How To Determine If You Qualify For Food Stamps In Georgia

Please enable JavaScript

The only problem with this is that it takes time and effort to apply for Georgia Food Stamps. You may spend hours filling out a Georgia SNAP application and gathering documents only to be denied benefits!

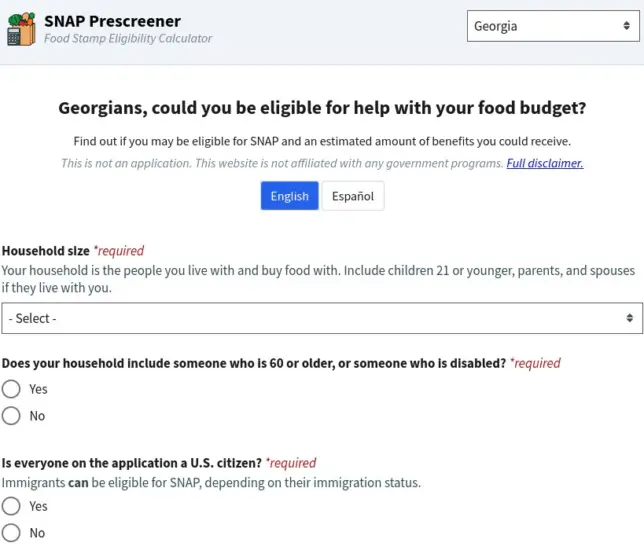

The Georgia SNAP calculator isnt an official tool from the Division of Family & Children Services, however, it can provide the quickest way to determine if its worth your time in completing a SNAP application to receive food stamp benefits in Georgia.

New York Food Stamp Benefits

If your household is struggling to afford food, then applying for New York food stamp benefits could provide you with some much-needed relief.

The Supplemental Nutrition Assistance Program , also known as food stamps provides monthly cash benefits to eligible New York households.

Monthly SNAP benefits can be used to purchase eligible food items at grocery stores, markets, gas stations, bakeries, and more.

Benefits are accessed by using an Electronic Benefits Transfer Card, also known as the NY EBT Card.

In the state of New York, the food stamps program is administered by the Department of Social Services through the My Benefits NY online portal.

However, in New York City, the program is administered by the NY Human Resources Administration through the ACCESS HRA online portal.

When applying for New York food stamp benefits, one of the first questions applicants want to know is how the NY Food Stamp Calculator works.

The Food Stamp Calculator New York tells you exactly how much you will receive in monthly benefits.

This is important because it allows you to determine if food assistance will make a difference for your household.

With that said, lets get started on how to calculate your New York food stamp benefits.

Definition Of A Household

When determining eligibility, you need to provide information on all members of the household. A household, for this situation, is defined as all individuals that live together and purchase and prepare meals together. Likewise, you may have people living with you that are not considered part of your household. For example, if you rent a room to someone that does not purchase or prepare food with you, they are not part of your household. However, whatever they pay you for rent has to be counted under income.

There are two exceptions to this definition. The first is a household that includes a husband, wife, and children under 22 years of age. This group will be considered a household even if they purchase and prepare meals separately. The second exception is elderly or disabled individuals that are unable to purchase and prepare their meals independently and live with others that do.

