Applying For And Receiving Benefits

Snap Eligibility: General Requirements

General Eligibility Requirements Eligibility for the District of Columbia Supplemental Nutrition Assistance Program is based on income, resources, and the number of individuals applying together as a household or may be based on the fact that you receive another type of assistance, such as Supplemental Security Insurance . A household with an elderly or disabled person has different eligibility requirements.

- See if you may be eligible for SNAP by answering a few questions

SNAP HouseholdA household is everyone who lives together and purchases and prepares meals together as a group. Spouses and most children under age 22 are automatically included in the same SNAP household even if they purchase and prepare meals separately.

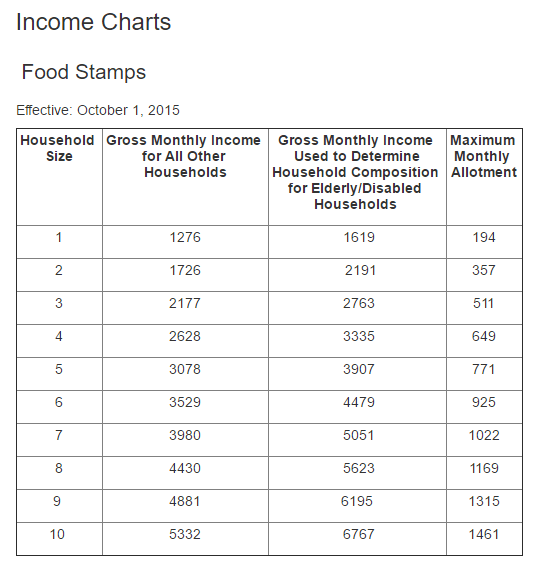

SNAP Income LimitsIn general, each SNAP household members income is counted together and compared to the income limits to determine eligibility. Income includes money earned from a job or self-employment and money received from sources like the United States Social Security Administration or retirement.

Households must meet both a gross and net monthly income limit for their household size . Households with a person age 60 years or older or a person with a disability only need to meet the net monthly income limit.

- Gross income means a SNAP households total income before any deductions

- Net income means a SNAP households total gross income minus allowable deductions

State Supplements And Food Stamp Receipt

Because the FSP benefit is nationally uniform , it would be reasonable to expect that the prevalence of food stamp receipt would be lower in states with a substantial SSI supplement than in states without. However, separate calculation of FSP prevalence in states grouped by size of supplement revealed no clear pattern. For the elderly, living in a high supplement state is associated with higher, not lower, prevalence of food stamp receipt. For children, the opposite is true. It may be that the effect of high benefits is offset by high living costs. On average, housing coststhe key component of interstate variation in costs of livingare positively correlated with the presence and amount of the SSI state supplement.5

You May Like: Apply For Food Stamps In Oklahoma City

How To Calculate Net Income

Now that you have your households monthly gross income, you can use that number to calculate your net income. Use the chart below to calculate your monthly net income and determine if your household is eligible for Florida SNAP EBT benefits.

Please not that there may be exceptions to the net income calculation. These exceptions apply to household members that are elderly or disabled. For more information or immediate help, in your county.

| How to Calculate SNAP Net Income | |

| Net Income Calculation: | |

| Determine if shelter costs are more than half of adjusted income | $700 total shelter $602 = $98 excess shelter cost |

| Subtract excess amount, but not more than the limit, from adjusted income | $1,204 $98 = $1,106 net monthly income |

| Apply the net income test | Since $1,106 is less than $2,209 allowed for a 4-person household, this household has met the income test. |

The Food Stamp Program

The FSP helps people buy food by providing grocery credit. The name is an anachronism today all recipient households receive the FSP benefit through the use of electronic benefit transfer cards. These are ATM-like debit cards that recipients use to purchase food from authorized grocery stores and supermarkets. The benefit is adjusted annually for changes in food costs. The FSP eligibility unit is the household, defined as an individual or group of people who live, buy food, and prepare meals together. This contrasts with SSI, which is determined on an individual, and not household, basis.

Don’t Miss: Kynect Food Stamps

What Benefits Can You Expect If Youre Eligible For Snap

The amount you receive each month in benefits is called your allotment. This is the amount of money being provided for you to buy food based on your income and household size. There is one formula used to determine your allotment.

