Definition Of A Household

When determining eligibility, you need to provide information on all members of the household. A household, for this situation, is defined as all individuals that live together and purchase and prepare meals together. Likewise, you may have people living with you that are not considered part of your household. For example, if you rent a room to someone that does not purchase or prepare food with you, they are not part of your household. However, whatever they pay you for rent has to be counted under income.

There are two exceptions to this definition. The first is a household that includes a husband, wife, and children under 22 years of age. This group will be considered a household even if they purchase and prepare meals separately. The second exception is elderly or disabled individuals that are unable to purchase and prepare their meals independently and live with others that do.

Approved Medical Expense Reduction

For this reduction, it covers the medical expenses that are approved for the elderly or disabled members of the household. For the medical expense to be approved for a deduction, it has to exceed $35 a month and not covered by insurance. Most of your office visits co-pays will not be deductible, though.

Is There A Gross Income Test For Snap

ALERT: Many of the rules in the SNAPAdvocacy Guide do NOT apply during the pandemic. Please go to the following COVID-19 & DTA benefits page: until further notice for more information about changes.

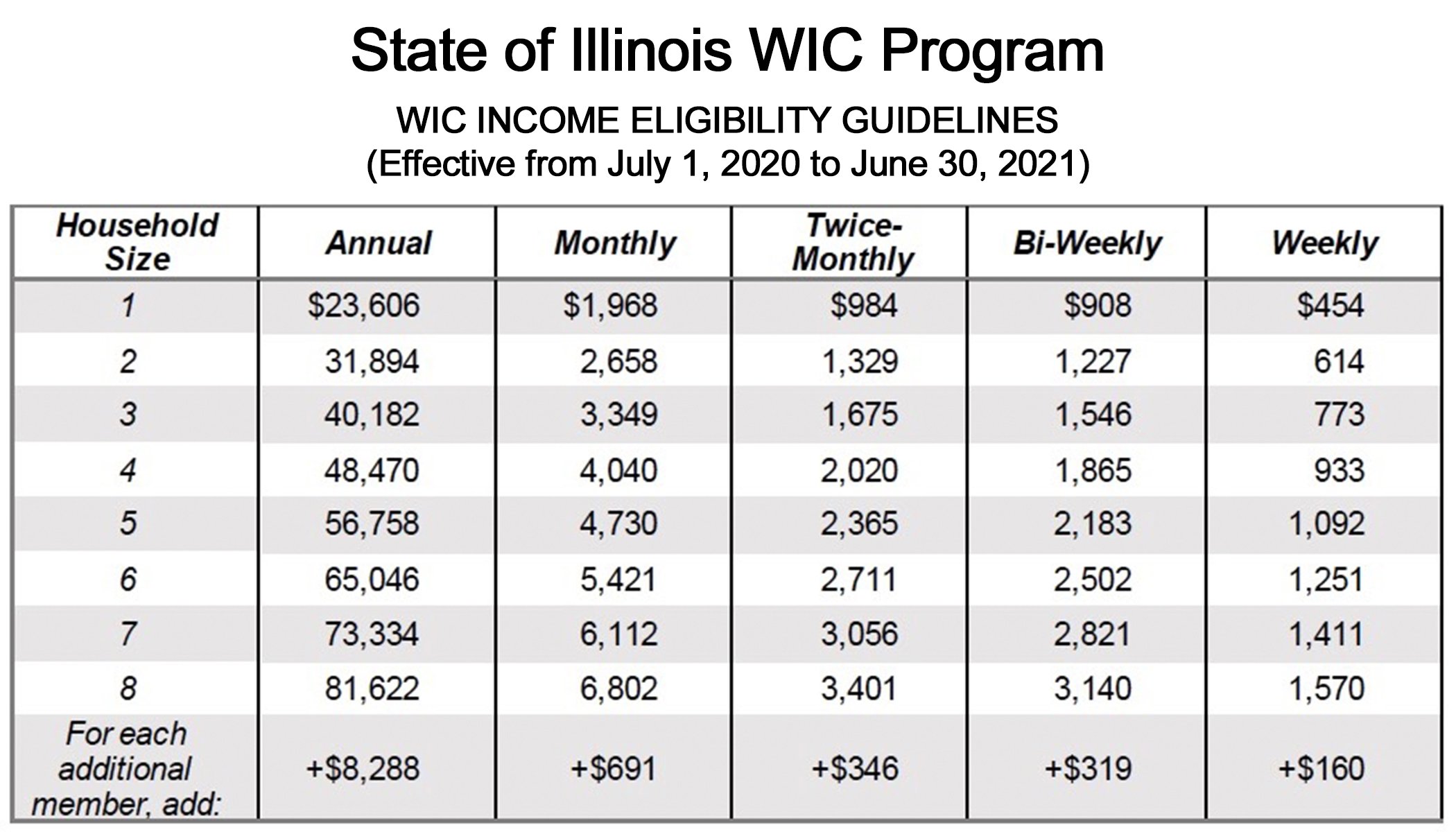

Yes! Most SNAP households need to have gross income under 200% of the federal poverty level. Gross income is your monthly income before any taxes or deductions. 106 C.M.R § 364.370, 106 C.M.R. § 365.180.