Don’t Miss: What’s The Monthly Income For Food Stamps

How Much Food Stamps Will I Get

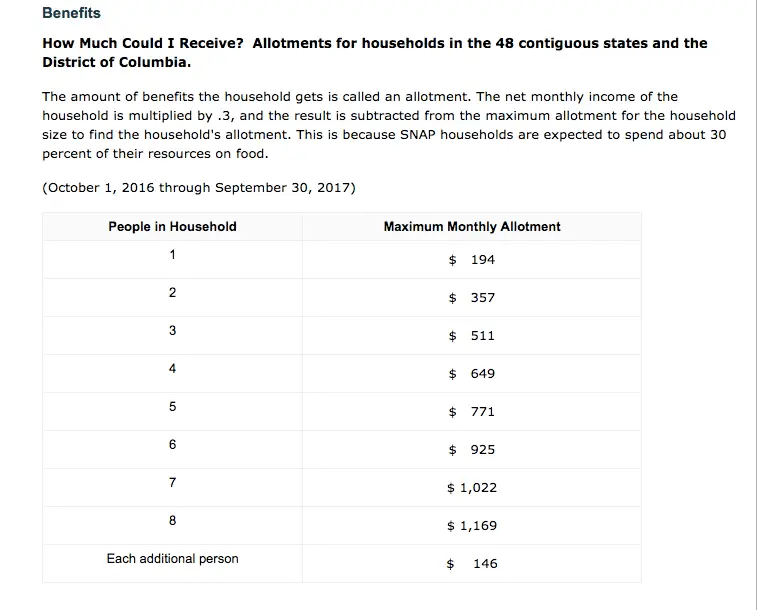

The amount of food stamps you receive comes down to a few major factors your household income, household size, and the number of allowable deductions.

Other factors such as assets and resources play a role in how much you can expect to receive in monthly food benefits.

Additionally, your monthly household income includes money earned from work, as well as payments from Social Security, Unemployment, and SSI.

Provide Your Personal Information

After that, you will be asked to provide some basic personal and financial information pertaining to your household.

This includes your:

- Disability Status

- Blind or Hearing Status

Once you complete this information, you will be asked to select the type of benefits you are interested in.

Be sure to select Food and Nutrition from the list, as well as any other benefits you are interested in.

For help, see the screenshot below.

After that, click the Next button to proceed.

Also Check: Department Of Human Services Application For Food Stamps

What Time Is Calfresh Ebt Deposited In California

Generally, your EBT payment is available at midnight on your payment date.

In the state of California, Food Stamps Benefits are deposited on EBT Cards over the first 10 days of every month. When your food stamps benefit is deposited on your EBT Card depends on the last digit of your case number. Here is the schedule of payment based on the last digit of your case number:

| If your Case Number ends in | Benefits are deposited on the |

| 1 |

Here are the most frequently asked California Food Stamps questions.

North Carolina Emergency Food Help

If you are facing a life-threatening situation and need immediate help with food, there is assistance available to you.

The Emergency Feeding Assistance Program provides food Banks, soup kitchens, drug and alcohol rehab centers, and violence prevention shelters for women and children with food to assist those facing a life-threatening situation.

Low income and elderly North Carolina residents can get immediate access to help with nutritious meals at no cost by visiting one of the centers listed above.

To locate a participating North Carolina food bank, food pantry, soup kitchen or another feeding site near you, visit the Feeding America website.

In addition, if your household has $100 or less in total resources and a monthly income less than $150, you can qualify for Expedited Food Assistance in North Carolina.

To apply for Expedited SNAP benefits in North Carolina, visit or contact a North Carolina DSS location near you.

You May Like: How Can You Qualify For Food Stamps

Who Qualifies For Snap In North Carolina

Individuals and households that qualify for North Carolina food stamps meet the SNAP income guidelines, or have someone in the household that is elderly or disabled.

