Do You Have To Use All Your Food Stamps In One Month

If youre receiving food stamps, you may find that sometimes you dont use the entire allotment for the month. Fortunately, you wont lose any food stamps that are left over at the end of the month. Any balance remaining on your Electronic Benefit Transfer, or EBT, card will roll over to the following month.

How To Calculate Net Income

Now that you have your households monthly gross income, you can use that number to calculate your net income. Use the chart below to calculate your monthly net income and determine if your household is eligible for Florida SNAP EBT benefits.

Please not that there may be exceptions to the net income calculation. These exceptions apply to household members that are elderly or disabled. For more information or immediate help, in your county.

| How to Calculate SNAP Net Income | |

| Net Income Calculation: | |

| Determine if shelter costs are more than half of adjusted income | $700 total shelter $602 = $98 excess shelter cost |

| Subtract excess amount, but not more than the limit, from adjusted income | $1,204 $98 = $1,106 net monthly income |

| Apply the net income test | Since $1,106 is less than $2,209 allowed for a 4-person household, this household has met the income test. |

Food Stamp Qualifications For Applicants Born Outside The Us

You may be wondering, Who can qualify for food stamps if they were born abroad? If you are an immigrant who was born outside of the United States, this can be a tricky question. This is due to the fact that the answer depends on what type of immigration status you have. Can a green card holder get food stamps? may be the next question that comes to your mind. If you are a legal permanent resident in the country, you may be able to receive SNAP if you meet one of the following criteria:

- You are a minor.

- You have lived in the United States for five years or more.

- You receive insurance or benefits due to a disability you have.

However, if you are wondering, Can non citizens get food stamps? the answer is no. You must be a U.S. citizen or have legal permanence in the country to qualify for SNAP.

You May Like: Okc Food Stamps

Being Approved For Food Stamp Benefits

When you are found eligible for SNAP benefits, you will receive an Electronic Benefit Transfer card. Your benefits are automatically loaded onto the card each month. The card will work like a debit card with funds deducted from the account with each purchase. The card can only be used at stores that are approved to accept them.

New Snap Rule Would Cost Many Of Nations Poorest Their Food Aid

Statement by Robert Greenstein, President

“The Trump Administration issued a draconian rule in the Supplemental Nutrition Assistance Program that will cut off basic food assistance for nearly 700,000 of the nations poorest and most destitute people.”Today, the Trump Administration issued a draconian rule in the Supplemental Nutrition Assistance Program that will cut off basic food assistance for nearly 700,000 of the nations poorest and most destitute people. Those affected SNAP participants ages 18 through 49 who arent raising minor children in their homes are among the poorest of the poor, according to U.S. Department of Agriculture data. Their average income is just 18 percent of the poverty line. Their average monthly SNAP benefits are about $165 per month.

A longstanding, harsh provision of SNAP limits these 18- through 49-year-olds to just three months of benefits, while not employed for at least 20 hours a week, out of every three years. Because of its severe nature, this provision of law also allows states to seek, and USDA to grant, waivers of this three-month cut-off for areas where insufficient jobs are available for these individuals, such as when unemployment is elevated.

Most of these individuals are ineligible for any other form of government financial assistance because they arent elderly, severely disabled, or raising minor children. For many of them, SNAP is the only assistance they can receive to help make ends meet.

Don’t Miss: Apply For Food Stamps In Oklahoma City

Can I Get Food Stamps If I Am On The Gi Bill

Military veterans and others who are taking advantage of the GI Bill program are sometimes curious if GI Bill money or BAH income is counted towards the income requirements for SNAP. The answer is yes, BAH income is typically counted towards your gross income when determining if you are eligible for food stamps. As such, your GI Bill benefits do contribute to your income, even though that income is temporary and not taxed. Receiving BAH does not stop you from being eligible for food stamps outright, it is just included in the income calculation.

SNAP Overview

The federal food stamp program is now called the Supplemental Nutrition Assistance Program . SNAP is the largest domestic program available to nutritional assistance, and it is available for low-income individuals and families that meet the eligibility requirements. The federal food and nutrition service works with a wide range of other organizations including state agencies, nutrition educators, and neighborhood organizations to provide SNAP recipients with nutrition assistance and information.

The local agencies provide aid for people while they are going through the application process, and once people are approved, these agencies help them to access their benefits. The goal of this program is to provide monetary assistance with food while the members of the household are actively looking for work or working in positions that do not pay enough to cover food and living costs.

Benefits

Example of Benefits Allotment

Special Rules For Elderly Or Disabled

There are several exceptions and exemptions to the SNAP procedures if a household member is elderly or disabled. A person is considered elderly for SNAP purposes if they are 60 years or older.

A person is considered disabled for SNAP purposes if they are:

- Receiving federal disability or blindness payments under the Social Security Act or SSI.