|

Household Size |

|

|

$6,607 |

*These numbers are effective as of January 15, 2020. For the most up to date numbers, go to: Masslegalservices.org/content/ma-snap-calculation-worksheet

Households that Pay Child Support

If a household member pays legally obligated child support to a child outside the home, the child support is not counted in the initial gross income test. 106 C.M.R. § 363.230. See Question 82.

Elder/Disabled Households above 200% FPL

There is no gross income test for households that include an elder or disabled member. However, to qualify for SNAP, the household must meet the asset test. See Question 67. These households must also have very high shelter and/or medical expenses to qualify for any SNAP benefit.

Sanctioned households and 130% FPL

Snapshot of the SNAP income and asset tests

| Household under sanction due to IPV | YES | 130% FPL |

* But households net income must be low enough to qualify for a benefit. Households above 200% FPL gross income do not receive the $16 minimum benefit.

Recommended Reading: Can You Buy Pediasure On Food Stamps

Supplemental Nutrition Assistance Program For Households With An Elderly Or Disabled Person

Are you eligible for SNAP? If your household income is low, you may be eligible for SNAP benefits. If you have a person in your household who is disabled or who is age 60 or older, you may be eligible for a larger SNAP allotment. The amount of your SNAP allotment depends upon your family size and income after subtracting various expenses. The County Assistance Office uses a computer to find out if a household is eligible for SNAP and to figure out the amount of the SNAP allotment. However, the computer will give the wrong answer if the caseworker puts in the wrong information. In most cases, you can figure out the correct SNAP allotment by following the steps below. These steps are for households with an elderly or disabled person.

For all these steps, use monthly figures for the entire household.

Find your adjusted household income per month.

Excess Shelter Deduction For Snap Ebt

The excess shelter deduction when calculating your households monthly net income applies to shelter costs that are more than half of the households income after other deductions.

Allowable shelter costs include:

- Some states allow a set amount for utility costs instead of actual costs.

Maximum Shelter Deduction for Florida SNAP Benefits

The amount of the shelter deduction is capped at $597 unless one person in the household is elderly or disabled.

For a household with an elderly or disabled member all shelter costs over half of the households income may be deducted.

You May Like: Food Stamp Office In Waco Tx

Snap Ebt Net Income Limit For 2021

With a few exceptions, all households applying for food stamps in Florida also have to meet the net monthly income limit.

To calculate your net monthly income, you have to subtract any eligible allowable deductions from your monthly gross income.

For help, use the list of allowable deductions provided below.

Can Snap See My Bank Account

Since you are providing any personal information for SNAP to check eligibility and the number of food stamps that you qualify for, you might be wondering if SNAP will be able to check on your bank account for your money going in and out.

Although the Right to Financial Privacy Act protects the privacy of your checking account information, states, and federal policies may require you to provide information to access your bank account, including your deposits, withdraws, and recent statements.

Your Department of Social Services or SNAP distributing office might indeed require access to view your current bank statements as part of the process to check your eligibility for food stamps. But in addition to your bank statements, agencies might also request your bank to access your financial information, with your consent.

Though it is important to note that refusing to cooperate or consent in the requisition to view bank statements or other financial information can end up with a denial of benefits.

Read Also: What Is The Minimum Income To Qualify For Food Stamps

How Do I Apply For Snap

There are several options for applying. Only one member of the households needs to apply for the total household, but everyone living in the household needs to be included on the application along with their income. Most states provide an online application to start the process. See the States website section for a link to your states website. If your state does not provide an online application or you do not have access to a computer, you can go to your local state or county office to apply.

As part of the application process, you will need to go to your local state or county office for a face-to-face interview. If you are not able to go to the local office or apply online, you can designate an authorized representative. This is someone you give authority to represent you. You have to designate the person in writing to be official. This person can be a friend or relative.

The entire process generally involves filling out an application, going in for a face-to-face interview, and providing verifications for needed information such as income, residency, and expenses. If because of age or disability, an applicant is unable to go to the office and cannot appoint a representative, the interview may be waived at the discretion of the local office. However, if the interview is waived, the applicant will have to have a phone interview or consent to a home visit instead.

How To Apply For Florida Food Stamps

There are four ways you can apply for food stamps in Florida. But before we get into that, here are the documents and information you are going to need to complete the application form:

- Social Security number and date of birth.

- Income information such as job, child support or any other sources.

- Resource or asset information such bank accounts , vehicles, homes, land or life insurance.

- Housing expenses such as rent or utilities.

- Health insurance information.

Also Check: Apply For Food Stamps Lexington Ky

What Happens If You Dont Report Income For Food Stamps

If you do not report when your income is more than your households IRT limit you may get more benefits than you should. You must repay any extra benefits you get based on income you do not report. If you do not report on purpose to try to get more benefits, this is fraud, and you may be charged with a crime.

How Is Snap Benefits Calculated

How much could I receive in SNAP benefits? Because SNAP households are expected to spend about 30 percent of their own resources on food, your allotment is calculated by multiplying your households net monthly income by 0.3, and subtracting the result from the maximum monthly allotment for your household size.

Also Check: Can You Buy Pediasure On Food Stamps

Is Making 50k A Year Good

Income is, of course, another very important consideration for most people. As such, a $50,000 salary would be above the national median and a pretty good salary, of course, dependent on where one lives. Thats good news for people making an annual salary of $50,000 or higher.

What Income Is Not Counted For Snap

When caseworkers determine your eligibility, one important thing they will look at is your household monthly income. Your household monthly income plays a big part in deciding if you are qualified for the benefits, and also the number of food stamps benefits you will be qualified for. This means income will certainly depend on the number of members of your household, and you will have to provide information about them.

According to Mass Legal Help, not all income will count towards your SNAP benefits. Some of the income that does not count for SNAP from Mass Legal Help may include:

â VISTA, Youthbuild, and AmeriCorps allowances, earnings, or fees for individuals that are, in any other case, eligible.

â Earnings of a kid under the age of 18 who are attending secondary college at least half of the time.

â Lump-sum bills â together with inheritances, tax credits, damage awards, one-time severance pay, or different one-time payments

â Reimbursements â the amount of money you get back to pay again for costs, such as schooling-associated costs and medical costs

â Senior Community Service Employment Program stipends paid to older employees doing community service jobs part-time

â Anything you do not receive as cash, including free housing or food, or expenses that are paid straight to a landlord or utility company made by a relative, friend or agency that has no legal obligation to do so

