the following criteria:

- Be employed for an average of 20 hours per week and be paid for such employment or, if self-employed, be employed for an average of 20 hours per week and receive weekly earnings at least equal to the Federal minimum wage multiplied by 20 hours.

- Participate in a State or Federally financed work study program during the regular school year.

- Provide more than half the physical care for one or more dependent household members under the age of six or provide more than half the physical care of dependent household members who have reached the age of six but are under the age of 12 where adequate child care is not available.

- Enrolled full-time in an institution of higher education and is a single parent with responsibility for the care of a dependent child under age 12.

- Receive Unemployment Benefits .

How Much Snap Benefit To Expect

SNAP benefits to a household are called an allotment. SNAP households are expected to spend about 30% of their resources on food, so the allotment is calculated by multiplying the households net monthly income by 0.3, and subtracting the result from the maximum monthly allotment for household size.

The maximum monthly allotments in 2021:

- 1 household member: $234.

You May Like: How Do I Sign Up For Food Stamps

North Carolina Food Stamps Requirements

There are four primary food stamps requirements in North Carolina that petitioners must meet in order to collect SNAP benefits. These prerequisites include:

- Income: Since SNAP is available only for low-income households, there are requirements for food stamps that relate specifically to how much income petitioners earn. Claimants need to earn less than a certain amount of income, and these limits are assigned based on household size.

- Household structure: Generally, food stamps are awarded to households as units. Therefore, petitioners need to qualify as a household according to the states definition. Examples of acceptable structures include roommates who live and cook together, parents and their children and married couples.

- Immigration status: Food stamps eligibility requirements indicate that applicants must be U.S. citizens or petitioners born abroad that possess legal immigration statuses.

- Funds and resources: While not a requirement for all petitioners, some candidates will need to fulfill resource requirements for the state. Claimants who need to meet this prerequisite may not have quantifiable resources that total greater than $2,250. However, households with at least one disabled family member or household member who is older than 60 years of age may have up to $3,500 in resources and still qualify for benefits.

C1315 Irs Monthly Income Thresholds

Revision 21-2 Effective April 1, 2021

Each year, the Internal Revenue Service establishes income thresholds for earned and unearned income. People whose income exceeds the federal income tax filing threshold are expected by the IRS to file a federal income tax return under federal law. The IRS monthly income thresholds are used to determine if a persons income must be counted when calculating Modified Adjusted Gross Income financial eligibility, as explained in A-1341, Income Limits and Eligibility Tests, for Medical Programs, Step 3.

Determining whether a person is expected to be required to file a federal income tax return is determined by comparing the specified income types to the IRS thresholds in the following table.

| Type of |

|---|

Don’t Miss: What Is The Max Income For Food Stamps

To Get Snap You Need To:

- Apply online, by paper application, by phone or or in person when our lobbies reopen. Currently, they are closed for safety due to COVID-19.

- Meet eligibility requirements

- Provide the required documentation. A verification checklist can also be found here.

- Have an interview with DHS staff *

* Due to the pandemic, the federal government has allowed required in-person interviews to happen over the phone. DHS is also allowed to postpone interviews for SNAP applicants who are eligible on an expedited timeline and offers the flexibility to skip the interview entirely if DHS has all the information necessary to make an eligibility decision.

You may have another person act as an authorized representative by applying and being interviewed on your behalf by designating an authorized representative in writing.

To receive SNAP benefits, you must apply in the State in which you currently live. Learn more about your rights and responsibilities here.

Recommended Reading: How To File For Food Stamps In Washington State

State By State Breakdown

According to the Center on Budget and Policy Priorities, at $258, Hawaii had the highest average monthly SNAP benefit per household member in 2019. Additionally, the Aloha State is also unique in that it is the only state with an average monthly benefit over $200. The second-highest state, Alaska, came in at $181 per month. The state with the lowest monthly benefit payment was Arkansas, at $108, with the second lowest, New Hampshire, being just two dollars higher.

At 3,789,000 people in 2019, the state of California had the largest number of participants in its CalFresh program. The second highest, and the only other state with more than 3 million participants, was Texas at 3,406,000. The third-highest state was noticeably lower compared to the difference between the first two, with Florida’s Food Assistance Program having 2,847,000 participants that same year. The state with the lowest number of participants was Wyoming, at 26,000, followed by North Dakota at 49,000.

You May Like: How To Apply For Medicaid And Food Stamps In Texas