What Is The Ohio Supplemental Nutrition Assistance Program

The Ohio Supplemental Nutrition Assistance Program is a program designed to improve nutritional levels, and seemingly increase purchasing power and protect the health of people from low-income Ohio families. This program is also known as the Food Assistance Program. Also, you should know that a household may consist of one person or group of people who live, buy and eat food together.

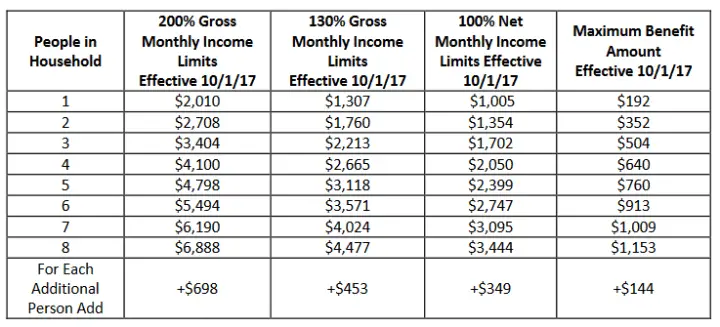

Table I: Snap Income Limits

SNAP Income Allotments and Deductions

The maximum allowable gross and net income standards for determining eligibility of assistance units and the maximum allotments authorized appear below.

| Assistance Unit Size | 165% PovertyMaximum Gross Monthly Income Elderly/Disabled | Maximum Gross Monthly Income 130% of Poverty | Maximum NetMonthly Income 100% of Poverty | Thrifty Food Plan Maximum Allotment |

| 1 | ||||

| +$379 | +$188 |

- The standard deduction is $177 for AU sizes of 1-3, $184 for AU size of 4, $215 for AU size of 5 and $246 for AU sizes of 6 and above.

- The excess medical deduction is excess over $35.

- The maximum excess shelter cost for nonelderly/nondisabled assistance units is $597.

- The utilities only standard is $291. utilities not heating/cooling).

- Wyomings Standard Utility Allowance is $417.

- The telephone only allowance is $55.

- The Homeless Shelter Deduction is $159.73

- The earned income deduction is 20%.

- The minimum monthly SNAP benefit for categorically eligible assistance units of one or two persons is $20.

- Mileage reimbursement rate is $0.585 cents per mile.

How Long Will It Take To Receive Florida Food Stamp Benefits

If your Florida SNAP Application is approved, you will start receiving benefits no later than 30 days from the date you submit your application.

In addition, once you are approved for Florida food stamp benefits, you will receive an EBT Card in the mail. An EBT Card, also know as an Electronic Benefits Transfer Card is similar to a bank debit card.

Your Florida EBT Card will be used to access your monthly food stamp benefits at grocery stores and online retailers. To learn more about the Florida EBT Card, check out our FAQ Page here.

You May Like: Amazon Accept Ebt Online

New Allowable Deductions For 2022

To calculate your net monthly income, you must deduct approved household expenses. Here are the expenses that can be deducted from your households gross income:

- 20% deduction from Earned Income

- Standard deduction of $177 for households with 1 to 3 people and $184 for households with 4 or more people

- Dependent care deduction when needed for work, training, or education

- A deduction for elderly or disabled members medical expenses that exceed $35 a month

- Any legally owed child support payments can be deducted

- Homeless Households shelter costs deduction of $159.73.

- A deduction for excess shelter costs that exceed more than half of the households income .

Georgias Food Stamp Program: The Basics

The Georgia Supplementary Nutrition Assistance Program is a food aid program funded at the federal level to assist households with low income or minimal resources. It is available to U.S. citizens and legal residents. However, you must meet the set income limits to be eligible for the program.

Any eligible individual or family will receive an Electronic Benefits Transfer card, which draws money from their SNAP account to pay for the food items they buy from SNAP-authorized retail stores.

Recommended Reading: Snap Income Limits Massachusetts

Hawaii Food Stamps Requirements

The Hawaii food stamps requirements for eligibility encompass several different aspects of petitioning applicants portfolios. In particular, these stipulations relate to three main categories. The requirements for food stamps are as follows:

- Income eligibility: In order to qualify for food assistance, claimants must meet the states income limits. For example, households monthly net and gross incomes must fall within a certain percentage of the Federal Poverty Limit .

- Citizenship: Food stamp eligibility requirements indicate that petitioners either need to be U.S. citizens or foreign-born applicants who are legally residing and working in the country. However, in order to receive SNAP, all claimants and their household members must have valid Social Security Numbers . Candidates must present proof of identity to the DHS. Potential claimants who do not yet have their cards are obligated to provide proof that they applied for this documentation.

- Work: In some instances, adults who are physically capable of performing standard job tasks must be able to work in order to collect food stamps. However, these criteria vary depending on petitioners ages and physical conditions.

What Deductions Are Allowed For Net Income In Food Stamp

- Earned income is deducted at a rate of 20 percent.

- For households of 1 to 3 people, the standard deduction is $ 167 and for households of 4 people, it is $ 178 .

