To Get Snap You Need To:

- Apply online, by paper application, by phone or or in person when our lobbies reopen. Currently, they are closed for safety due to COVID-19.

- Meet eligibility requirements

- Provide the required documentation. A verification checklist can also be found here.

- Have an interview with DHS staff *

* Due to the pandemic, the federal government has allowed required in-person interviews to happen over the phone. DHS is also allowed to postpone interviews for SNAP applicants who are eligible on an expedited timeline and offers the flexibility to skip the interview entirely if DHS has all the information necessary to make an eligibility decision.

You may have another person act as an authorized representative by applying and being interviewed on your behalf by designating an authorized representative in writing.

To receive SNAP benefits, you must apply in the State in which you currently live. Learn more about your rights and responsibilities here.

Does A Car Payment Affect Food Stamps

When you register for your SNAP benefits, your caseworker will determine your qualifications based on your earnings, your household members, and the number of cashable assets, according to USDA. An asset that is considered cashable includes cars that members of the household owns. Although USDA sets the principles and guidelines for the worth of the asset, states are given the liberty to essentially determine to either execute these regulations or disregard them.

According to USDAâs vehicle policy, up to approximately $4,650 of a vehicleâs value is excluded from assets. For example, this means that if your vehicleâs worth is $5,000, only $350 of that total is considered to be a resource.

Yet there have been some instances where the vehicle’s entire worth has been exempt, including if you use the vehicle to reside in if the car is used to help make money, if you use it to transfer a disabled family member, or if the equity value is $1,500 or less.

However, many states exclude cars as an asset. According to World Work, they exempt vehicles as a resource regardless of what the household uses it for or what it worths. States that have total exemption include Alabama, California, Connecticut, Mississippi, and New Jersey.

Costs Of Shelter For Homeless Households

This deduction applies to your household if all members in your household are homeless and reside in a homeless shelter or with another individual who acquires, reasonably awaits to acquire shelter or expenses for utility are qualified for the standard shelter/utility deduction.

Yet not all states will offer this deduction, so it is important that if you are homeless you notify your caseworkers when you apply for SNAP benefits.

Recommended Reading: Food Stamps In Colorado Springs

Will Snap Benefits Increase In 2021

The U.S. Department of Agriculture announced Monday, March 22, a 15 percent increase in Supplemental Nutrition Assistance Program benefits through September 2021. The increase will provide an estimated $3.5 billion to households experiencing food insecurity during the COVID-19 pandemic, the department said.

What If I Do Not Provide The Required Documents

If you do not provide proof of residency and income, DSS will send you a denial letter outlining why your application wasdenied.

If you receive a denial letter due to missing documents, you can still submit the missing documents, but theymust be submitted within 60 days from the date you submitted your application.

If you fail to submit the missing documents within the 60 day period, your application will be denied and you must re-apply for SNAP benefits.

You May Like: Ebt Application San Diego

Eligibility Test : Gross Monthly Income Of An Individual Or Family

To qualify for Food Stamp benefits, you must first meet the gross income requirement.

Food Stamp Income Requirements

The SNAP program has eligibility standards for both gross and net monthly income. Most people will need to fit within both the gross and net income guidelines in order to be eligible. Exceptions to this include the elderly. For households including at least one person over the age of 60, only the net income standard is applied. Another exception is those receiving TANF and SSI.

The table below shows the maximum gross and net monthly income based on family size for SNAP eligibility. The gross income is the income you make prior to any deductions. Net income is after deductions. The only exceptions to the chart below are Alaska and Hawaii, which have higher income limits due to the significant increase in cost of living.

| Household Size |

|---|

| +$347 |

Also Check: Www.azdes.gov Renewal Application

How To Calculate Your Gross Income

The gross income for your household is the total income earned before taxes have been taken out. I

f you are applying for New York food stamp benefits, you must determine your gross monthly income to see if you qualify.

Step 1

Determine your Household Size

A household is a group of people who regularly buy and eat food together. The people in a household do not have to be related to each other.

- Households can be as small as one person

- The same address can have more than one household

- You dont need to have a home to receive food stamps

Step 2

Gather your Monthly Earned Income

Earned income is any countable income you have earned within a given one-month period before taxes. For the New York food stamps income limit, earned income includes any of the following:

- Wages or salaries earned from a job

- Earnings from self-employment

- Income made from renters, roommates, or boarders

- Any income from rental property

- Social Security payments

Step 3

Add your Earned Income to Calculate Gross Monthly Income

Once you have determined all your sources of earned income, add them all together. This will give you your total gross monthly income for your household.

Step 4

Determine if your Gross Monthly Income is Eligible

Now that you have your gross monthly income, you can see if your income is eligible for New York food stamp benefits. Use the chart and follow the steps below to determine your eligibility.

| Household size | |

| $737 | $360 |

How Long Before The Snap Benefits Office Make Its Decision

The food stamp office must make a decision on your application within 30 days of the date you submit it.

They will usually issue SNAP benefits going back to the date of your application.

However, if you or someone in your household causes a delay, your application can be held open another 30 days.

In this case, you will not get back benefits. If you delay completing the application for more than 60 days, your application can be denied.

You May Like: Alabama Food Stamp Income Limits 2020

What Is The Maximum Income To Qualify For Food Stamps

If you want to be eligible for food stamps benefits, there is a limit to how high your income can be before you are not able to qualify for the benefits. Yet what exactly qualifies as an income?

According to USDA, SNAP includes cash earnings from an accumulation of the sources. The two main sources that SNAP count as income are:

â Income that you earned

â The income you did not earn

In essence, to be qualified for food stamps benefits, the total amount of your household income must be below a certain number. This means once you determine the sum of your income in regards to both earned and unearned income, it must be below a specific number.

This certain number all depends on the total amount of people living in your household. To qualify for SNAP benefit, your maximum total income per month should be 130% of the federal poverty level.

Here is a list of approximate income limits to be eligible for food stamps, according to In Charge:

â 1 household member: $1,287 $990

â 2 household members: $1,736 $1,335

â 3 household members: $2,184 $1,680

â 4 household members: $2,633 $2,025

â 5 household members: $3,081 $2,370

â 6 household members: $3,530 $2,715

â 7 household members: $3,980 $3,061

â 8 household members: $4,430 $3,407

â Every additional member: Add $451 to the gross and $347 to the net

Are My Child/children Eligible For P

Children who receive free school lunches through the National School Lunch Program are eligible for P-EBT food benefits if their school has been operating with reduced in-person attendance due to COVID-19 during the 2020-21 school year.

In the state of New York, this includes children who attend Community Eligibility Provision schools and any private, prekindergarten, parochial, and charter schools that participate in the National School Lunch Program.

You do not need to apply for P-EBT food benefits. P-EBT food benefits will automatically be issued to eligible children.

You May Like: Okdhs Food Stamps Application

Notice: Snap Benefits Are Increasing

The U.S. Department of Agriculture has revised the Thrifty Food Plan to account for modern costs associated with the standard American diet. SNAP households will see an increased amount of your regular, non-pandemic benefits beginning Oct. 1.

El Departamento de Agricultura de Estados Unidos ha revisado el plan de Thrifty Food para incluir la subida del coste actual asociado con la dieta estándar Americana. Su familia recibirá un aumento en sus beneficios regulares determinados por niveles antes de la pandemia comenzando el 1 de Octubre del 2021.

About the Supplemental Nutrition Assistance Program

The Supplemental Nutrition Assistance Program helps low-income households in Colorado purchase food. It provides a monthly benefit that helps families and individuals buy the food they need for good health.

The benefit is provided based on income, resources and the number of individuals in the household. Electronic Benefit Transfer cards are used to receive the benefit and can be used similar to debit cards at participating food stores. The benefit can be doubled in value by shopping at participating markets and food stores that support the Double Up Food Bucks program.

SNAP is part of a federal nutrition program to help low-income households purchase food. County human services departments are responsible for determining eligibility and authorizing SNAP.

What you need to know

Legally Owed Child Support Payments

This reduction in child support you are legally obliged to pay for children who do not live in your household, which is not counted under the gross income test and thus a deduction in figuring out your net income.

Your payments for child support is only not countable if you have an administrative order, court order, or any other enforceable legal separation contract of agreement that states that you must pay this amount of money.

If you pass the gross income test, in addition to paying the child support from your earned income, the amount you have compensated will be added back into the sum of your earnings for an increase in your allowed 20% income.