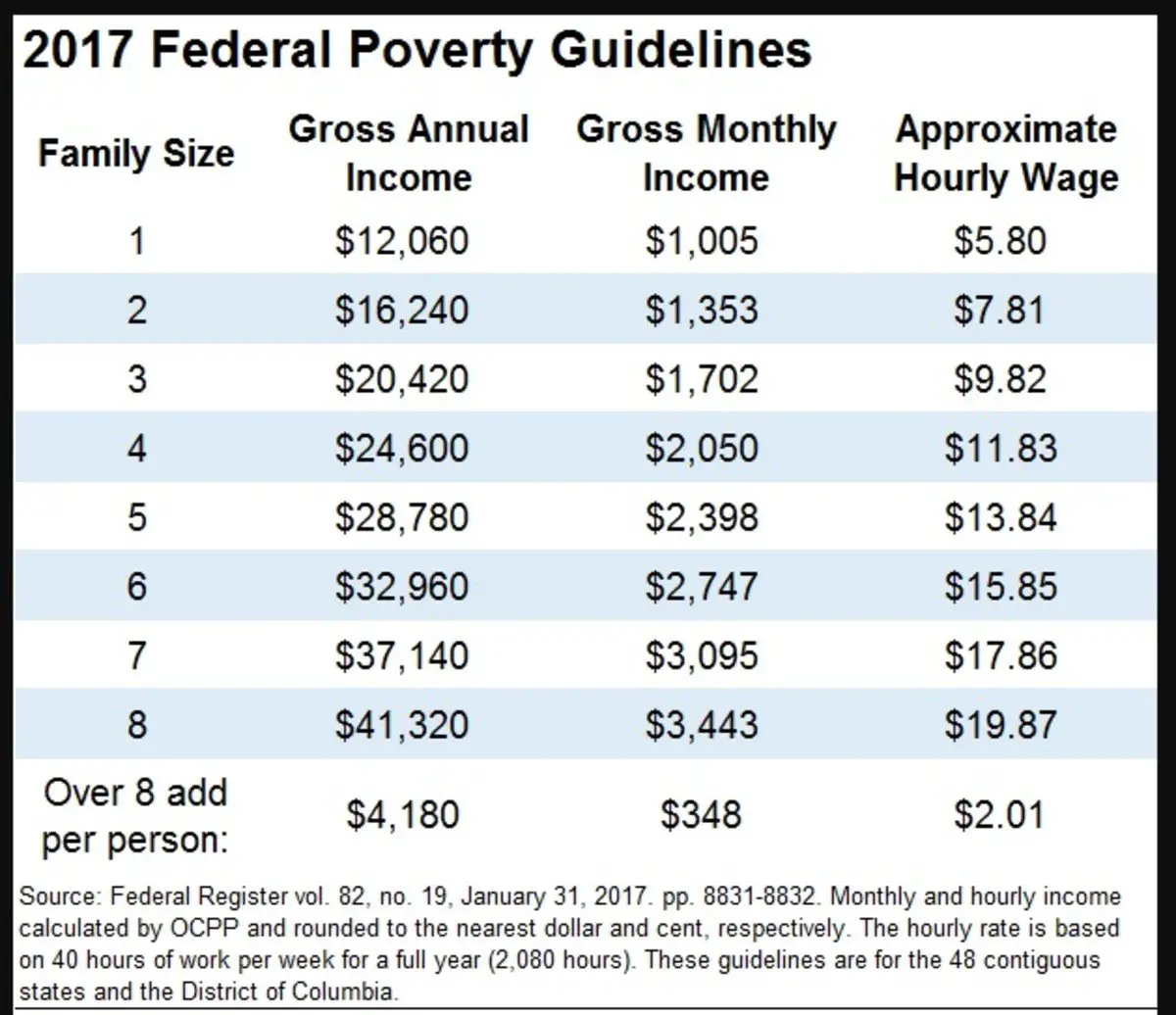

The North Carolina Food Stamps Income Limit is set by the USDA at 130% of the current years Federal Poverty Level.

To learn more about who qualifies for food stamps in North Carolina, continue reading below.

Who Pays Land Transfer Tax In Ontario

The buyer of a home will pay the land transfer tax, not the seller of a home. Ontario home buyers should budget for the land transfer tax as part of theirclosing costswhen purchasing a home, which can include costs of getting amortgage. While land transfer tax makes up most of the closing costs for buyers, other closing costs include legal fees, registration fees, and home inspection fees. To calculate how much land transfer tax you will need to pay, use the Ontario land transfer tax calculator at the top of this page.

There are ways that the land transfer tax can be avoided. For example, there is no land transfer tax between family members in Ontario if the property is gifted and no payment was made for the property.

Don’t Miss: Can I Do Walmart Pickup With Ebt

Can I Get Calfresh If I Am A College Student

Students, ages 18 through 49 enrolled in college or other institutions of higher education at least half time, students may be able to get CalFresh if they are:

- Physically or mentally unfit, or

- Working at least 20 hours per week, or

- Participating in a state or federally financed work-study program, or

- Participating in an on-the-job training program, or

- Receiving CalWORKs benefits, or

- Taking care of a dependent household member under the age of 6, or

- Taking care of a dependent household member over the age of 6 but under 12 and do not have adequate child care to be able to attend school and work a minimum of 20 hours, or take part in a state or federally financed work-study program, or

- Single parent enrolled full time in college and taking care of a dependent household member under the age of 12, or

- Enrolled in college as a result of participation in the Job Training Partnership Act , or the Job Opportunities and Basic Skill program under Title IV of the Social Security Act.

- Voluntarily participating in The Workforce Innovation and Opportunity Act or The Extended Opportunity Programs and Services .

- Voluntarily participating in EOP, JOBS, DSPS, CARE, MESA, Puente, McNAIR, Former Foster Youth Programs, Cal Grant A& B that meet TANF requirements.

