Tax Counseling For The Elderly #

What is it?

TCE is an IRS-run program that offers free tax help for people 60 and older.

Am I eligible?

If youre 60 or older, youre eligible!

Ok, Im in! Whats next?

What to bring:This IRS checklist explains everything you need to bring with you to a TCE center.

Where to go:This IRS locator can help you find a TCE site near you.

What Are The Income Limits For Food Stamps

In order to be eligible for food stamps, you must have an annual household income that is below a certain threshold. The specific income limit varies depending on the size of your household, but in general, the larger your household, the higher the income limit. For example, a family of four can have a household income of up to $32,640 in order to be eligible for food stamps.

Learn About The Types Of Food You Can Buy With Snap Benefits

If youre eligible, you can purchase food using benefits that are issued to you monthly. You can use your SNAP benefits to buy a variety of foods for your household, including:

- Fruits and vegetables

See the United States Department of Agriculture’s list of foods and products you can buy using SNAP benefits.

Don’t Miss: Can You Use Food Stamps At Sams

Food Stamps And Meal Programs During The Covid

Because of the COVID-19 pandemic, it may be easier for you and your family to get food stamps and take part in meal programs. Contact your state’s social services agency to see if you’re eligible.

During the pandemic:

-

Food stamp recipients may receive additional funding. More people may be eligible to receive SNAP during the pandemic than normally.

-

Parents whose kids’ schools are closed can pick up school meals for their kids to eat at home.

-

People can enroll in food programs remotely rather than in person. This applies to programs for pregnancy, families, seniors, and people with disabilities.

Do I Have To Tell Dta I Got A Tax Refund Or Earned Income Tax Credit

To be safe, report your tax refund or EITC/EIC to the Department of Transitional Assistance . If you do not report a tax refund or EITC/EIC, you may have problems with DTA. The Department of Revenue shares tax information with DTA.

In most cases, your tax refund or EITC/EIC will not hurt your SNAP and TAFDC benefits.

Don’t Miss: Check Ebt Balance Nj Phone Number

Who Can Qualify For Food Stamp Or Snap

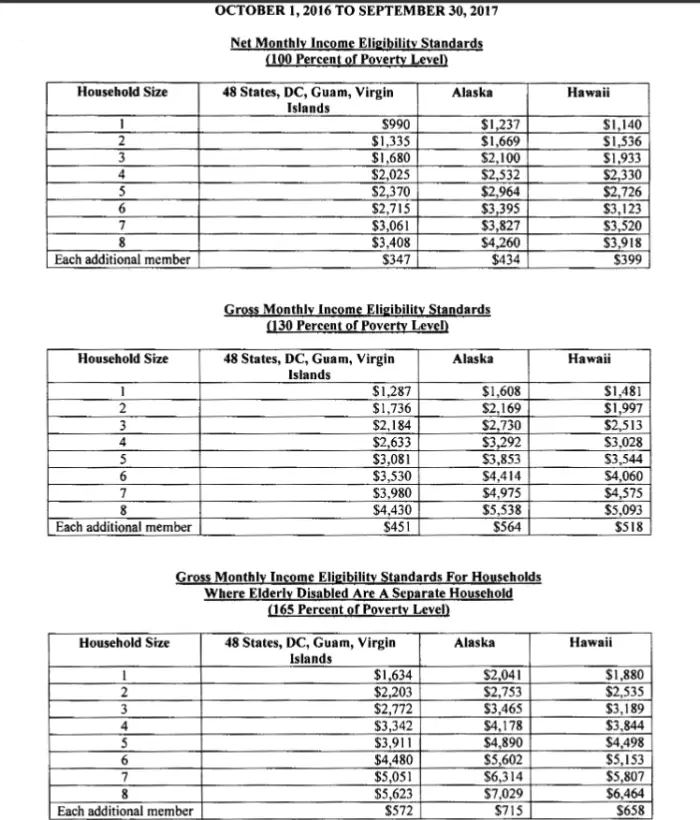

Food stamps are available to most families and individuals who meet the income guidelines. The table showing income limits can be found below.

- It depends on your household income and certain expenses how much food stamps you can receive.

- If your child is under 21 and lives with your parents, you must apply together.

- Citizens and eligible non-citizens of the United States are eligible to apply.

- In order to receive food benefits, recipients of TANF, GA, or SSI must meet no income requirements.

