Food Stamp Act Of 1977

Both the outgoing Republican Administration and the new Democratic Administration offered Congress proposed legislation to reform the FSP in 1977. The Republican bill stressed targeting benefits to the neediest, simplifying administration, and tightening controls on the program the Democratic bill focused on increasing access to those most in need and simplifying and streamlining a complicated and cumbersome process that delayed benefit delivery as well as reducing errors, and curbing abuse. The chief force for the Democratic Administration was Robert Greenstein, Administrator of the Food and Nutrition Service .

In Congress, major players were Senators George McGovern, Jacob Javits, Hubert Humphrey, and Bob Dole, and Congressmen Foley and Richmond. Amid all the themes, the one that became the rallying cry for FSP reform was “EPR”eliminate the purchase requirementbecause of the barrier to participation the purchase requirement represented. The bill that became the law did eliminate the purchase requirement. It also:

- eliminated categorical eligibility

In addition to EPR, the Food Stamp Act of 1977 included several access provisions:

The integrity provisions of the new program included fraud disqualifications, enhanced Federal funding for States’ anti-fraud activities, and financial incentives for low error rates.

EPR was implemented January 1, 1979. Participation that month increased 1.5 million over the preceding month.

Cutbacks Of The Early 1980s

The large and expensive FSP proved to be a favorite subject of close scrutiny from both the Executive Branch and Congress in the early 1980s. Major legislation in 1981 and 1982 enacted cutbacks including:

- addition of a gross income eligibility test in addition to the net income test for most households

- temporary freeze on adjustments of the shelter deduction cap and the standard deduction and constraints on future adjustments

- annual adjustments in food stamp allotments rather than semi-annual

- consideration of non-elderly parents who live with their children and non-elderly siblings who live together as one household

- required periodic reporting and retrospective budgeting

- prohibition against using Federal funds for outreach

- replacing the FSP in Puerto Rico with a block grant for nutrition assistance

- counting retirement accounts as resources

- state option to require job search of applicants as well as participants and

- increased disqualification periods for voluntary quitters.

Electronic Benefits Transfer began in Reading, Pennsylvania, in 1984.

A14281 Allowable Medical Expenses

Revision 21-2 Effective April 1, 2021

Deductions are allowed for the following medical expenses:

Note: When determining transportation costs, the person may choose to use 56 cents per mile instead of keeping track of actual expenses.

Deductions are not allowed for the following medical expenses:

- the costs of policies that do not specifically cover medical costs

- food supplements that can be purchased with SNAP, such as Ensure and baby formula, even if prescribed by a physician

- paid or past due expenses billed prior to the initial certification period

- medical marijuana, even if prescribed by a physician or

- herbal products. Examples include: melatonin, valerian root, echinacea, flaxseed, ginseng, ginkgo, St. Johnâs wort and garlic.

Also Check: Can You Get Enfamil On Food Stamps

Don’t Miss: Food Stamps El Cajon

What If I Am A College Student

To participate in SNAP, a student in college or at least half-time must meet the income eligibility for SNAP and one of the following criteria:

- Be employed for an average of 20 hours per week and be paid for such employment or, if self-employed, be employed for an average of 20 hours per week and receive weekly earnings at least equal to the Federal minimum wage multiplied by 20 hours.

- Participate in a State or Federally financed work study program during the regular school year.

- Provide more than half the physical care for one or more dependent household members under the age of six or provide more than half the physical care of dependent household members who have reached the age of six but are under the age of 12 where adequate child care is not available.

- Enrolled full-time in an institution of higher education and is a single parent with responsibility for the care of a dependent child under age 12.

- Receive Unemployment Benefits .

How To Apply For Mydssmogov Food Stamps Application Online

To get into the Missouri Food Stamps Application, here are a few steps to follow.

2. Tap on the Apply for Benefits option to move to the application form.

3. If you already have an account with them, you can login by inserting your username and password in the space provided. However, if you do not have an account, you must click on the New User Registration option.

