Can I Get Food Stamps If I Am On The Gi Bill

Military veterans and others who are taking advantage of the GI Bill program are sometimes curious if GI Bill money or BAH income is counted towards the income requirements for SNAP. The answer is yes, BAH income is typically counted towards your gross income when determining if you are eligible for food stamps. As such, your GI Bill benefits do contribute to your income, even though that income is temporary and not taxed. Receiving BAH does not stop you from being eligible for food stamps outright, it is just included in the income calculation.

SNAP Overview

The federal food stamp program is now called the Supplemental Nutrition Assistance Program . SNAP is the largest domestic program available to nutritional assistance, and it is available for low-income individuals and families that meet the eligibility requirements. The federal food and nutrition service works with a wide range of other organizations including state agencies, nutrition educators, and neighborhood organizations to provide SNAP recipients with nutrition assistance and information.

The local agencies provide aid for people while they are going through the application process, and once people are approved, these agencies help them to access their benefits. The goal of this program is to provide monetary assistance with food while the members of the household are actively looking for work or working in positions that do not pay enough to cover food and living costs.

Benefits

Example of Benefits Allotment

Extra Rules For Workers Without Kids

If you’re age 18-49, able to work and don’t have any kids, you may need to meet both the general work requirements and an additional work requirement for ABAWDS, which stands for able bodied adult without dependents.

This is in order to get food stamps for more than three months in three years, which is the time limit.

You can meet the ABAWD work requirement by doing any of the below things:

- Work at least 80 hours a month. Work can be for pay, for goods or services , unpaid, or as a volunteer

- Participate in a work program at least 80 hours a month. A work program could be SNAP Employment and Training or another federal, state, or local work program

- Participate in a combination of work and work program hours for a total of at least 80 hours a month

- Participate in workfare for the number of hours assigned to you each month

Similar to above, there are exceptions to the ABAWD work requirement and time limit.

This applies to you if you’re any of the below things:

- Unable to work due to a physical or mental limitation

- Pregnant

- Have someone under 18 in your household

- Excused from the general work requirements

If you have to meet the ABAWD work requirement but you dont, you will lose your benefits after three months.

To get food stamps again, you must meet the ABAWD work requirement for a 30-day period or become excused.

Otherwise, you need to wait until the end of your three-year period, when youll get another three months under the time limit.

How To Apply For Food Stamps In Pennsylvania

Once prospective candidates believe they are eligible for SNAP, they may want to know how to apply for food stamps in Pennsylvania. This process is straightforward, and claimants have various formats they may use to submit their petitions to the DHS, including:

- Petitioning through an online food stamps application.

- Filing an application in person at their county assistance locations.

- Sending printed enrollment forms to the appropriate offices.

Claimants must remember when they apply for food assistance that these petitions are generally used to represent whole household units. Therefore, only heads of the household, their spouses, trustworthy household members or pre-chosen representatives may apply for a particular unit. When submitting their claims, petitioners will need to provide the DHS with information regarding different aspects of their families. These requirements are necessary regardless of whether claimants apply for food stamps online or using a paper application. Specifically, candidates will need to provide specific information relating to:

Read Also: Local Food Stamp Office Phone Number

Florida Food Stamps Income Limit

The Florida food stamps income limit is the biggest factor in deciding whether your SNAP application will be approved or not.

In order to use the SNAP income limit chart, you must first calculate your total monthly gross income for your household.

Your total gross income is compared to a percentage of the federal poverty level to determine if you qualify for Florida food stamps.

Once you know your households total gross income, expenses like childcare, medical expenses and housing costs and subtracted to calculate your total net income.

Your households total net income is used to determine how much you will receive in FL SNAP benefits each month.

Now that you know it works, you can use the Florida food stamps income limit chart to determine if your household qualifies for food assistance benefits.

In addition, we will walk you through the steps to successfully calculate your gross and net monthly income including standard and allowable deductions for your household.

Other Types Of Benefits And Programs For The Unemployed

Educational Help

Federal agencies offer many unemployment education and training programs. They are generally free or low cost to the unemployed.

Self-Employment Help

Self-employment assistance programs help unemployed workers start their own small businesses. Delaware, Mississippi, New Hampshire, New York, and Oregon offer this program.

You May Like: Kentucky Food Stamps Income Limits

How To Apply For Florida Food Stamps

There are four ways you can apply for food stamps in Florida. But before we get into that, here are the documents and information you are going to need to complete the application form:

- Social Security number and date of birth.

- Income information such as job, child support or any other sources.