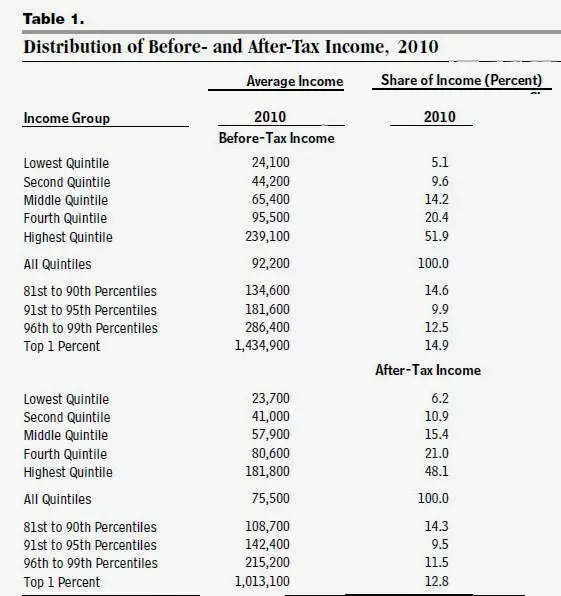

Reviewing Government Benefits And Taxation

According to the Internal Revenue Service, food stamps and public assistance are not taxable and will not affect your tax return. Keep in mind that public assistance is not the same as unemployment insurance or social security both unemployment insurance and social security income are taxable income and are not defined as cash aid. If you are eligible for food stamps, you should strongly consider filing your tax return, because you are likely to get a refund on your income taxes — and not filing may result in the loss of the refund, in addition to penalties.

Everyone in your house who buys and prepares food together may be eligible for food stamps under some basic conditions. Everyone must have a social security number and be a resident or national of the United States. Aboriginals who were born in Canada or Mexico also qualify. Others may qualify as well contact your local aid office to discuss the requirements. Recipients must register for work or participate in an approved employment training program. Some college students may be eligible as well.

Read Also: What’s The Income Limit For Food Stamps

Will We Get Extra Food Stamps In September 2021

As part of the Food Stamps Emergency Allotment that was approved as part of the stimulus bill in March 2021, food stamps beneficiaries were approved for extra benefits through September 2021. Effective April 2021, all CalFresh households will receive a minimum EA of $95 per month in food stamps benefits.

Learn More About The Wic Program

Your agency may not have enough money to serve everyone who needs WIC. In that case, it will maintain a waiting list and use a priority system to decide who will get WIC benefits first.

For more information and help applying, contact your state or local WIC agency. You can also call its toll-free number.

Don’t Miss: How Do I Renew My Food Stamps Online In Georgia

Struck By Ebt Fraud Thousands Of San Diego Food

Advocates have seen a growing number of fraud claims in recent months and are pressing policymakers to upgrade EBT card technology.

With more than 9 million cards issued, though, just 0.5% would still be a large number of victims 45,000, representing potential losses of $9 million to more than $47 million.

Given the size of the MCTR program, we anticipated the possibility of fraud, LePage said. FTB and Money Network take all fraud claims seriously and will investigate each claim reported on an individual basis. We will ensure recipients get the payments that theyre eligible for.

Here are some tips for protecting the money the state sent you, as well as what you should do if you think youve been victimized by scammers.

Will My Tax Refund Count Against My Tafdc

DTA counts your tax refund that is not EITC/EIC as an asset. An asset is savings in the bank or certain property you own. An asset limit is the amount of assets you can have and still qualify for TAFDC. The asset limit for TAFDC is $5,000. If you get a tax refund that is not EITC/EIC and you end up with more than $5,000, counting all your assets, your TAFDC will stop. You can apply again for TAFDC later, after your assets drop to $5,000 or less.

Example 1

Tim and his family get TAFDC. Tim gets a $2,500 tax refund that is not an EITC payment. The $2,500 counts as an asset right away. Tim does not have any other assets. He is not over the $5,000 asset limit, so the tax refund does not change his TAFDC.

Example 2

Lilly and her children get TAFDC. Lilly gets a tax refund that is not EITC money. Lillys tax refund is $5,000. Lilly already has $600 in savings when she gets the refund. Once she gets the refund, she has $5,600. This is more than the $5,000 asset limit for TAFDC, so Lillys TAFDC benefits stop. Lilly can apply again for TAFDC later, once her assets drop to $5,000 or less.

