About Kentucky Food Stamps

Participants in the Kentucky Food Benefits program are provided with EBT cards. These cards can be used to purchase foods from participating retailers. When you sign up for the benefits program, you are provided with an Electronic Benefits Transfer card and a Personal Identification Number in the mail that will be used to access your food stamp benefits.

Generally, any food can be purchased using your Kentucky food stamps EBT card. However, ready-to-eat hot foods are not eligible. Kentucky food benefits are deposited into a participant’s account each month.

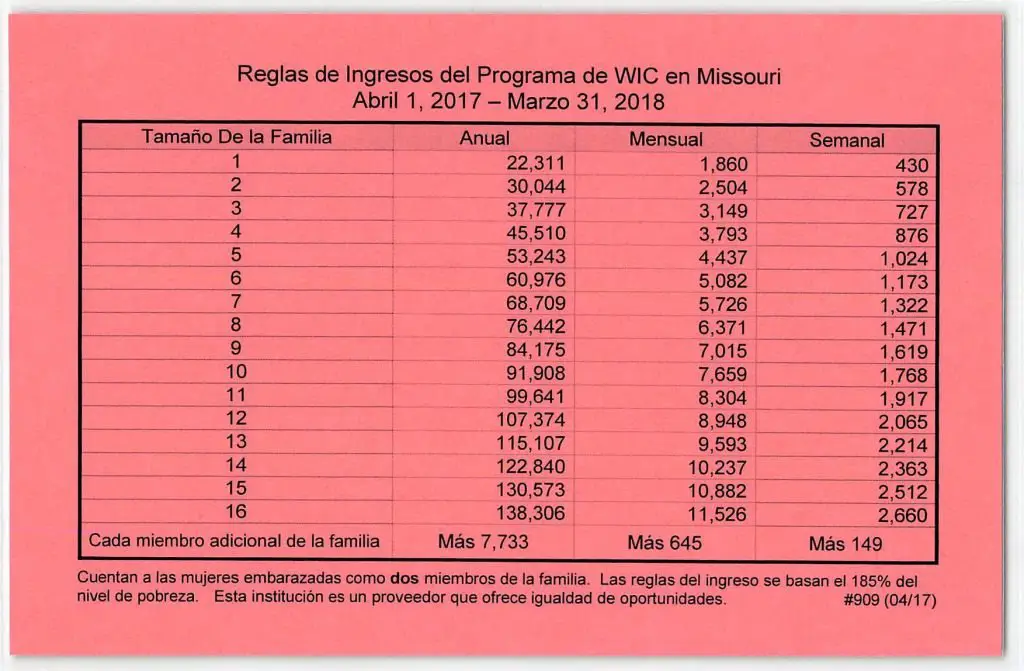

What Is Considered Low Income In Missouri

You must be considered low income. Your household assets cannot exceed $2,250. Some assets, like the home where you live, your cars, prepaid burial plots, non-income producing property, etc, are not counted towards your asset limits. If everyone in your household is above the age of 60, then the limit is $3,500.

How To Appeal A Denial Of Benefits Or A Low Benefit Amount

If you do not agree with the benefit decision given to you by the Missouri Family Support Division, you can appeal your decision in person, by phone, or by mail within 90 days of receiving your determination letter.

To file an appeal in person, visit a local Family Support Division office. You will need to speak with a representative and tell them why you are appealing your determination. Find your nearest location here.

To file an appeal , call 1 373-4636 or your local FSD office.

To file an appeal , you will need to write a letter that includes the following information:

- Your name

- Your address

- Your phone number

- The reason for your appeal, whether you were denied benefits or you received a lower benefit amount than you believe you should have

Recommended Reading: Local Food Stamp Office Phone Number

Minimum Wage And Poverty In Missouri

Some evidence suggests that the minimum wage regulations might also be a contributing factor to poverty levels in Missouri.

At the time of writing, the minimum wage in Missouri stands at $8.60 per hour.

But according to the Massachusetts Institute of Technology living wage calculator, that number needs to be higher to address poverty in the state.

The MIT âliving wage calculatorâ calculates the amount people would need to earn per hour to make a living wage in Missouri. They calculate their âliving wageâ numbers based on the assumption that someone works 40 hours per week.

âLiving wageâ is defined as an income that is adequate enough to provide for oneâs basic needs in Missouri at a reasonable level.

Here are some examples of what would be an adequate wage in Missouri, according to MIT.

- 1 adult with no children – $11.16

- 1 adult with 1 child – $22.86

- 2 adults with no children – $18.42

- 2 adults with 1 child – $22.57

- 2 adults with 1 child – $12.77

- 2 adults with 2 children – $14.97

As we can see, in each scenario, MIT suggests that the necessary living wages are higher than the current minimum wage of $8.60.

Also, we should note that the recommended wages are per working adult, and not combined for the entire household.

Now that weâve explored some of the factors that are driving poverty in Missouri, letâs take a look at how it affects specific areas of life, such as food, healthcare, and housing.