How Much Texas Food Stamps Can I Receive Each Month

You can receive anywhere from $250 to $1504 each month in Texas SNAP benefits if you qualify. The exact amount will be determined by your household size and householdincome.

The Texas Health and Human Services Department makes the final decision but you can estimate how much you might receive in monthly Texas food stamps by using the:

This is an estimate of the maximum amount of food stamps that Texas Health and Human Services will provide you.

| Household Size | Maximum Month Food Stamp Benefits In Texas |

| 1 | |

| Each additional person. | $188 |

Below is a table that lets you know what is the maximum income to qualify for Texas food stamps.

| Household Size | Monthly Income Limit For Texas Food Stamps |

| 1 |

Also Check: How Do You Qualify For Food Stamps In Pa

Citizenship And Residency Requirements For Snap In Texas

One of the most basic food stamp qualifications in Texas relates to the fact that all applicants must be U.S. citizens or legal residents. Keep in mind that not all legal aliens are accepted into this program, even if they meet the qualifications for other government programs. However, many are eligible.

If you have a mix of legal and non-legal residents in your household, you can still apply for benefits. Because SNAP eligibility is limited to applicants who have a legal status in the U.S., you will simply receive a different amount of assistance based on the number of household members who are deemed eligible. For example, it is possible for the children of non-citizens to receive benefits, even if their parents do not meet the requirements.

In addition to being a U.S. citizen or legal resident, you must also be a resident of Texas in order to receive help from the state HHSC. If you think that you qualify for food stamps, but you are not a resident of Texas, you may be eligible for assistance in your home state.

Each state operates its own benefits program, and the requirements are typically very similar. You may use a SNAP calculator to determine if you meet the requirements in a different state.

You May Like: Can I Apply For Food Stamps Online In Arkansas

Do You Pay Double Land Transfer Tax In Toronto

Toronto is the only city in Ontario to have a municipal land transfer tax. Neighbouring cities, such as Mississauga, Brampton, Vaughan, and Markham do not have a municipal land transfer tax, and only have to pay the provincial land transfer tax. If you were to purchase a home inTorontos housing market, you will pay double the land transfer tax compared to someone purchasing a home anywhere else in the province before rebates, such as in Mississauga or Ottawa.

Don’t Miss: Do Trader Joes Accept Ebt

Vive En Su Hogar Alguna Persona Mayor Y / O Discapacitada

ATTENTION: This calculator has been updated to reflect federal guidelines that are effective October 1, 2022. Also, this calculator is intended to provide an ESTIMATE on what your benefits would be. Your actual benefits may end up being slightly more or less.

Esta calculadora se ha actualizado para reflejar las pautas federales vigentes a partir del 1 de octubre de 2022.

Who is part of my household?

If your family buys, prepares, and stores food separately from another family that lives with you, then you may be considered separate households. Otherwise, both families will be considered part of the same household for food stamps.

What counts as income?

Enter your monthly income before taxes. Include the income of anyone in your household over the age of 17. If you have children who do not go to school and have a job, their income must also be counted.

What do I do if my earned income changes from month to month?

Take your best guess based on your current work situation. When you apply for food stamps, they will ask you for check stubs from one to three months back to determine your expected income. If you do not have a job, enter $0. The food stamp office can help you determine your average income.

What counts as unearned income?

This could include child support, Social Security, financial assistance, or regular payments you receive from a family member or friend. Lump sums of cash do not count as income.

What counts as an out of pocket medical cost?

Who Has To Pay The Non

Homebuyers that are not Canadian citizens or permanent residents will need to pay the NRST. This includes foreign corporations that are based in another country and Canadian corporations that are controlled by a foreign national or foreign corporation.

The Non-Resident Speculation Tax is charged if one purchaser is a foreign national, even if all other purchasers are Canadian citizens or permanent residents.

For example, three homebuyers are looking to buy a $500,000 home in Toronto. Two of the purchasers are Canadian citizens, but one of them is a foreign national. The 25% NRST will be applied to the whole purchase price. This would equal $125,000.

You May Like: Stores That Accept Ebt For Delivery

North Carolina Food Stamps Customer Service Information

For additional help completing your North Carolina Food Stamps Application, contact your local county assistance NC DSS office.