You May Like: Apply For Food Stamps Online In Mississippi

Finding More About Food Programs

Whether or not you qualify for food stamp assistance depends on a variety of factors. Your assets, taxable income and the number of people in your household all affect eligibility. If your income is from social security or unemployment, that income is included. Food stamps aren’t the only type of assistance available. WIC, the Women, Infants and Children food program, assists mothers with infants and small children. The Emergency Food Assistance Program, TEFAP, distributes food through food pantries and soup kitchens.

How Do I Apply For Snap Benefits

*If you need help reading this information or communicating with us, ask us or call 1-877-423-4746. Our services, including interpreters, are free. If you are deaf, hard-of-hearing, deaf-blind or have difficulty speaking, you can call us at the number above by dialing 711 .

The Georgia Food Stamp Program , is a federally-funded program that provides monthly benefits to low-income households to help pay for the cost of food. A household may be one person living alone, a family, or several unrelated individuals cohabitating who routinely purchase and prepare meals together.

Review SNAP Benefits in Georgia

Read Also: Ebt Nyc Customer Service Number

Income Limits For Food Stamps In Usa

The following post will explain what the income limits for food stamps are and how to successfully apply for them. The following information will be covered in this article about the food stamp income limit:

- Do you know what food stamps are?

- Who can get food stamps?

- Is there a minimum income requirement to receive food stamps?

- Food stamp income limit

- What number of food stamps will I get?

- Elderly and disabled special rules

- about applying for food stamps

- What happens when I apply for a food stamp?

- Emergency Food Stamps

Do You Have To Count Food Stamps On Your Federal Return

Supplemental Nutrition Assistance Program or SNAP, more commonly known as food stamps, is a program of federal benefits provided by the United States Department of Agriculture that assists low-income families and the under-employed in affording nutritious food and basic household necessities. The program has been in operation since the 1960s, and currently serves more households than any other state or federal public-assistance program. However, anyone receiving food stamps should be aware of the tax treatment of these benefits by the Internal Revenue Service.

Tips

-

When completing your federal tax return, you do not need to report food stamps or any money received through TANF.

Also Check: What Can You Buy With Food Stamps In Nc

Other Types Of Help If Youre Homeless

Visit Benefits.gov to find out if youre eligible and how to apply for other types of help. This may include financial assistance, transportation, food, counseling, and more.

If you dont have medical insurance, you can use HRSA health centers. They give checkups, treatment when youre sick, pregnancy care, and immunizations for your children.

Who Is Eligible For Food Stamps

In order to be eligible for food stamps, you must meet certain income and asset guidelines. Households with incomes below 130% of the federal poverty level are typically eligible for food stamps. households with incomes between 130% and 185% of the federal poverty level may also be eligible for food stamps, depending on their household size.

You May Like: Does Trader Joes Take Food Stamps

Covid Relief Bill Increase

Under the recently passed $900 billion COVID relief bill, $13 billion of additional funding was allocated to the SNAP/Food stamp program, which increases the maximum benefits through the food assistance program through June 30, 2021. The main benefit, which was missing from the original stimulus bill, is an across-the-board 15% increase in monthly SNAP benefits for the next six months, starting January. 1st 2021. This will benefit approximately 43 million Americans receiving food stamps. The package also expands eligibility for SNAP benefits to lower income college students, while the elderly will see a boost in funding for the Older Americans Act nutrition programs .

With no new stimulus package currently approved by a divided Congress, the following are COVID SNAP adjustments still available:

Emergency Allotments : States can issue emergency supplements to SNAP households that normally receive less than the maximum benefit.

Pandemic EBT : States can provide benefits to children who normally receive free or reduced-price school meals.

SNAP Online Purchasing: The Food and Nutrition services department has rapidly expanded SNAP online purchasing to support social distancing, bringing access to nearly three-quarters of the states, covering 90% of SNAP households.

Additional funding has been provided under the CARE stimulus bill, that provides some critical program funding for many middle and lower income American families. Key provisions include:

Homeless Resources For Special Groups

These resources are geared toward specific audiences:

Veterans

- Homeless Veteran Resources from the Department of Veterans Affairs – Use these resources to find safe housing. Or explore opportunities to return to employment, find health care, or get mental health services.

