Social Security Back Pay

When applying for SSDI, there is a standard 5-month wait that does not count towards back pay. Thats why it is always important to file for Social Security Disability as soon as you become disabled. Do not attempt to wait out your illness or see how it develops. When you apply, make sure you provide all the necessary paperwork, meet the deadlines, and show up to your interview, in order to speed up the process.

In some cases, you will benefit from soliciting the services of a Social Security disability lawyer to help you file a case. If your SSDI application does take longer than 5 months to process, you will be awarded back pay and/or retroactive pay for up to 12 months. Back pay covers any time between your application, otherwise known as the EOD.

Retroactive pay covers any time period between the onset of your illness and when you filed your application, if the SSA agrees with your claim in such matters. It may be tempting to quickly spend lump sum payment, but its prudent to allocate your funds wisely to needed expenses or strategize with a financial planner about how to maximize their usefulness and impact.

Can My Va Disability Be Taken Away

VA can stop a veterans disability benefits if it severs service connection for the veterans disability . However, if VA does find that severance of service connection is warranted, it will discontinue the veterans disability payments as the veteran will no longer be service connected for that condition.

Snap Food Assistance For Persons With Disabilities

The Voice is the e-mail newsletter of The Special Needs Alliance. This installment was written by Special Needs Alliance member Laurie Hanson, Esq., a shareholder in the Minneapolis, Minnesota elder law firm of Long, Reher & Hanson, P.A. The firm’s focus is to provide positive strategies to individuals who are aging or living with disabilities to enable them to live as independently as possible for as long as possible. Laurie concentrates her practice exclusively in the areas of government benefit eligibility, special needs trusts, trust and public benefit litigation, estate planning and planning for incapacity. She is the past president of the Elder Law Section of the Minnesota State Bar Association and is repeatedly named a Super Lawyer in the field of elder law by her peers.

SNAP is for the most part uniform across the country and is reaching an estimated 43 million low-income Americans to provide them a nutritionally adequate diet. More than 75 percent of all food stamp participants are in families with children nearly 25 percent of participants are elderly people or people with disabilities. The federal government pays the full cost of the food stamp benefits, but it splits the cost of administration with the states. SNAP is administered through Food and Nutrition Services, a division of United States Department of Agriculture.

Don’t Miss: Oregon Food Stamp Income Chart

Food Stamps And Meal Programs During The Covid

Because of the COVID-19 pandemic, it may be easier for you and your family to get food stamps and take part in meal programs. Contact your state’s social services agency to see if you’re eligible.

During the pandemic:

-

Food stamp recipients may receive additional funding. More people may be eligible to receive SNAP during the pandemic than normally.

-

Parents whose kids’ schools are closed can pick up school meals for their kids to eat at home.

-

People can enroll in food programs remotely rather than in person. This applies to programs for pregnant women, families, seniors, and people with disabilities.

Disability In The United States

Estimating the number and describing the characteristics of people with disabilities in the United States is difficult because individuals face a broad range of physical, mental, and sensory impairments, and the definition of disability depends on the context for which it is defined. In general, disability refers to a physical, mental, or emotional condition that limits participation in the usual roles and activities of everyday life. As the World Health Organization notes:

The disability experience resulting from the interaction of health conditions, personal factors, and environmental factors varies greatly. Persons with disabilities are diverse and heterogeneous, while stereotypical views of disability emphasize wheelchair users and a few other classic groups such as blind people and deaf people. Disability encompasses the child born with a congenital condition such as cerebral palsy or the young soldier who loses his leg to a land-mine, or the middle-aged woman with severe arthritis, or the older person with dementia, among many others. Health conditions can be visible or invisible temporary or long term static, episodic, or degenerating painful or inconsequential.

Don’t Miss: Owsley County Kentucky Food Stamps

Insurance Coverage And Discounted Medical Care

You may qualify for Medicaid or state health insurance, since these programs have financial-need measurements for eligibility. Many clinics offer services on a sliding scale for patients who meet income thresholds and for those without insurance too. Your regular doctors office may have a need-based sliding scale as well, so be sure to talk to the staff there about your disability application and your financial concerns. Your doctor can also help you find discount prescriptions and may provide you samples to help cut your costs.