4. If you click on the New User Registration, you can fill in all the relevant information and also check the box accepting all their rules and policies.

5. Once registered, you will next be taken to an application form where you have to fill in your details around your income, address, identity, and other essential information.

6. Attach relevant documents and then submit the form.

Also Check: Alabama Food Stamp Income Limits 2019

C1315 Irs Monthly Income Thresholds

Revision 21-2 Effective April 1, 2021

Each year, the Internal Revenue Service establishes income thresholds for earned and unearned income. People whose income exceeds the federal income tax filing threshold are expected by the IRS to file a federal income tax return under federal law. The IRS monthly income thresholds are used to determine if a persons income must be counted when calculating Modified Adjusted Gross Income financial eligibility, as explained in A-1341, Income Limits and Eligibility Tests, for Medical Programs, Step 3.

Determining whether a person is expected to be required to file a federal income tax return is determined by comparing the specified income types to the IRS thresholds in the following table.

| Type of |

|---|

Also Check: Lexington County Food Stamp Office

Mickey Leland Childhood Hunger Relief Act

- eliminating the shelter deduction cap beginning January 1, 1997

- providing a deduction for legally binding child support payments made to nonhousehold members

- raising the cap on the dependent care deduction from $160 to $200 for children under 2 years old and $175 for all other dependents

- improving employment and training dependent care reimbursements

- increasing the FMV test for vehicles to $4,550 on September 1, 1994 and $4,600 on October 1, 1995, then annually adjusting the value from $5,000 on October 1, 1996

- mandating asset accumulation demonstration projects and

- simplifying the household definition.

Read Also: Apply For Food Stamps Online Tn

When Will I Know If Im Approved

You will typically know if you are approved for SNAP within 30 days. The Family Support Division will process your application and any supporting documentation as soon as they receive it. This can take up to 10 days. Once your application is processed, you will get a letter that lets you know if you are eligible for SNAP benefits or not.

In some emergency cases, you can get SNAP benefits in seven days or less. You will need to complete Section 2 of your SNAP application to see if you are eligible. You can also tell the Family Support Division if these questions apply to you when you submit your application.

You May Like: Oklahoma Food Stamps

Income Limits For Food Stamps In Usa

The following post will explain what the income limits for food stamps are and how to successfully apply for them. The following information will be covered in this article about the food stamp income limit:

- Do you know what food stamps are?

- Who can get food stamps?

- Is there a minimum income requirement to receive food stamps?

- Food stamp income limit

- What number of food stamps will I get?

- Elderly and disabled special rules

- about applying for food stamps

- What happens when I apply for a food stamp?

- Emergency Food Stamps

Recommended Reading: Oklahoma City Food Stamp Office

A Quick Guide To Snap Eligibility And Benefits

Most families and individuals who meet the programs income guidelines are eligible for the Supplemental Nutrition Assistance Program . The size of a familys SNAP benefit is based on its income and certain expenses. This paper provides a short summary of SNAP eligibility and benefit calculation rules that are in effect for federal fiscal year 2022, which began in October 2021.

How to Find Out if You Can Get Help From SNAP

If you would like help from SNAP, contact your local human services office. The staff there will work with you to find out if you qualify.

Notes: SNAP is often referred to by its former name, the Food Stamp Program. Your state may use a different name.

SNAP has special rules following natural disasters.

When Did The Program Begin

The Supplemental Nutrition Assistance Program traces its earliest origins back to the Food Stamp Plan, which began in 1939 to help needy families in the Depression Era. The modern program began as a pilot project in 1961 and was authorized as a permanent program in 1964. Expansion of the program occurred most dramatically after 1974, when Congress required all states to offer food stamps to low-income households. The Food Stamp Act of 1977 made significant changes in program regulations, tightening eligibility requirements and administration, and removing the requirement that benefits be purchased by participants.

You May Like: P Ebt Alabama Balance

Food Stamp Act Of 1964

The Food Stamp Act of 1964appropriated $75 million to 350,000 individuals in 40 counties and three cities. The measure drew overwhelming support from House Democrats, 90 percent from urban areas, 96 percent from the suburbs, and 87 percent from rural areas. Republican lawmakers opposed the initial measure: only 12 percent of urban Republicans, 11 percent from the suburbs, and 5 percent from rural areas voted affirmatively. President Lyndon B. Johnson hailed food stamps as “a realistic and responsible step toward the fuller and wiser use of an agricultural abundance”.

Rooted in congressional logrolling, the act was part of a larger appropriation that raised price supports for cotton and wheat. Rural lawmakers supported the program so that their urban colleagues would not dismantle farm subsidies. Food stamps, along with Medicaid/Medicare, Head Start, and the Job Corps, were foremost among the growing anti-poverty programs.

President Johnson called for a permanent food-stamp program on January 31, 1964, as part of his “War on Poverty” platform introduced at the State of the Union a few weeks earlier. Agriculture Secretary Orville Freeman submitted the legislation on April 17, 1964. The bill eventually passed by Congress was H.R. 10222, introduced by Congresswoman Sullivan. One of the members on the House Committee on Agriculture who voted against the FSP in Committee was then Representative Bob Dole, of Kansas.

The major provisions were:

Selecting The Best Offer

When you determine which companies offer phones in your area, you must next visit the websites of the companies that distribute these phones. Many of the providers that offer phones in different states vary what their programs offer each individual consumer, so you may need to shop around at each of their websites in order to determine which has the best deal.

Some providers give you the 250 minutes as part of the government program, but also offer additional minutes at a reduced rate. In addition, some of the providers may also offer texting at reduced rates.

Dont Miss: Heb Curbside Food Stamps

Also Check: Food Stamps Tulsa

Your Nc Food Stamps Card Can Do This

This post may contain affiliate links. If you complete a purchase using one of our links, we may receive a small commission at no extra cost to you. Learn more about our editorial and advertising policies.

A North Carolina food stamps card can do so much more than buy groceries and give you cash benefits. It can also be used for discounted admission, growing a garden and so much more! Check out all the awesome and unadvertised NC food stamps perks weve discovered!

Also Check: Food Stamps Application Colorado Springs

In Addition To The Income Guidelines What Else Changed On October 1 2021

At the beginning of every federal fiscal year, the United States Department of Agricultures Food and Nutrition Service adjusts maximum Supplemental Nutrition Assistance Program benefits, deductions and income eligibility standards. These adjustments are known as the SNAP Cost of Living Adjustment .

The SNAP COLA is based on changes in the cost of living and takes effect on October 1st of each year. Please read the following to learn about all the changes, some already reflected on this page as well as additional elements of the COLA, that became effective on .

Also Check: Getcalfresh Org En Docs

Find Out If You Or Your Children Are Eligible For The Wic Program

-

If youre applying for yourself, you must be at least one of the following:

-

Pregnant

-

Breastfeeding

-

Within six months of having given birth or pregnancy ending

If youre applying for your children, they must be under 5 years old.

You must meet other WIC eligibility requirements based on your income, your health, and where you live.

Learn How To Apply To State Food Programs For Seniors

To apply for either program:

-

Select your state or territory from this nutrition programs contact map.

-

From the list of available programs, choose a food program for seniors:

-

Commodity Supplemental Food Program

-

Senior Farmers Market Nutrition Program

If either program is not on the list, you may not live in an area that offers the program.

Read Also: Arizona Apply For Food Stamps

Income Guidelines For Food Stamps In Texas

- People who dont have a lot of money as long as they meet program rules.

- Most adults age 18 to 49 with no children in the home can get SNAP for only 3 months in a 3-year period. The benefit period might be longer if the person works at least 20 hours a week or is in a job or training program. Some adults might not have to work to get benefits, such as those who have a disability or are pregnant.

Snap Ebt Net Income Limit For 2021

With a few exceptions, all households applying for food stamps in Florida also have to meet the net monthly income limit.

To calculate your net monthly income, you have to subtract any eligible allowable deductions from your monthly gross income.

For help, use the list of allowable deductions provided below.

Recommended Reading: Food Stamp Office In Conroe Texas

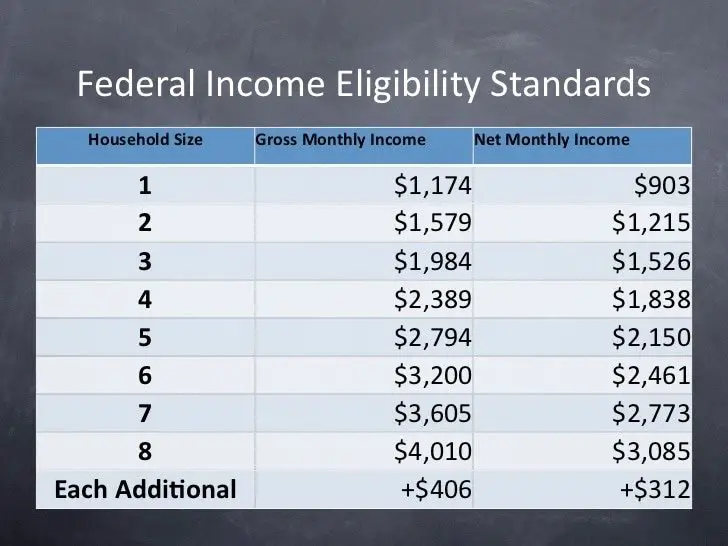

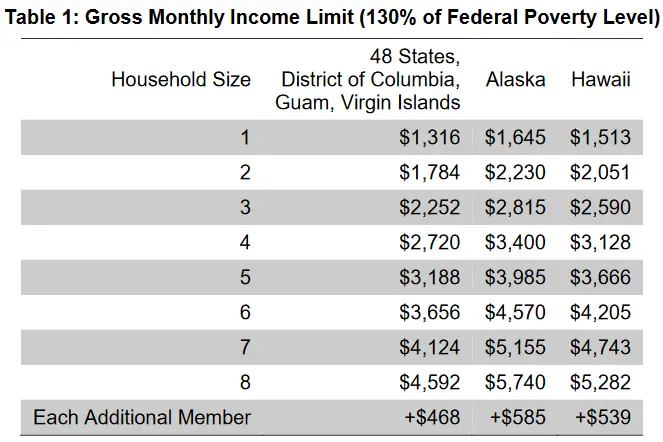

Table : Snap Gross And Net Monthly Income Limits By Household Size

The below income limits are set by the Federal government and are subject to change each October 1. The gross monthly income limit is set at 130 percent of the Federal Poverty Line and the net monthly income limit is set at 100 percent of the FPL.

|

Effective October 1, 2021 September 30, 2022 |

|

Household Size |

DeductionsTo determine a SNAP households monthly net income, there are certain allowable deductions that are subtracted from the households gross monthly income. Some of the deduction amounts are set by the Federal government and are subject to change each October 1.

Households with a person age 60 years or older or a person with a disability can also deduct out-of-pocket medical expenses of more than $35. Payments made by insurance or someone else cannot be counted.

Resource LimitsResources are things like bank accounts, money market funds, certificates of deposit, and stock and bonds. Some things never count, such as the value of the home. Most District residents applying for SNAP are determined categorically eligible and do not have a limit on resources.

If you apply for SNAP, the District will review your information to determine if a resource limit applies.

For households that have a resource limit, households may have $2,500 in countable resources. If the household includes a person who is age 60 or older or a person who has a disability, the resources limit is $3,750. Resource limits are set by the Federal government and are subject to change each October 1.