Youth

- Housing programs and street outreach – Find stable, safe housing. You can also get education help, survival aid, counseling, crisis intervention, and follow-up support.

People With Mental Illness

- Projects for Assistance in Transition from Homelessness – Find help if you have a serious mental illness. The PATH program can assist you if youre homeless or at risk of homelessness.

Don’t Miss: Date Stamp For Food Packaging

Advance Child Tax Credit

Because of the COVID-19 pandemic, the CTC was expanded under the American Rescue Plan of 2021. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. When you file your 2021 tax return, you can claim the other half of the total CTC.

Learn more about the Advance Child Tax Credit.

How Can I Find Out Where To Apply For Snap

Probably, the quickest way is to apply for SNAP online at myBenefits.ny.gov or if you live in New York City. After your application is filed, the SNAP office will review your information, conduct an interview, and determine your household’s eligibility for SNAP.

You may also apply in person, by mail, or fax. To find the address and phone number of the SNAP office nearest you, call the toll-free New York State Temporary Assistance Hotline at 1-800-342-3009. By following the prompts on the automated caller response system, you can find the address and phone number of the SNAP office for where you live.

You can also choose the option to speak to an operator, and they will give you the information about the SNAP office for where you live. You may also find a listing for your county Department of Social Services in the blue pages of government office listings in your phone book. If you live in New York City, you should look for the listings of the Human Resources Administration. You may also visit the following websites: Local Departments of Social Services or New York City SNAP Centers.

Don’t Miss: Does Ibotta Work With Food Stamps

Thoughts On 2023 Monthly Food Stamp Benefit And Maximum Allotment Increase Again

Im 68 yrs old worked until I was 66 with bad back spasms for last 3 yrs of work but not qualif for being disabled now Im on social security of 1,800 a month which I know is a lot more then a lot of people but I also have a 800 a month mortgage 2,000 prop tax bill 300 a month electric bill living in New England and car insurance, water bill , only internet cant afford tv and I cant get any help because my social security is to much and 170 taken out for medicare part B which Im going to have to cancel soon and just not go to the doctor anymore I cant go back to work by back cant take it anymore, so I pay my bills set in pain and eat very little and Just to think I couldnt wait to retire, cant afford to go anywhere do anything and have about 20 left to buy food half way though the month

Its really disgraceful how they dont clearly explain that in many if not most states, for those over 60 or disabled, if their income is below 200% of the federal poverty level then they have no maximum asset limit for SNAP. As far as I know from researching it today, the only US state where thats clearly stated in plain English on their SNAP website is California. Because of that, I missed out on 7 years of SNAP and a $9.95 a month internet plan that I was paying full price for and lost around $7,500 or more in benefits over that time period, including the $250 minimum monthly benefit most single people got during the pandemic until I finally figured it out today.

How To Protect Yourself Against Fraud

The simplest way would have been to sign up for direct deposit from the FTB, so your Middle Class Tax Refund could have gone directly into your bank account. According to the board, about 7 million people received their money that way, compared with 9.1 million who have been issued debit cards.

But for people who already have cards, as well as the relatively small number still due to receive them, there are a few things you can do to reduce your risk:

- As the FTB says, do not disclose your card details unless speaking directly with Money Network or your bank, or making a purchase from a trusted seller. And remember, neither your bank nor the Money Network will ever ask you for your account password, your cards PIN or your full Social Security number.

Recommended Reading: Ny State Food Stamps Eligibility

Will Getting A Big Tax Refund Make Me Lose My Benefits

This year, you wont have to worry about losing your benefits if you get a big tax refund. Starting in 2011, any tax refunds you get will not affect most public benefits, or how much you get!

Under the law passed in December 2010:

Any Federal Tax Refund WILL NOT count as income in determining:

Eligibility or the Amount of Benefit you may get for any federally funded public benefit program. This includes state programs funded by federal money. So, if you get benefits under these programs, your tax refund will not be counted:

- TANF /ASPIRE /Parents as Scholars

- HUD and FmHA-subsidized housing

- Alternative Aid

- Emergency Family Assistance.

The General Assistance program, run by cities and towns, does not get federal money. So your tax refund may affect your eligibility for GA. We advise that you use your refund money for basic needs and keep a record of those expenses before applying for GA after getting a refund.

Learn more here: