Notice Of Eligibility For Pause On Utility Disconnections

Under Virginia General Assembly law, Virginia customers who received TANF, SNAP, or WIC anytime between January 2019 – July 31, 2021 may qualify to avoid Dominion Energy disconnection.

Click here to learn more.

Supplemental Nutrition Assistance Program can be used like cash to buy eligible food items from authorized retailers.Authorized retailers will display either the Quest logo or a picture of a Virginia EBT card.

A SNAP account is established for eligible households and automatic deposits are made into the account each month. To access the account, they will also receive an EBT Card, which will debit the account each time eligible food items are purchased. A secret Personal Identification Number is required to use the card.

Florida Food Stamps Income Limit Questions

We hope our post on the Florida Food Stamps Income Limit for 2021-2022 was helpful to you! If you need additional help determining your eligibility for food stamps or submitting your application for Florida SNAP, please let us know in the comments section below.

If you found this article helpful, we encourage you to please share it with someone using the Share this button below.

In the meantime, be sure to check out our other articles on Florida SNAP EBT:

Apply For Food Stamp Benefits

If you have determined that your income is eligible to receive SNAP EBT benefits in your state, you are ready to submit your application for benefits.

There are three ways to apply for food stamps online, in-person, or by mail. To find out how to apply for food stamp benefits in your state, .

To apply for SNAP EBT benefits in-person at your local office or by mail, .

Please note, that when you apply for benefits, you have to visit your state specific website to submit an application. If you have questions about applying for food stamps, please let us know in the comments section below.

Also Check: Ky Snap Application

Don’t Miss: Oregon Food Stamps Income Limits 2020

How To Calculate Net Income

Now that you have your households monthly gross income, you can use that number to calculate your net income. Use the chart below to calculate your monthly net income and determine if your household is eligible for Florida SNAP EBT benefits.

Please not that there may be exceptions to the net income calculation. These exceptions apply to household members that are elderly or disabled. For more information or immediate help, in your county.

| How to Calculate SNAP Net Income | |

| Net Income Calculation: | |

| Determine if shelter costs are more than half of adjusted income | $700 total shelter $602 = $98 excess shelter cost |

| Subtract excess amount, but not more than the limit, from adjusted income | $1,204 $98 = $1,106 net monthly income |

| Apply the net income test | Since $1,106 is less than $2,209 allowed for a 4-person household, this household has met the income test. |

Does Snap Check Your Bank Account

Your Department of Social Services or food stamp issuing office may request current bank statements as part of the application process. The Federal Government requires verification of citizenship, income, Social Security numbers and other qualifying information additional verification is a state option.

Read Also: Alabama Food Stamp Income Limits 2020

Eligibility Test : Gross Monthly Income Of An Individual Or Family

To qualify for Food Stamp benefits, you must first meet the gross income requirement.

What Is Considered Low Income In Missouri

You must be considered low income. Your household assets cannot exceed $2,250. Some assets, like the home where you live, your cars, prepaid burial plots, non-income producing property, etc, are not counted towards your asset limits. If everyone in your household is above the age of 60, then the limit is $3,500.

Don’t Miss: Waco Medicaid Office

How Is Your Snap Benefit Calculated

How much could I receive in SNAP benefits? Because SNAP households are expected to spend about 30 percent of their own resources on food, your allotment is calculated by multiplying your households net monthly income by 0.3, and subtracting the result from the maximum monthly allotment for your household size.

Snap Allowable Expenses & Deductions For 2021

To calculate your net monthly income, you are asked to subtract approved household expenses from your gross income.

The expenses that can be deducted from your gross income include:

- 20% deduction from Earned Income

- Standard deduction of $177 for households with 1 to 3 people and $184 for households with 4 or more people

- Dependent care deduction when needed for work, training, or education

- A deduction for elderly or disabled members medical expenses that exceed $35 a month

- Any legally owed child support payments can be deducted

- Homeless Households shelter costs deduction of $159.73.

- A deduction for excess shelter costs that exceed more than half of the households income .

Read Also: Beaumont Food Stamp Office

Also Check: How To File For Food Stamps In Washington State

Snap Resources And Income Limits

SNAP benefits require households to meet tests that measure resources and income. Some of these changed temporarily or were waived during the coronavirus pandemic, so check with your state to make sure what the current standards are. For the 48 contiguous states and the District of Columbia, the requirements are:

Income Limits For Food Stamps In Usa

The following post will explain what the income limits for food stamps are and how to successfully apply for them. The following information will be covered in this article about the food stamp income limit:

- Do you know what food stamps are?

- Who can get food stamps?

- Is there a minimum income requirement to receive food stamps?

- Food stamp income limit

- What number of food stamps will I get?

- Elderly and disabled special rules

- about applying for food stamps

- What happens when I apply for a food stamp?

- Emergency Food Stamps

Read Also: Beaumont Food Stamp Office

Income Limit For Food Stamps Tn

When you apply for food stamps in tennessee the person assigned to your case called a caseworker applies federal guidelines to your circumstances to see if you qualify for help. Food stamp rules allow income deductions including a 20 deduction on earnings a standard deduction given to all households dependent care expenses incurred a shelter utility deduction for a non special household not to exceed 586 and.

Travel Planner Travel Journal Travel Printable Daily Planner Digital Planner Trip Planner Vacation Itinerary Travel Planning Travel Itinerary Template Travel Journal Printables Travel Printables

Recommended Reading: Food Stamp Office In Conroe Tx

Will Ssi Recipients Receive Stimulus Check

A person whose sole source of income is SSI is not eligible to receive a stimulus payment, but many SSI recipients who have at least $3,000 in other annual income, such as Social Security benefits, are eligible to receive the payments. However, an income tax return must be filed in order to receive a stimulus payment.

Also Check: 13838 Buffalo Speedway

Read Also: Apply For Food Stamps Lexington Ky

Minimum Wage And Poverty In Missouri

Some evidence suggests that the minimum wage regulations might also be a contributing factor to poverty levels in Missouri.

At the time of writing, the minimum wage in Missouri stands at $8.60 per hour.

But according to the Massachusetts Institute of Technology living wage calculator, that number needs to be higher to address poverty in the state.

The MIT âliving wage calculatorâ calculates the amount people would need to earn per hour to make a living wage in Missouri. They calculate their âliving wageâ numbers based on the assumption that someone works 40 hours per week.

âLiving wageâ is defined as an income that is adequate enough to provide for oneâs basic needs in Missouri at a reasonable level.

Here are some examples of what would be an adequate wage in Missouri, according to MIT.

- 1 adult with no children $11.16

- 1 adult with 1 child $22.86

- 2 adults with no children $18.42

- 2 adults with 1 child $22.57

- 2 adults with 1 child $12.77

- 2 adults with 2 children $14.97

As we can see, in each scenario, MIT suggests that the necessary living wages are higher than the current minimum wage of $8.60.

Also, we should note that the recommended wages are per working adult, and not combined for the entire household.

Now that weâve explored some of the factors that are driving poverty in Missouri, letâs take a look at how it affects specific areas of life, such as food, healthcare, and housing.

Food insecurity in Missouri

- Overeating unhealthy foods

Screening For Eligibility & Applying

-

- Option 2: Bypass eligibility screening and submit an application manually. Fill out an “Application for Benefits” from the forms section on this page and return it to your local department of social services.

Please note the following:

- The USDA has temporarily expanded SNAPeligibility for students enrolled at least part-time in a higher education institution.

- A manual application cannot be processed and is not considered complete until it is signed and received by your local department.

- An interview will be required unless you meet the conditions for a waiver.Proof of identity , residence, income, resource and shelter expenses will be required.

- Applications for Temporary Assistance for Needy Families or General Relief, are considered an application for SNAP, unless you request otherwise.

- If all members have applied for or get Supplemental Security Income , you may also apply for SNAP at the local Social Security office.

Recommended Reading: Oregon Food Stamps Income Limits 2020

Supplemental Nutrition Assistance Program

You can help them!online screeningonline screeningnot

- You must live in Virginia

- You must be a U.S. citizen or meet certain requirements if you are an immigrant

- You must apply at the agency serving the city or county in which you live

- You must meet the specific requirements of each program for which you are applying

*** Christmas Recipes ***

Italian sausage and a heap of Parmesan cheese lend signature flair to the easy Thanksgiving dressing…

A classic dry martini cocktail made with gin and vermouth and stirred with ice.

It’s all about the layers and ruffles in this dramatic seasonal pie.

As with hot chocolate, use any milky liquid you prefer, whether it’s from a cow, nuts ,…

This is the dramatic seafood paella that looks stunning, with crustaceans and shellfish. You can vary…

Alton Brown’s turkey brine recipe from Good Eats will give you a flavorful Thanksgiving turkey with juicy…

Bone-in turkey breasts are easy to find, and as impressive as a whole bird when you roast them in butter…

Make and share this Basic All Purpose Brine for Meats, Chicken, and Turkey recipe from Food.com.

Cutting leeks into large pieces gives them a presence equal…

Poach quince in rosé with a dash of cocktail bitters and a few warm spices, then assemble into a tart…

It takes a day or two for the peel to dry, so plan ahead perfect Candied Orange Peels

The killer combination of coconut, almonds, and milk chocolate makes for a delectable candy bar. One…

A whole roasted duck doesn’t have to be fussy. With just a few hours’ roasting and hardly any work at…

This recipe is from Eben Freeman, bartender of Tailor Restaurant in New York City. The drink tastes best…

When Beatrice Ojakangas published *The Great Scandinavian Baking Book* in 1988, she won a lot of fans-including…

Recommended Reading: Applying For Food Stamps In Texas Online

Does A Car Payment Affect Food Stamps

When you register for your SNAP benefits, your caseworker will determine your qualifications based on your earnings, your household members, and the number of cashable assets, according to USDA. An asset that is considered cashable includes cars that members of the household owns. Although USDA sets the principles and guidelines for the worth of the asset, states are given the liberty to essentially determine to either execute these regulations or disregard them.

According to USDAâs vehicle policy, up to approximately $4,650 of a vehicleâs value is excluded from assets. For example, this means that if your vehicleâs worth is $5,000, only $350 of that total is considered to be a resource.

Yet there have been some instances where the vehicle’s entire worth has been exempt, including if you use the vehicle to reside in if the car is used to help make money, if you use it to transfer a disabled family member, or if the equity value is $1,500 or less.

However, many states exclude cars as an asset. According to World Work, they exempt vehicles as a resource regardless of what the household uses it for or what it worths. States that have total exemption include Alabama, California, Connecticut, Mississippi, and New Jersey.

Food Stamp Benefits To Increase By Largest Amount In History Starting October 1

by: Nathan Crawford, Associated Press

RICHMOND, Va. Starting October 1, the average benefits for food stamps officially known as the Supplemental Nutrition Assistance Program will increase for recipients across the Commonwealth.

The permanent increase in benefits is the largest single increase in the programs history. The average benefits for food stamps will rise more than 25% above pre-pandemic levels.

No one in Virginia should ever go hungry. This long-overdue change to the Thrifty Food Plan means that over 760,000 Virginians can better afford nutritious meals, said VDSS Commissioner S. Duke Storen. Food insecurity has spiked to frightening levels during the pandemic, and every opportunity to provide meals and more financial resources to low-income families must be taken. USDA has done their part by increasing SNAP benefits, and now we must all work together to make sure every eligible household participates in SNAP and that we implement all the strategies in the Commonwealths Roadmap to End Hunger.

The increase follows a recent update to the Thrifty Food Plan methodology by the United States Department of Agriculture . This is the first increase since 1975.

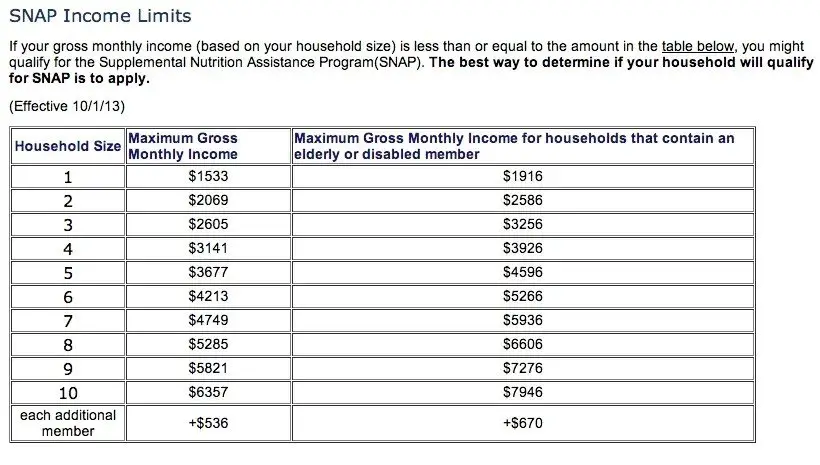

Starting October 1, the new income limits are:

Previously, officials released emergency allotments of benefits to eligible families. The benefits were automatically be loaded to recipients Electronic Benefits Transfer cards.

You May Like: Why Do I Only Get $16 Food Stamps

Food Stamp Income Requirements

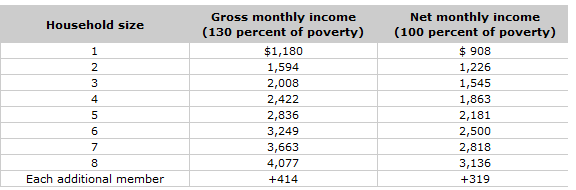

The SNAP program has eligibility standards for both gross and net monthly income. Most people will need to fit within both the gross and net income guidelines in order to be eligible. Exceptions to this include the elderly. For households including at least one person over the age of 60, only the net income standard is applied. Another exception is those receiving TANF and SSI.

The table below shows the maximum gross and net monthly income based on family size for SNAP eligibility. The gross income is the income you make prior to any deductions. Net income is after deductions. The only exceptions to the chart below are Alaska and Hawaii, which have higher income limits due to the significant increase in cost of living.

| Household Size |

|---|

| +$347 |