You May Like: Apply For Food Stamps In Oklahoma City

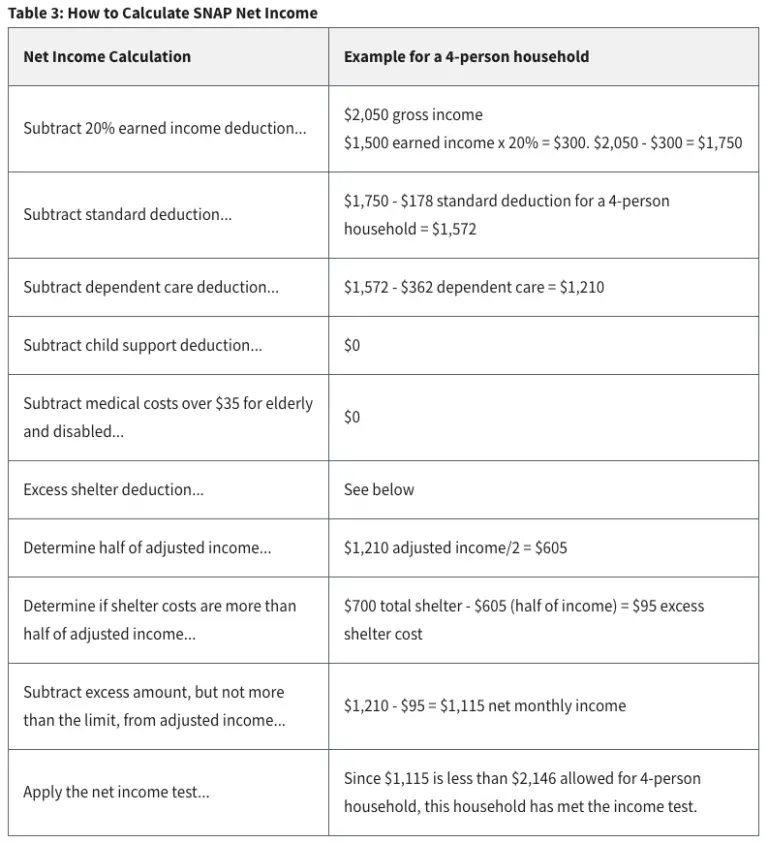

What Deductions Are Allowed For Net Income In Food Stamp

- Earned income is deducted at a rate of 20 percent.

- For households of 1 to 3 people, the standard deduction is $ 167 and for households of 4 people, it is $ 178 .

- Expenses relating to child care or other dependents that a household member must incur so that they can work or attend school

- In the absence of insurance or another payment source, medical expenses in excess of $ 35 per month for elderly or disabled members.

- A household member pays child support for any legal obligations he or she has.

- Standard deduction for homeless families is $ 152.06 in some states.

- See below for housing costs in excess of the standard deduction.

Determining Eligibility For Food Stamps

To qualify for your SNAP benefits, your household must meet certain prerequisites and requirements. Yet what exactly qualifies as a household?

A household includes all those who reside with you, purchases, and prepares food with you. When considering resources and income, it is the sum of all the members of your household, not just the head of the household.

Under federal guidelines to be eligible for food stamps, a householdâs resources and earnings must essentially meet these three requirements, according to the Social Security Administration:

You May Like: Oregon Food Stamp Income Limits

What Income Is Not Counted For Snap

When caseworkers determine your eligibility, one important thing they will look at is your household monthly income. Your household monthly income plays a big part in deciding if you are qualified for the benefits, and also the number of food stamps benefits you will be qualified for. This means income will certainly depend on the number of members of your household, and you will have to provide information about them.

According to Mass Legal Help, not all income will count towards your SNAP benefits. Some of the income that does not count for SNAP from Mass Legal Help may include:

â VISTA, Youthbuild, and AmeriCorps allowances, earnings, or fees for individuals that are, in any other case, eligible.

â Earnings of a kid under the age of 18 who are attending secondary college at least half of the time.

â Lump-sum bills â together with inheritances, tax credits, damage awards, one-time severance pay, or different one-time payments

â Reimbursements â the amount of money you get back to pay again for costs, such as schooling-associated costs and medical costs

â Senior Community Service Employment Program stipends paid to older employees doing community service jobs part-time

â Anything you do not receive as cash, including free housing or food, or expenses that are paid straight to a landlord or utility company made by a relative, friend or agency that has no legal obligation to do so

â Up to $300 in three months from private charities

Snap Resources And Income Limits

SNAP benefits require households to meet tests that measure resources and income. Some of these changed temporarily or were waived during the coronavirus pandemic, so check with your state to make sure what the current standards are. For the 48 contiguous states and the District of Columbia, the requirements are:

Recommended Reading: Does Heb Curbside Accept Food Stamps

Can I Get Food Stamps If I Am On The Gi Bill

Military veterans and others who are taking advantage of the GI Bill program are sometimes curious if GI Bill money or BAH income is counted towards the income requirements for SNAP. The answer is yes, BAH income is typically counted towards your gross income when determining if you are eligible for food stamps. As such, your GI Bill benefits do contribute to your income, even though that income is temporary and not taxed. Receiving BAH does not stop you from being eligible for food stamps outright, it is just included in the income calculation.

SNAP Overview

The federal food stamp program is now called the Supplemental Nutrition Assistance Program . SNAP is the largest domestic program available to nutritional assistance, and it is available for low-income individuals and families that meet the eligibility requirements. The federal food and nutrition service works with a wide range of other organizations including state agencies, nutrition educators, and neighborhood organizations to provide SNAP recipients with nutrition assistance and information.

The local agencies provide aid for people while they are going through the application process, and once people are approved, these agencies help them to access their benefits. The goal of this program is to provide monetary assistance with food while the members of the household are actively looking for work or working in positions that do not pay enough to cover food and living costs.

Benefits

Example of Benefits Allotment