Food insecurity in Missouri

- Overeating unhealthy foods

Approved Medical Expense Reduction

For this reduction, it covers the medical expenses that are approved for the elderly or disabled members of the household. For the medical expense to be approved for a deduction, it has to exceed $35 a month and not covered by insurance. Most of your office visits co-pays will not be deductible, though.

Read Also: How Do I Renew My Food Stamps Online In Arizona

Learn About Missouri Food Stamps Requirements

Before you can apply for food assistance in the state, you must make sure that you meet the requirements for food stamps eligibility in Missouri. Formerly referred to as food stamps, the Supplemental Nutrition Assistance Program is designed to help low-income individuals and families buy healthy food. Therefore, income is one of the main requirements that you must meet to qualify for food stamps.

In Missouri, the Department of Social Services administers the program and distributes funds to qualifying households. During the application process, these families must meet income limits according to their household size in order to qualify. They must also meet other food stamp qualifications related to their residency and legal citizenship status. In certain cases, applicants may automatically qualify for the program or may be eligible to receive expedited food stamp services.

In addition to these eligibility requirements, participants of the program must maintain their status by meeting criteria related to employment. Continue below to learn more about SNAP eligibility in Missouri.

Deductions Are Expenses That Are Subtracted From The Household’s Monthly Gross Income When Determining Eligibility

Learn about food stamp income limits and other eligibility requirements and guidelines in massachusetts. In order to maintain your massachusetts food stamp eligibility, you will be required to report updates. All available income for all members of your household is counted when we determine your eligibility for food stamp benefits. Maximum monthly food stamp program allotment and income limits, by household size, 2004 . Net monthly income limits are set at 100% of poverty. Is there a time limit on how long i can receive food stamps? An indispensable handbook for all who need to know about the food stamp/snap program in massachusetts. Massachusetts collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. The biggest factor when determining if you are eligible for food stamp benefits is your household income. The income tax rate in massachusetts is 5.00%. Other land and property can count toward asset limits, but some states, such as massachusetts, exempt income property from asset totals. Food stamps in the united states. To provide for improved levels of nutrition among low the congress hereby finds that the limited food purchasing power of low income households because of food stamps, massachusetts grocers sold the equivalent of 33 million more quarts of.

You May Like: Apply For Food Stamps Lexington Ky

How Much Will I Get In Florida Food Stamps

You must meet all eligibility requirements including the Florida Food Stamps Income Limit, in order to be approved for benefits. The amount of money you will get each month depends on your household size.

See the chart below for the maximum amount you may get based on the number of people in your household.

| Maximum SNAP Benefit Amount by Household Size for Florida | |

| Effective October 1, 2021 September 30, 2022 | |

| Household Size | |

| Each Additional Household Member: | +$188 |

Now you know the Income requirements for food stamps in Florida. If you qualify for food stamps and want to apply, or see below for detailed instructions on how to apply for the nutrition assistance program or SNAP/Food Stamps.

Definition Of A Household

When determining eligibility, you need to provide information on all members of the household. A household, for this situation, is defined as all individuals that live together and purchase and prepare meals together. Likewise, you may have people living with you that are not considered part of your household. For example, if you rent a room to someone that does not purchase or prepare food with you, they are not part of your household. However, whatever they pay you for rent has to be counted under income.

There are two exceptions to this definition. The first is a household that includes a husband, wife, and children under 22 years of age. This group will be considered a household even if they purchase and prepare meals separately. The second exception is elderly or disabled individuals that are unable to purchase and prepare their meals independently and live with others that do.

Also Check: Apply For Food Stamps Lexington Ky

How Much Money Can You Make While Getting Snap

Eligibility is determined by income limits. The food stamp income limits KY residents face depend on household income. However, anyone researching the food stamp income limits KY residents are subject to should be aware that a new Kentucky food stamp law has created some changes for how Kentucky residents apply for food benefits.

In response to COVID-19, Kentucky is issuing waivers to protect the health of participants. This includes waiving both initial and re-certification interviews for participants.

What Income Is Not Counted For Snap

When caseworkers determine your eligibility, one important thing they will look at is your household monthly income. Your household monthly income plays a big part in deciding if you are qualified for the benefits, and also the number of food stamps benefits you will be qualified for. This means income will certainly depend on the number of members of your household, and you will have to provide information about them.

According to Mass Legal Help, not all income will count towards your SNAP benefits. Some of the income that does not count for SNAP from Mass Legal Help may include:

â VISTA, Youthbuild, and AmeriCorps allowances, earnings, or fees for individuals that are, in any other case, eligible.

â Earnings of a kid under the age of 18 who are attending secondary college at least half of the time.

â Lump-sum bills â together with inheritances, tax credits, damage awards, one-time severance pay, or different one-time payments

â Reimbursements â the amount of money you get back to pay again for costs, such as schooling-associated costs and medical costs

â Senior Community Service Employment Program stipends paid to older employees doing community service jobs part-time

â Anything you do not receive as cash, including free housing or food, or expenses that are paid straight to a landlord or utility company made by a relative, friend or agency that has no legal obligation to do so

â Up to $300 in three months from private charities

You May Like: How To Apply For Medicaid And Food Stamps In Texas

What Bills Count For Food Stamps

Published by Nicole Thelin –

Our site is ad-supported and this post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases. If you complete a purchase using one of our links, we may receive a small commission at no extra cost to you. Learn more about our editorial and advertising policies.

Have you ever wondered what bills count for food stamps? When you complete your first application for food stamps, you are asked a lot of questions about your income and expenses but what expenses actually count as food stamps deductions?

Will Ssi Recipients Receive Stimulus Check

A person whose sole source of income is SSI is not eligible to receive a stimulus payment, but many SSI recipients who have at least $3,000 in other annual income, such as Social Security benefits, are eligible to receive the payments. However, an income tax return must be filed in order to receive a stimulus payment.

Also Check: 13838 Buffalo Speedway

What Are The Snap Income Guidelines In Missouri

In order to be eligible for food assistance, you must meet SNAP income guidelines. In general, the program takes into account both your householdâs combined gross income and net income in relation to your household size and makeup.

In Missouri, you cannot make more than 130 percent of the federal poverty level. This means that you cannot have an income that exceeds $1,307 if you are a household of one person. If you are a family of six, your householdâs monthly gross income cannot exceed $3,571. Income requirements for food stamps are based on the cost of living for that fiscal year. In any case, when calculating your net income, the following deductions are allowed:

- A 20 percent deduction from your earned income

- Dependent care

Missouri Food Stamp Program

The Supplemental Nutrition Assistance Program , or the Food Stamps Program as it is known by the public, is a federal program that provides grants to the States for purpose of reducing hunger and malnutrition in all eligible households across the nation. SNAP helps provide healthy food to qualifying low-income families with children, elderly or disabled in each State of the USA, including Missouri.

It is important to know that the Supplemental Nutrition Assistance Program is a federal entitlement program funded by U.S. Government grants. Any U.S. Citizen, even some legal alien residents, will get free food assistance as long as they meet the SNAP eligibility guidelines. In other words, there is enough Supplemental Nutrition Assistance for every American that qualifies.

In Missouri, the SNAP is administered by the Missouri Department of Social Services and its Family Support Division . The Federal Government oversees the State operation of the SNAP. According to the Missouri Department of Social Services, SNAP is designed to promote the general welfare and safeguard the health and well-being of the nations population by raising the levels of nutrition among low-income households. The program is called the Food Stamp Program in Missouri.

Also Check: Apply For Food Stamps Lexington Ky

What Are The Income Guidelines For Food Stamps In Missouri

Here are the general guidelines to qualify for the food stamps program in Missouri.

There are some other additional eligibility factors, like criminal history, etc. For detailed information, visit the Missouri Department of Social Services food stamps page.

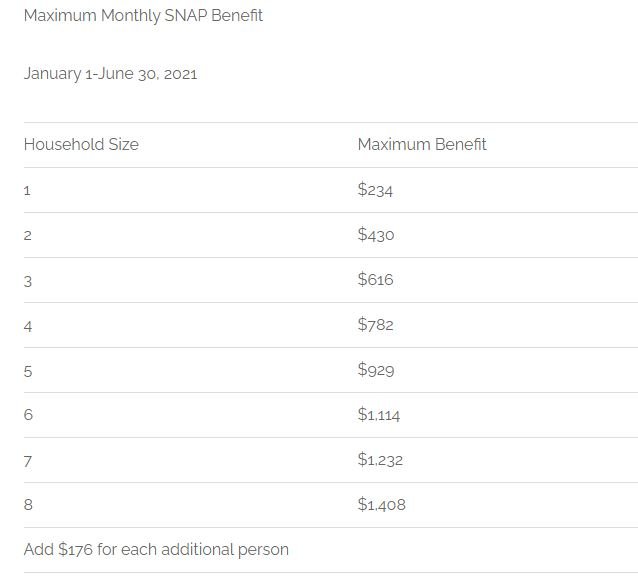

Maximum Monthly Amounts On Food Stamps

There is a maximum monthly allotment based on the size of the household. When determining your benefit allotment, they will take your net monthly income and multiply it by 30%. That number will then be subtracted from the maximum monthly allotment. The remaining amount is the total monthly allotment you will receive based on your application. This amount may change if your income or household size changes.

SNAP benefits are a specific money amount provided to recipients each month to go towards nutritional foods. Recipients are provided with an electronic benefits transfer card, and money is added to the card each month. You can check your balance by phone, and any unused funds at the end of the month remain on the card to be used to following month. Once allocated, benefits will not expire.

Benefits can be used to buy food and drinks at most grocery stores, convenient stores, gas stations, pharmacies that sell food, and farmers markets. Benefits cannot be used to buy alcohol, tobacco, medicine, hot food, food meant to be eaten in the store, or any non-food items.

Recommended Reading: Okdhs Food Stamp Guidelines