- Receiving a disability retirement benefit from a governmental agency because of a disability considered permanent under the Social Security Act.

- Receiving an annuity under the Railroad Retirement Act while being eligible for Medicare and considered disabled under the SSI rules.

- A veteran who is totally disabled, permanently housebound or in need of regular aid or attendance.

- A surviving spouse or child or a veteran who is receiving VA benefits and is considered to be permanently disabled.

The SNAP program is one of several programs offering financial help for senior citizens.

Also Check: How To Get Food Stamps In San Diego

Who Is Eligible To Receive Snap Benefits

Households must meet eligibility requirements and provide information and verification about their household circumstances. To participate in the Supplemental Nutrition Assistance Program:

- Households may have no more than $2,250 in countable resources, such as a bank account . Certain resources are not counted, such as your home and one vehicle.

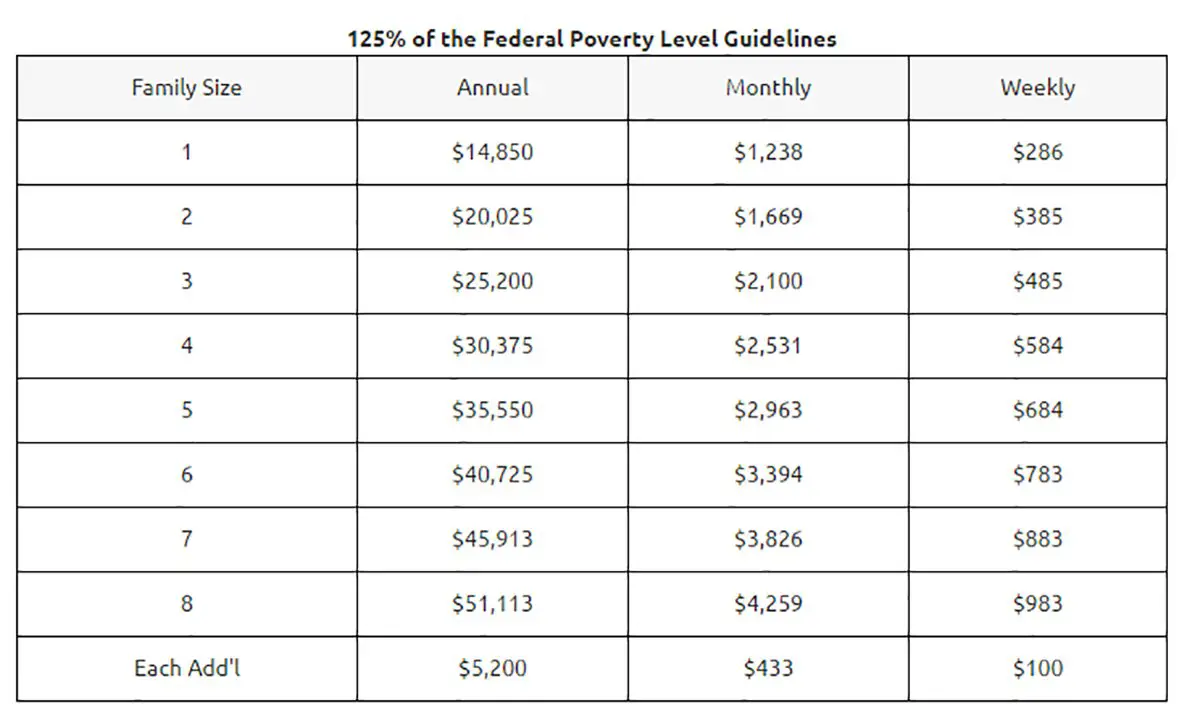

- The gross monthly income of most households must be 130 percent or less of the Federal poverty guidelines. Gross income includes all cash payments to the household, with a few exceptions specified in the law or the program regulations.

- Net monthly income must be 100 percent or less of the Federal poverty guidelines. Net income is figured by adding all of a household’s gross income, and then subtracting the approved deductions for shelter costs, dependent care costs, child support payments made to someone not living with the household, and medical expenses for individuals over the age of 60 or with a disability. Households with a person with a disability or age 60 or older are subject only to the net income test.

- Most able-bodied adult applicants must meet certain work requirements.

- All household members must provide a Social Security number or apply for one, if they wish to receive benefits.

- Federal poverty guidelines are established by the Office of Management and Budget and are updated annually by the Department of Health and Human Services.

What Are Deductions And How Do They Affect Snap Eligibility

There are seven allowable deductions that you can consider when determining your net pay. To figure out your net income, you have to figure out which allowable deductions apply to your situations and deduct them from your gross income. The difference is your net income.

Each state outlines employment requirements as part of SNAP eligibility. These requirements include:

- Registering for work – some states will require you to provide proof that you are actively applying for work on a weekly basis.

- Not voluntarily quitting your job If you are unemployed, you need to prove that it was not your choice.