You can contact the North Carolina Food Stamps Customer Service phone number by calling them at .

Additionally, you can contact the North Carolina Department of Health and Human Services Customer Service Center by calling .

Customer Service representatives are available to help you Monday through Friday.

Exemptions To Calfresh Income Limits

If all members of your household are receiving TANF, SSI, or in some places general assistance, you do not have to meet the food stamps income test.

In addition, while most households must meet both the gross and net income tests, if you live in a household where there is an elderly person or a person who is receiving certain types of disability payments, then that household will only have to meet the net income test to qualify for California food stamps .

Read Also: Food Stamp Office In Columbia Missouri

What Day Will My North Carolina Food Stamps Be Deposited Into My Ebt Card Account

Your NC food stamp benefits will be deposited onto your North Carolina EBT Card at 6am on your assigned day between the 3rd and the 21st of each month.

The North Carolina EBT Deposit Schedule is based on the last-digit of your Social Security Number .

Use the chart below to find out your NC EBT Deposit Date:

| If your SSN ends in: | Your benefits will be available after 6am on the: |

| 1 | |

| 0 | 21st of every month |

If you do not have a Social Security Number, your SNAP benefits will be deposited on the third day of every month.

How To Calculate Your Net Income

Net income for the CalFresh Income Limits is your households total gross monthly income minus any allowable expenses.

All allowable expenses should be subtracted from your gross monthly income. To find out what all of the allowable deductions are, continue reading below.

Deductions Allowed for Net Income

To calculate your net monthly income, you must deduct approved household expenses. Here are the expenses that can be deducted from your households gross income:

- 20% deduction from Earned Income

- Standard deduction of $177 for households with 1 to 3 people and $184 for households with 4 or more people

- Dependent care deduction when needed for work, training, or education

- A deduction for elderly or disabled members medical expenses that exceed $35 a month

- Any legally owed child support payments can be deducted

- Homeless Households shelter costs deduction of $159.73.

- A deduction for excess shelter costs that exceed more than half of the households income .

Also Check: How Do I Apply For Food Stamps In Ky

How Much Is College Tuition In Mexico

Although the average costs of higher education overall are around US$5,000 per year, this varies quite a lot. Public universities in Mexico can charge as little as $378 up to $818 per year for undergraduate programs, while private institutions will charge considerably more, between $1,636 and $16,353 per year.

Recommended Reading: What Is The Food Stamp Office Phone Number

Comparison Of Ontario Land Transfer Taxes With Other Provinces

I am a first-time home buyer

I am a resident of Nova Scotia

History of the Ontario Land Transfer Tax

Introduced to Ontario in 1974, the ConservativeOntario Governmentpresented the provincial Land Transfer Tax to property buyers with a starting percentage of 0.3% for up to $35,000 of the purchase price of property and 0.6% for the rest. In 2008, a municipal Land Transfer Tax was introduced in addition to the provincial one to home buyers in Toronto and a Non-Resident Speculation Tax became effective for the Greater Golden Horseshoe Region in 2017. Ontarios Land Transfer Tax rates were last updated in 2017. Land transfer tax rates in Ontario arent changed often. When Ontario land transfer tax rates were last updated in 2017, it was the first update in 20 years since 1997.

Read Also: Can I Get Food Stamps If I M Not Working

Calfresh Standard Deduction Amount

When determining your eligibility for California food stamp benefits, you will subtract a standard deduction from your total household income. The standard deduction amount is based on two factors your household size and location.

To find out how much your standard deduction will be, use the SNAP Standard Deduction Chart for the fiscal year 2022 provided below:

| Florida SNAP Standard Deductions for Fiscal Year 2022 |

| Effective October 1, 2021 September 30, 2022 |

| Household Size |

| Determine if shelter costs are more than half of adjusted income | $700 total shelter $602 = $98 excess shelter cost |

| Subtract excess amount, but not more than the limit, from adjusted income | $1,204 $98 = $1,106 net monthly income |

| Apply the net income test | Since $1,106 is less than $2,209 allowed for a 4-person household, this household has met the income test. |

Step 2

Determine if your Net Monthly Income is Eligible

Now that you have your net monthly income, you can see if your income is eligible for California food stamp benefits. Use the chart and follow the steps below to determine your eligibility.

| Household size | |

| Each additional member | $379 |