First, there are predetermined maximum allotments a household can receive. These amounts are based solely on household size. The following table shows the current maximum amounts.

| People in the household | |

|---|---|

| Each additional person | $146 |

Another important factor is the actual amount of income taken into consideration for eligibility. It is expected that a household will spend roughly 30% of their net income on food during a months time. While this is not an exact figure and some households may regularly spend more or less than 30%, that is the standard used to figure eligibility.

Therefore, your net income is multiplied by 0.3 in order to come up with your 30% amount. That amount is then subtracted from the maximum monthly allotment allowed for your household size. The difference is what you get each month in benefits. Here are a few examples to demonstrate how this formula works.

Example 1:

Net monthly income of $1800

$1800 x 0.3 = $540

Maximum allotment for a family of 5 = $771

$771 – $540 = $231

Net monthly income of $2200

$2200 x 0.3 = $660

Maximum allotment for a family of 4 = $649

$649 – $660 = -$11

Although the difference is only off by $11, this family would not be approved for SNAP benefits.

Information Needed For Eligibility

Whether you are applying for the first time, or renewing your benefits, you may need one or more of the following pieces of information to determine whether you are eligible:

- Proof of citizenship and identity for everyone who is applying for benefits.

- Alien Registration Cards, if there are non-U.S. citizens applying for benefits in your household.

- Social Security numbers for everyone, or proof that a Social Security number has been applied for.

- Proof of relationship, birth certificates may be used

- Name, address & daytime phone number of landlord or neighbor.

- A statement verifying your address and the names of everyone living with you. The statement must be made by a non-relative who doesnt live with you. It must be signed, dated and include that person’s address and telephone number.

- Proof of ALL money your household received from any source last month and this month.

- Proof that your employment ended and last date paid.

- Bank or credit union complete statement for the most recent month.

- Proof of savings bonds, securities, retirement plans and life insurance.

- Proof of rent/mortgage and utility bills for the most recent month.

- Proof of child care expenses for the most recent month.

- Proof of all medical expenses for those applying for benefits who are age 60 or older or receive disability benefits.

When possible, please include this information with your application.

You May Like: Food Stamp Office Decatur Tx

Florida Food Stamps Allowable Deductions

Deductions are expenses subtracted from the households gross income when determining the food assistance benefits for a month.

Florida SNAP deductions include:

- 20% deduction from earned income

- Standard deduction based on household size

- Cost of child care when needed to work, seek work or attend training for work

- Medical expenses more than $35 for elderly or disabled household members

- Court-ordered child support payments paid to non-household members or

- A portion of shelter and utility costs

The Minimum Income To Qualify For Food Stamps

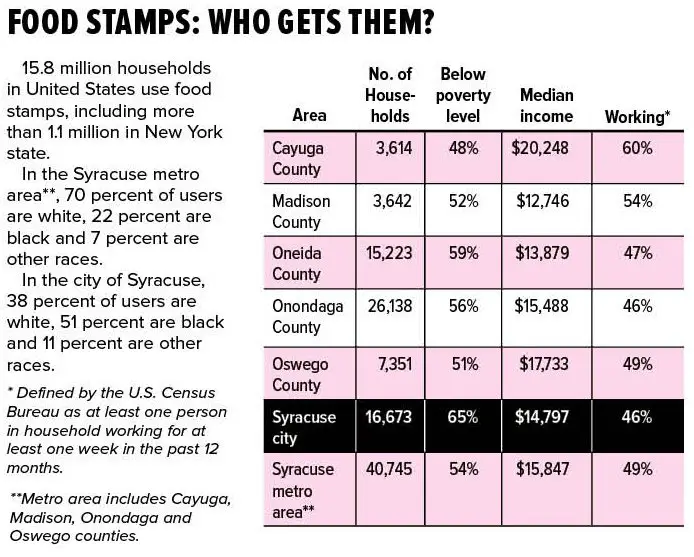

Food stamps help low income families buy food. Though the program is federally mandated, it is administered by local agencies. If your income falls below the maximum limits for the program, you may be eligible to receive food stamps. Income limits are set based on the number of people in your household.

Also Check: Food Stamp Application Oklahoma

The Prevalence Of Food Stamp Receipt

Table 2 illustrates the use of both resources, SSI and the FSP. The data for each year are separately tabulated by SSI recipient age group. The SSI recipient counts in the first row for each group are from Social Security administrative records and are averages for the months of the fiscal year. These are exact counts of payments made. The counts in the second row are derived from FSPQC sampling probabilities. “Prevalence” is just the ratio of the estimated total number of SSI recipients living in units receiving food stamps divided by the total number of recipients in the relevant age class . Thus we estimate that 939,106 elderly SSI recipients lived in FSP recipient households in 2006 this was 63.6 percent of all SSI recipients in the group. Although the denominators for these statistics are from administrative data and are effectively known with certainty, the FSP recipient counts are sample based and therefore subject to sampling errors. However, since the samples are quite large, confidence intervals around the sample-based recipient estimates are small, so the precision of the prevalence estimates is high.

Table 2. Estimated prevalence of food stamp receipt among SSI recipients, by age group, fiscal years 20012006| SSI recipient characteristic |

|---|

| 63.6 |

| NOTES: SSI = Supplemental Security Income FSP = Food Stamp Program. |

| Ninety-five percent confidence intervals in parentheses are shown in percentage points. |

What Is The Maximum Income To Qualify For Food Stamps In Louisiana : How To Qualify For Food Stamps: 12 Steps With Pictures / For Benefits Add $150 For Each Additional Household Member

What Is The Maximum Income To Qualify For Food Stamps In Louisiana : How to Qualify for Food Stamps: 12 Steps , stocks, and bonds. Households that require to pass resources eligibility test can’t have more than $2000 in resources. The gross income limit is 300% of the ssi federal benefit rate for an individual. Food stamps eligibility your total household income must be below a certain number. It is a simplified version of snap.

The gross income limit is 300% of the ssi federal benefit rate for an individual. 2021 program limits by family size. See 0029.06.03 for the current rate. Have lived in the united states for at least 5 years. However, income is not the only eligibility factor for medicaid long term care, there are asset limits and level of care requirements.

Recommended Reading: Food Stamp Office Somerset Ky Phone Number

Can I Get Food Stamps If I Am On The Gi Bill

Military veterans and others who are taking advantage of the GI Bill program are sometimes curious if GI Bill money or BAH income is counted towards the income requirements for SNAP. The answer is yes, BAH income is typically counted towards your gross income when determining if you are eligible for food stamps. As such, your GI Bill benefits do contribute to your income, even though that income is temporary and not taxed. Receiving BAH does not stop you from being eligible for food stamps outright, it is just included in the income calculation.

SNAP Overview

The federal food stamp program is now called the Supplemental Nutrition Assistance Program . SNAP is the largest domestic program available to nutritional assistance, and it is available for low-income individuals and families that meet the eligibility requirements. The federal food and nutrition service works with a wide range of other organizations including state agencies, nutrition educators, and neighborhood organizations to provide SNAP recipients with nutrition assistance and information.

The local agencies provide aid for people while they are going through the application process, and once people are approved, these agencies help them to access their benefits. The goal of this program is to provide monetary assistance with food while the members of the household are actively looking for work or working in positions that do not pay enough to cover food and living costs.

Benefits

Example of Benefits Allotment

The $600 Stimulus Checks Also Won’t Be Counted As

Households not exempt from the resource limit may have up to $2250 in resources, such as a bank account, cash, certificate of deposit , stocks, and bonds. Click on the state name in the table. Their combined gross income must not exceed 600% of the. And 6:30 p.m., to apply and be interviewed for dsnap benefits. To meet eligibility, the maximum gross income must be lower than the. How to apply for snap in louisiana. The best way to determine if and how much your household will qualify for snap is to apply. This dollar amount is based on the number of people in your household, your income and your expenses. If you are eligible for lacap, you will receive a louisiana purchase card and snap benefits will be automatically deposited into your account every month. The $300 boost in federal pandemic unemployment benefits will not be counted as income or resources in determining snap eligibility. The maximum allotment you could receive is based upon a net income of 0, and it decreases as you come closer to the maximum income. The food and nutrition act of 2008 limits eligibility for snap benefits to u.s. People who don’t have a lot of money as long as they meet program rules.

Recommended Reading: Food Stamp Office Colorado Springs Co

Florida Food Stamps Explained

The Florida Food Assistance helps low-income individuals and families buy food needed for good health.

If you meet the program guidelines, you will get a special debit card .

Each month, your food stamps benefits are loaded onto your Florida EBT card, which you can use to purchase approved food items at grocery stores and most farmers markets.

Florida SNAP program is fun by the Florida Department of Children and Families .