What Can I Do While On Disability

SSDI recipients are entitled to a trial work period during which they can make more than the SGA amount without losing benefits. Trial work period. Extended period of eligibility. Expedited reinstatement. Calculating countable income. State supplemental payments. Expedited reinstatement. Ticket to Work program.

Don’t Miss: Can I Buy Similac With Ebt

How Do I Qualify For Ssdi

SSDI requires that an applicant has both a qualifying disability and has worked long enough to be considered insured. In general, you can either have a partial disability or full disability which prevents you from working for at least 12 months or is expected to end in death. Some disabled workers may still be able to work in some capacity, but to qualify you must be unable to engage in substantial gainful activity .

Your disability typically must also be listed in the SSAs list of impairments, commonly referred to as the Blue Book. The Blue Book lists all conditions that are pre-approved for medical eligibility, however, it is possible to be granted an exception if your condition isnt listed here.

For the work credits requirement, you typically need to have worked for at least 10 years. You can earn a maximum of 4 credits per year, and need to have at least 40 credits to qualify.

Waivers are available and required work credits are less if you are younger. For the youngest age bracket, you only need 20 work credits. You may also be granted a waiver if you were married and did not earn work credits since your spouse was the main earner for your family.

Retroactive Back Pay Amounts Are Calculated

If the SSA honors your Alleged Onset Date, that means there has been some time before you applied for SSDI, when your disability prevented you from working. In these cases, the SSA will also issue retroactive back pay, which is different from SSDI back pay. SSDI back pay is the amount you should receive to cover any lapse in payment between your application and when you start getting payments, minus those 5 months.

Retroactive back pay is payment the SSA will award you to cover your period of disability before you even applied for SSDI. And again, there is a 12-month limit. This is a good reason to never delay filling out the SSDI application.

Read Also: Food Stamp Income Guidelines Mo

How To Apply For Ssi

You can apply for SSI online, in person at a Social Security office, or over the phone by calling 1-800-772-1213. However, if you are applying on behalf of a disabled child, the process is a bit different and you must first start a child disability report. After this has been reviewed by the SSA, you will be contacted by a representative who can help you apply. For people over the retirement age of 65, you need to apply either in person at a local Social Security office or by calling the toll-free number.

What Happens If My Ssdi Or Ssi Claim Is Denied

If your SSDI or SSI claim is denied, you have the right to appeal this decision. Denials can happen for all sorts of reasons, and you shouldnt give up just because youre denied on the first try. Sometimes mistakes are made by the SSA representative reviewing your file, or perhaps the medical evidence was deemed insufficient. Appeals can be done on your own or you can enlist the help of a Social Security disability attorney. A disability lawyer can help file your disability claim, gather any supporting documents, and help with communication and any eventual interviews or court dates.

The appeals process is broken into four stages. If you wish to contest the SSAs decision you must follow each step in order. The first step is called Reconsideration and it is the most basic and straightforward level in the appeals process. Within 60 days of your denial, you can ask that a new SSA representative review your application to see if an error was made. Approximately 10-15% of reconsiderations result in approval. However, if your appeal is denied, you can move on to the next level of appeals where you can request a formal disability hearing with an administrative law judge.

The third and fourth levels of appeal require you to submit a disability claim first with the Social Security Appeals Council and then with a federal court. At this stage of the appeals process, it is highly advised that you hire legal counsel.

Read Also: Oregon Snap Income Limits Per Month

Additional Services For Ssi Recipients

46 states including Washington D.C. currently offer additional monthly benefits that are added onto federal SSI payments. Arizona, Mississippi, West Virginia, and North Dakota do not contribute. Each state determines the amount of money thats added onto payments and it can range from $10 to $400 in additional benefits each month.

SSI recipients are eligible for other need-based programs such as Medicaid and Supplemental Nutrition Assistance Program . In most states, if you qualify for SSI you will automatically qualify for these programs as well.

Medicaid provides health insurance to low-income Americans. The program currently covers around 75 million people. Although Medicaid is a federal program, it is run on the state level and each state has its own guidelines on income qualifications and what coverage comes with it. Medicaid also covers the health needs of low-income children through the Childrens Health Insurance Program . CHIP can help by providing health insurance for children, even if the parents themselves arent able to qualify for Medicaid.

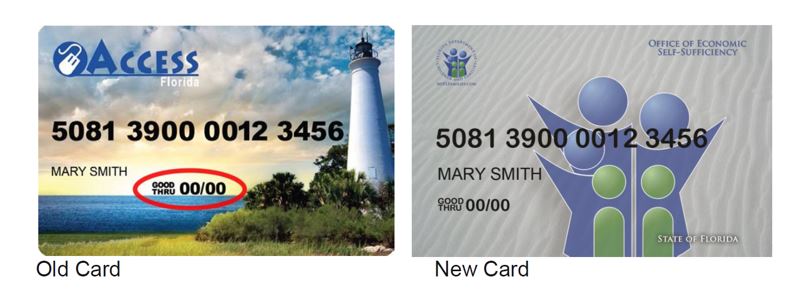

SNAP benefits is a federal program that helps low-income families purchase healthy food. This is usually done in the form of a monthly allowance or voucher that recipients can use at grocery stores and in some cases local farmers markets. Some states will automatically submit an application for SNAP benefits when you apply for SSI, while others will offer you the choice to pursue SNAP benefits on your SSI application.

Can I Work While Receiving Ssdi

Yes, you can work or return to work and still receive SSDI benefits. Since disability benefits are primarily intended to help those who arent able to work, there are certain regulations to follow. In most cases, you can be employed partially as long as your income stays under the threshold of substantial gainful activity. Or, if your condition improves and youd like to try working again, the SSA gives you a nine-month grace period to see if this is a viable option. If, after nine months, you can return to work, your benefits may be reduced or terminated altogether depending on how much you are able to earn.

The SSA offers beneficiaries access to their Ticket to Work program, which provides free training, job search help, vocational rehabilitation, and other support to gain employment. Taking part in the Ticket to Work program does not mean that your benefits will automatically stop, only that you are exploring your options for employment.

Don’t Miss: Qualifications For Food Stamps In Iowa

Snap/food Stamps For Elder/disabled Households With Medical Expenses

NOTE: During the COVID-19 pandemic, all households will get the maximum SNAP benefits for their household size. But you still should claim medical expenses when you apply for SNAP so that you continue to get the benefits you are entitled to when the pandemic ends. Click here to learn more about changes to SNAP during COVID-19.

For All Seniors and Persons with Disabilities

If you have out-of-pocket medical expenses, your SNAP benefits may increase! if you have medical expenses over $35 per month, DTA allows a $155 deduction from income. This deduction can increase your benefits. If you pay more than $190/month in expenses, you might get even more SNAP.

Snap Serves Diverse Group Of Low

This section looks at the characteristics of SNAP participants identified as disabled using SNAP administrative data, which find that about 5.2 million non-elderly participants, or about 12 percent of all participants , had a disability in 2015.

These figures are less than half the number and share of individuals receiving SNAP with a disability in the NHIS data used earlier in this paper, who represent individuals of all ages identified as having an impairment or work limitation or, among the non-elderly, receiving SSI or SSDI. These figures also are significantly lower than the number and share of non-elderly individuals identified in the NHIS data as having a disability: the NHIS data show 8.1 million non-elderly SNAP participants with disabilities, constituting about 22 percent of non-elderly SNAP participants. See Table 1 for a comparison of these estimates by age.

There are two major reasons why these figures differ so substantially. First, the SNAP administrative data use a narrower definition of disability to simulate disability as defined under SNAP rules, largely based on receipt of SSI and other government benefits. In contrast, the NHIS data capture the broader group with an impairment, many of whom may not qualify for or receive government benefits such as SSI and therefore would not be considered disabled under SNAP rules.

| TABLE 1 | |

|---|---|

| 59% |

Read Also: Ebt Acs Inc Com Georgia

Calfresh For Ssi Recipients

For the first time ever in California, older adults and adults with disabilities receiving SSI can apply for CalFresh food benefits.

If you receive Supplemental Security Income , you can get CalFresh benefits. There is no change or reduction to SSI/SSP payments.

CalFresh is a free nutrition assistance program that helps boost food budgets for low-income individuals and families. Food benefits for one person range between $20 to $250. Benefits are based on your household size, income, and monthly expenses.

For SSI households receiving SNB or TNB see here for new allotment amounts.

For community partners: Visit our CalFresh Benefits for SSI Recipients – Resources page for the tools to help you serve SSI recipients.