â Up to $300 in three months from private charities

Read Also: Apply For Food Stamps Lexington Ky

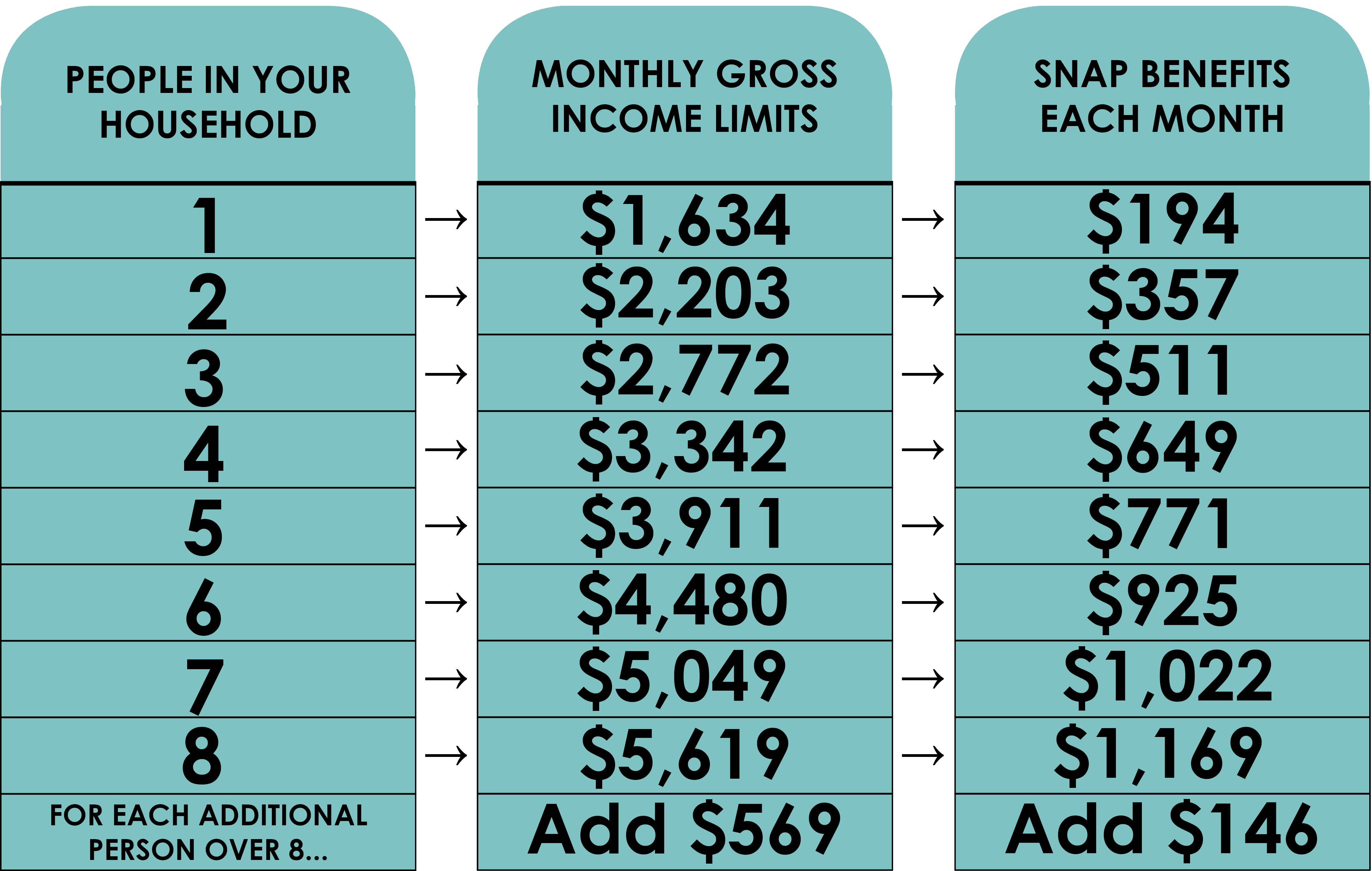

Florida Food Stamps Income Limit

The Florida food stamps income limit is the biggest factor in deciding whether your SNAP application will be approved or not.

In order to use the SNAP income limit chart, you must first calculate your total monthly gross income for your household.

Your total gross income is compared to a percentage of the federal poverty level to determine if you qualify for Florida food stamps.

Once you know your households total gross income, expenses like childcare, medical expenses and housing costs and subtracted to calculate your total net income.

Your households total net income is used to determine how much you will receive in FL SNAP benefits each month.

Now that you know it works, you can use the Florida food stamps income limit chart to determine if your household qualifies for food assistance benefits.

In addition, we will walk you through the steps to successfully calculate your gross and net monthly income including standard and allowable deductions for your household.

What Are Allowable Deductions When Determining Net Income

In regards to eligibility, your net pay is what is considered for income. To figure out your net income, you must first start with your gross income and then deduct all allowable deductions. For SNAP eligibility, there are seven acceptable deductions. Not all of these may apply to every person, but if any of them apply to your household, they can be deducted prior to submitting your application for consideration.

The allowable deductions are:

Once these deductions are subtracted from your income, your eligibility can be considered. In order to determine your allotment, they will take 30% of the net income to subtract from the maximum allotment amount for your household size. The deductions play a significant role in both eligibility and the determination of benefits.

If you are unsure of whether or not a specific deduction applies to you, you can ask a representative at your local SNAP office. However, if you think it applies, it is best to figure it in. If it doesnt, they will make the appropriate adjustments when determining your benefits. The lower you can get your net income by subtracting deductions, the more likely you will be to qualify for SNAP benefits.

Also Check: Grocery Outlet Take Ebt

Snap Eligibility: General Requirements

General Eligibility Requirements Eligibility for the District of Columbia Supplemental Nutrition Assistance Program is based on income, resources, and the number of individuals applying together as a household or may be based on the fact that you receive another type of assistance, such as Supplemental Security Insurance . A household with an elderly or disabled person has different eligibility requirements.

- See if you may be eligible for SNAP by answering a few questions

SNAP HouseholdA household is everyone who lives together and purchases and prepares meals together as a group. Spouses and most children under age 22 are automatically included in the same SNAP household even if they purchase and prepare meals separately.

SNAP Income LimitsIn general, each SNAP household members income is counted together and compared to the income limits to determine eligibility. Income includes money earned from a job or self-employment and money received from sources like the United States Social Security Administration or retirement.

Households must meet both a gross and net monthly income limit for their household size . Households with a person age 60 years or older or a person with a disability only need to meet the net monthly income limit.

- Gross income means a SNAP households total income before any deductions

- Net income means a SNAP households total gross income minus allowable deductions

Does Va Disability Count As Income For Taxes

Disability compensation is a benefit paid to Veterans because of injuries or disease that happened during active duty. In some cases, an existing disease or injury was worsened due to active military service. This benefit is also paid to certain Veterans disabled from VA health care. The benefits are tax-free.

Don’t Miss: Oregon Food Stamps Income Limits 2020