- Expenses relating to child care or other dependents that a household member must incur so that they can work or attend school

- In the absence of insurance or another payment source, medical expenses in excess of $ 35 per month for elderly or disabled members.

- A household member pays child support for any legal obligations he or she has.

- Standard deduction for homeless families is $ 152.06 in some states.

- See below for housing costs in excess of the standard deduction.

Recommended Reading: Calfresh Recertification Application

How Much In Food Stamps Will I Get

Once you determine you qualify for food stamps, you probably want to know how much in benefits your household will get on a monthly basis. See the chart below for details. You will find that the maximum benefits you can get is based on the number of people in your household.

| Maximum SNAP Benefit Amount by Household Size for California |

| Effective October 1, 2021 September 30, 2022 |

| Household Size |

Note: The allotments described here are for households in California

Check out the example for a SNAP benefit calculation below:

| Benefit Calculation | |

|---|---|

| Multiply net income by 30% | $1,106 net monthly income x 0.3 = 331.8 |

| Subtract 30% of net income from the maximum allotment for the household size | $835 maximum allotment for 4-person household $332 = $503, SNAP Allotment for a full month |

Being Approved For Food Stamp Benefits

When you are found eligible for SNAP benefits, you will receive an Electronic Benefit Transfer card. Your benefits are automatically loaded onto the card each month. The card will work like a debit card with funds deducted from the account with each purchase. The card can only be used at stores that are approved to accept them.

Don’t Miss: How To Apply For Illinois Food Stamps

Can I Get Food Stamps If I Am On The Gi Bill

Military veterans and others who are taking advantage of the GI Bill program are sometimes curious if GI Bill money or BAH income is counted towards the income requirements for SNAP. The answer is yes, BAH income is typically counted towards your gross income when determining if you are eligible for food stamps. As such, your GI Bill benefits do contribute to your income, even though that income is temporary and not taxed. Receiving BAH does not stop you from being eligible for food stamps outright, it is just included in the income calculation.

SNAP Overview

The federal food stamp program is now called the Supplemental Nutrition Assistance Program . SNAP is the largest domestic program available to nutritional assistance, and it is available for low-income individuals and families that meet the eligibility requirements. The federal food and nutrition service works with a wide range of other organizations including state agencies, nutrition educators, and neighborhood organizations to provide SNAP recipients with nutrition assistance and information.

The local agencies provide aid for people while they are going through the application process, and once people are approved, these agencies help them to access their benefits. The goal of this program is to provide monetary assistance with food while the members of the household are actively looking for work or working in positions that do not pay enough to cover food and living costs.

Benefits

Example of Benefits Allotment

Deductions To Gross Income

The Alabama Department of Human Resources makes certain deductions from gross income to arrive at the household’s net income. The standard deduction ranges from a minimum of $142 for households with one to three members to a maximum of $205 for households with six or more people. The earned income deduction is for those who derive income from a job and is 20 percent of the monthly gross earned income. If the income is from self-employment, that income is subject to a 40 percent deduction as a cost-of-business deduction. Households with disabled or elderly members may receive a deduction for out-of-pocket medical expenses if such expenses exceed $35 monthly. Childcare expenses and court-ordered child-support payments may be deductible as well. The costs of maintaining a residence, such as rent or mortgage payments, utilities, homeowner’s insurance and property taxes, may also be allowable deductions.

You May Like: Does Shipt Use Ebt

How To Calculate Net Income

Now that you have your households monthly gross income, you can use that number to calculate your net income. Use the chart below to calculate your monthly net income and determine if your household is eligible for Florida SNAP EBT benefits.

Please not that there may be exceptions to the net income calculation. These exceptions apply to household members that are elderly or disabled. For more information or immediate help, in your county.

| How to Calculate SNAP Net Income | |

| Net Income Calculation: | |

| Determine if shelter costs are more than half of adjusted income | $700 total shelter $602 = $98 excess shelter cost |

| Subtract excess amount, but not more than the limit, from adjusted income | $1,204 $98 = $1,106 net monthly income |

| Apply the net income test | Since $1,106 is less than $2,209 allowed for a 4-person household, this household has met the income test. |

What Time Is Calfresh Ebt Deposited In California

Generally, your EBT payment is available at midnight on your payment date.

In the state of California, Food Stamps Benefits are deposited on EBT Cards over the first 10 days of every month. When your food stamps benefit is deposited on your EBT Card depends on the last digit of your case number. Here is the schedule of payment based on the last digit of your case number:

| If your Case Number ends in | Benefits are deposited on the |

| 1 |

Here are the most frequently asked California Food Stamps questions.

Also Check: Ebt-acs Alabama

Food Stamp Income Limit In Ga In 2021

Household size is one of the biggest determining factors for income limits for SNAP participants. You can earn anywhere from $16,744 to $58,058 as maximum income per year, depending on the household size. That income range covers households of between one and eight people.

For example, if you live with a spouse, you can earn a total of $22,646. But if you and your spouse have two kids, the maximum income limit could go up to $34,450.

Beyond the eight-person limit, you are allowed to increase your maximum household income by $5,902 per person per year. So, for example, if there are nine members in your household, all of you can earn a total of $63,960 and still qualify for Georgia food stamps.

In addition, you can also get away with having additional resources beyond your food stamp income limit in GA in 2021 and still stay within SNAP. Currently, the acceptable countable resources limits stand at:

- Under $2,001 in both your savings and checking accounts

- Under $3,001 in both your savings and checking accounts if you live with one or more persons over 60 years old or someone with a disability

Remember, you are allowed to deduct some expenses to bring down your maximum income. These include legally owed child support, medical expenses for the elderly, educational expenses and so on. It would be wise of you to take advantage of these deductions to increase the SNAP benefits you could get.

What Is The Food Stamp Income Limit In Texas

In this guide, I will explain what the food stamp income limit is in Texas.

In order to qualify for SNAP benefits, you must fall below certain income guidelines. Texas food stamps are only available to low-income families and the income qualification is based on specific income guidelines.

How much money your household can make will be determined by the number of people living with you

Essentially the more people that you have to feed each month, the greater your earnings can be.

In this article, we will break down what the Texas SNAP income limit is according to household size.

Also Check: How To Sign Up For Food Stamps In Illinois

Oregon Raised Income Threshold

State assistance for food and child care costs has increased to about 18,000 additional Oregon families. A family earning up to 200 percent of the federal poverty level is now eligible for both programs, effective January 1. Formerly, the cap was set at 185 percent of the federal poverty level. In other words, people making up to $2,147 a month are qualified for both programs now, as per Oregon Live.

As a result, Oregonians will receive an additional $25 million per year in food assistance benefits. ODHS Director Fariborz Pakseresht noted that many Oregonians particularly those of color, members of Oregons tribal nations, disabled people, and the elderly had it tough before the COVID-19 pandemic. Thousands of Oregonians will benefit from this increase in food assistance.

Eligibility Test : Assets Calculation

The asset test is the final test you must pass.

Assets in your family must be below certain limits. A household without a member who has a disability or is elderly must have assets of $ 2,250 or less. The assets of a household with an elderly or disabled person must be less than $3,500.

For food stamps, what constitutes property?

In general, assets include assets that might be available to buy food at home, such as money in a bank account.

Household assets, personal assets, and retirement savings are not included in this calculation. Automobiles are also excluded. Individual states have the option of relaxing asset limits. A number of them have done so. For more information about asset requirements in your state, contact the food stamp agency.

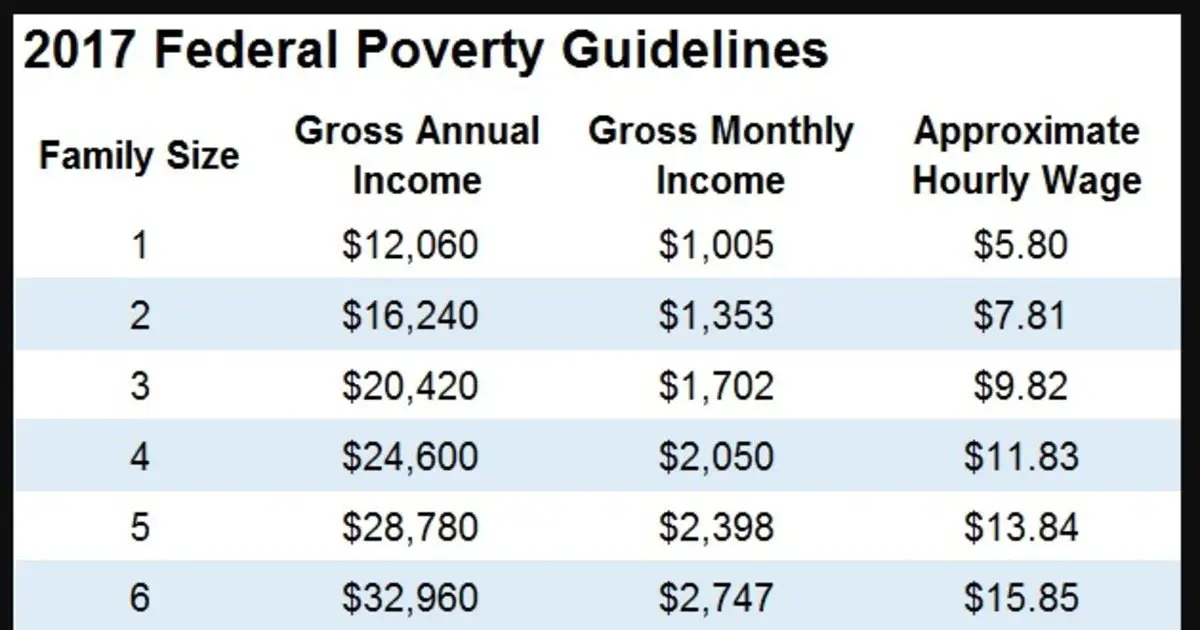

According to the Department of Health and Human Services , the food stamp income limit is determined by a percentage of the National Poverty Guidelines. Here is a list of the most recent poverty guidelines followed by the full food stamp income limit.

Recommended Reading: Food Stamps Tulsa Ok