- Resource or asset information such bank accounts , vehicles, homes, land or life insurance.

- Housing expenses such as rent or utilities.

- Health insurance information.

What Are The Snap Income Guidelines In Minnesota

If you are still wondering how to qualify for food stamps, there is still more to the program guidelines. The financial qualifications for SNAP are the most important part of the eligibility process. Financial guidelines depend on the household income and deductions in the family. Income eligibility is determined by the national poverty level and the number of members within the family.

The SNAP income guidelines are used to determine eligibility, which will consider every source of earning. Aside from your paycheck, other areas of your income will be reviewed, such as:

- Short-term disability payments.

- Child support.

- Pensions

Any payments an applicant receives from the Veterans Affairs program will also be counted as income within the food stamp income guidelines in Minnesota. Once the income has been calculated, monthly deductions are reviewed and calculated to determine the eligibility of an applicant. Typically, the deductions include expenses paid every month, such as:

- Child care.

- Medical bills.

- Utilities.

Therefore, in order to meet income eligibility, the applicant must meet the gross income and net income requirements to receive benefits. To learn more about income requirements for food stamps, today.

You May Like: Food Stamps In Orlando Fl

Definition Of A Household

When determining eligibility, you need to provide information on all members of the household. A household, for this situation, is defined as all individuals that live together and purchase and prepare meals together. Likewise, you may have people living with you that are not considered part of your household. For example, if you rent a room to someone that does not purchase or prepare food with you, they are not part of your household. However, whatever they pay you for rent has to be counted under income.

There are two exceptions to this definition. The first is a household that includes a husband, wife, and children under 22 years of age. This group will be considered a household even if they purchase and prepare meals separately. The second exception is elderly or disabled individuals that are unable to purchase and prepare their meals independently and live with others that do.

Snap Ebt Net Income Limit For 2021

With a few exceptions, all households applying for food stamps in Florida also have to meet the net monthly income limit.

To calculate your net monthly income, you have to subtract any eligible allowable deductions from your monthly gross income.

For help, use the list of allowable deductions provided below.

Recommended Reading: Apply For Food Stamps Lexington Ky

Mickey Leland Childhood Hunger Relief Act

- eliminating the shelter deduction cap beginning January 1, 1997

- providing a deduction for legally binding child support payments made to nonhousehold members

- raising the cap on the dependent care deduction from $160 to $200 for children under 2 years old and $175 for all other dependents

- improving employment and training dependent care reimbursements

- increasing the FMV test for vehicles to $4,550 on September 1, 1994 and $4,600 on October 1, 1995, then annually adjusting the value from $5,000 on October 1, 1996

- mandating asset accumulation demonstration projects and

- simplifying the household definition.

Corporate Influence And Support

In June 2014, Mother Jones reported that “Overall, 18 percent of all food benefits money is spent at Walmart,” and that Walmart had submitted a statement to the U.S. Securities and Exchange Commission stating,

Our business operations are subject to numerous risks, factors, and uncertainties, domestically and internationally, which are outside our control. These factors include… changes in the amount of payments made under the Supplemental Nutrition Assistance Plan and other public assistance plans, changes in the eligibility requirements of public assistance plans.

Companies that have lobbied on behalf of SNAP include PepsiCo, Coca-Cola, and the grocery chain Kroger. Kraft Foods, which receives “One-sixth revenues … from food stamp purchases” also opposes food stamp cuts.

Don’t Miss: Apply For Food Stamps San Diego

Income Requirements To Get Food Stamps In Texas

In order to get food stamps in Texas, households must meet certain maximum income requirements.

The Texas food stamps program is formally known as the Supplemental Nutritional Assistance Program . Monthly supplements are given to low-income households to purchase food on a scale based on their income, and are limited to a certain period typically six months, but potentially longer or shorter in specific circumstances. Food payments are placed on the Lone Star Card, the same payment card used for the Temporary Assistance for Needy Families welfare program, on a monthly basis.

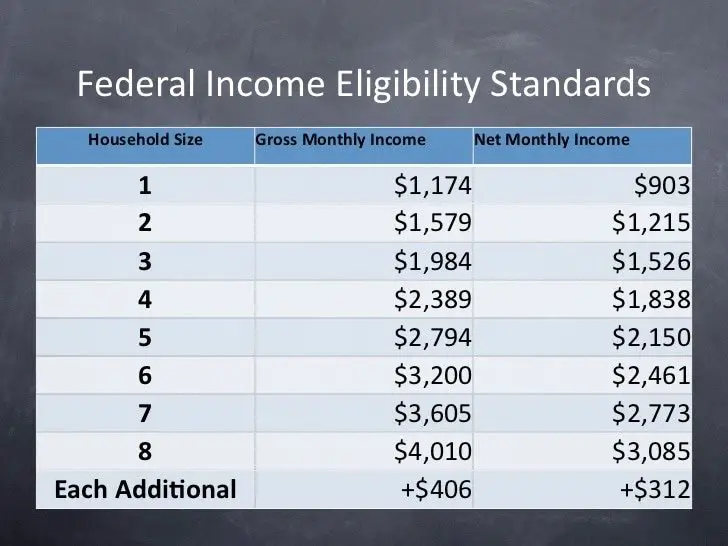

Texas sets maximum income requirements to qualify for food stamps. An online calculator is currently available to determine whether a particular households financial situation qualifies it for food assistance, and, if so, how much. In general, according to the East Texas Food Bank, households are eligible for food stamps in Texas if they have less than $2000 in cash and a monthly income less than $1174 for individuals, or $4010 for a family of eight. Maximum income size varies according to family size the income requirement for a family of four is $2389 per month. Beyond eight, each additional family member adds an additional $406 to the monthly income cap.

Supplemental Nutrition Assistance Program

| Parts of this article need to be . Please help update this article to reflect recent events or newly available information. |

In the United States, the Supplemental Nutrition Assistance Program , formerly known as the Food Stamp Program, is a federal program that provides food-purchasing assistance for low- and no-income people. It is a federal aid program, administered by the United States Department of Agriculture under the Food and Nutrition Service , though benefits are distributed by specific departments of U.S. states .

SNAP benefits supplied roughly 40 million Americans in 2018, at an expenditure of $57.1 billion. Approximately 9.2% of American households obtained SNAP benefits at some point during 2017, with approximately 16.7% of all children living in households with SNAP benefits. Beneficiaries and costs increased sharply with the Great Recession, peaked in 2013 and have declined through 2017 as the economy recovered. It is the largest nutrition program of the 15 administered by FNS and is a key component of the social safety net for low-income Americans.

You May Like: Apply For Food Stamps Lexington Ky

What Are The Snap Income Guidelines In Louisiana

Meeting the food stamp income guidelines is another important step in qualifying for benefits. Ultimately, the Louisiana SNAP income guidelines vary based on your household size. Generally speaking, a larger family may qualify for SNAP with a higher income due to the fact that larger households need to purchase more food each month.

In most cases, your familyâs income must be at or below 130 percent of the poverty level in Louisiana. However, you may have food stamps eligibility automatically if your family already receives benefits from other government programs such as the Family Independence Temporary Assistance Program or Supplemental Security Income . If you have been deemed eligible for programs such as these, the DCFS will determine that you also meet the SNAP guidelines due to the fact that you have already qualified for other income-based benefits.

While your family size affects your SNAP eligibility in Louisiana, your household composition can play a role as well. For example, if there are any members of your household who are seniors or have a disability, you may meet the eligibility requirements with a slightly higher income. This is because households that contain people with disability or elderly residents are allowed to count only their net income, whereas most other families must meet the requirements for both net and gross income.

What Are The Work Qualifications For Food Stamps In Ohio And How To Apply

Its not enough to meet the food stamps income guidelines Ohio as you also have to meet the work qualifications as food stamp eligibility Ohio has work guidelines as well.

There are two sets of employment eligibility criteria that should be met based on Ohio food stamp requirements. If you are between 16 to 59 years of age and can work, then you will need to meet the work requirements based on Ohio SNAP eligibility guidelines. These general employment requirements can be broken down into those for the unemployed and the employed.

If you are unemployed then you must:

- Take a suitable job offer if theres one. Otherwise, you lose your Ohio food stamps eligibility

- Register for work

- Participate in the programs employment and training if assigned by the food stamps Ohio office

If you are employed, then you are required to adhere to the following food stamps qualifications Ohio:

- Not reduce your work hours below a minimum of 30 hours weekly without a valid reason or voluntarily quit your job.

There are, however, some exceptions to these work requirements. If you meet any of the conditions below, then you are excused from the set work Ohio food stamp requirements.

If you fail to meet the general work requirements then you could be disqualified from getting Ohio food assistance for a minimum of one month. If you get the benefits again but fail to meet the requirements again, then your disqualification to the program could be longer or even forever.

You May Like: Does Freshdirect Take Ebt