- Not purposely reducing your hours If your hours are cut making you income eligible, you will need to prove that the cut in hours was beyond your control.

- Taking a job if offered

- Participating in state-offered employment and training programs.

SNAP benefits will be discontinued if any of these employment requirements are not followed. There are people exempt from the employment requirements. This includes children, seniors, pregnant women, and individuals that are exempt from working for health reasons.

Employment requirements apply to applicants determined to be Able-Bodied Adults without Dependents . Under the Personal Responsibility and Work Opportunity Reconciliation Act of 1996, ABAWDs are limited to 3 months of SNAP benefits over a 36-month period unless they are doing at least one of the following:

Also Check: Oregon Food Stamp Income Limits

How To Apply For Florida Food Stamps

There are four ways you can apply for food stamps in Florida. But before we get into that, here are the documents and information you are going to need to complete the application form:

- Social Security number and date of birth.

- Income information such as job, child support or any other sources.

- Resource or asset information such bank accounts , vehicles, homes, land or life insurance.

- Housing expenses such as rent or utilities.

- Health insurance information.

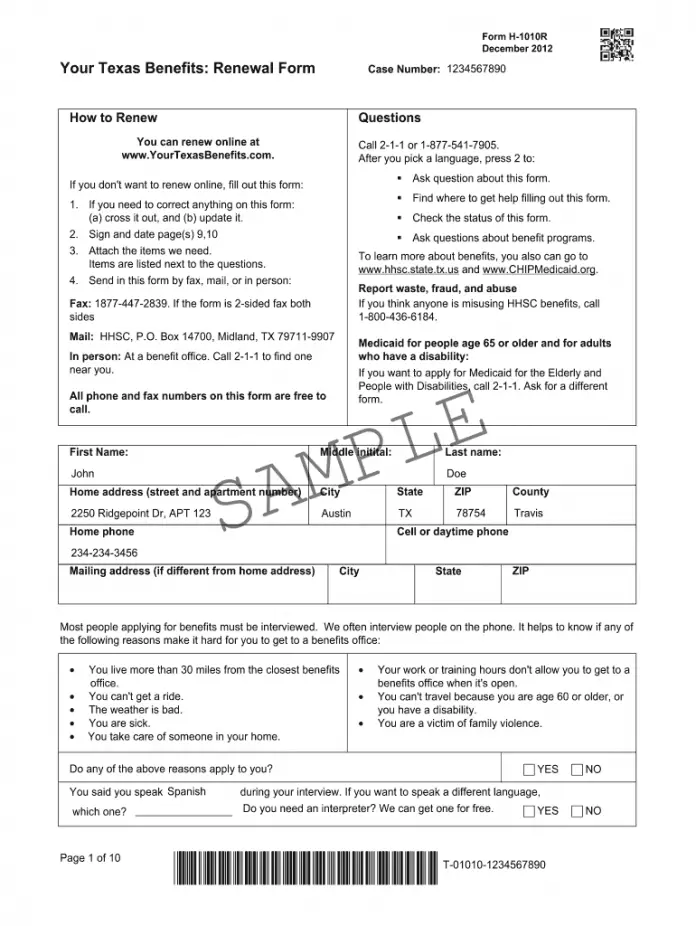

How Do I Apply For Snap

There are several options for applying. Only one member of the households needs to apply for the total household, but everyone living in the household needs to be included on the application along with their income. Most states provide an online application to start the process. See the States website section for a link to your states website. If your state does not provide an online application or you do not have access to a computer, you can go to your local state or county office to apply.

As part of the application process, you will need to go to your local state or county office for a face-to-face interview. If you are not able to go to the local office or apply online, you can designate an authorized representative. This is someone you give authority to represent you. You have to designate the person in writing to be official. This person can be a friend or relative.

The entire process generally involves filling out an application, going in for a face-to-face interview, and providing verifications for needed information such as income, residency, and expenses. If because of age or disability, an applicant is unable to go to the office and cannot appoint a representative, the interview may be waived at the discretion of the local office. However, if the interview is waived, the applicant will have to have a phone interview or consent to a home visit instead.

Don’t Miss: Snap Income Guidelines Oregon

Florida Snap Standard Deduction Amount

When determining your eligibility for Florida food stamp benefits, you will subtract a standard deduction from your total household income. The standard deduction amount is based on two factors your household size and location.

To find out how much your standard deduction will be, use the SNAP Standard Deduction Chart for fiscal year 2022 provided below:

| Florida SNAP Standard Deductions for Fiscal Year 2022 |

| Effective October 1, 2021 September 30, 2022 |

| Household Size |

| $1,500 earned income + $550 social security = $2,050 gross income. | |

| If gross monthly income is less than the limit for household size, determine net income. | $2,050 is less than the $2,871 allowed for a 4-person household, so determine net income. |

Is There A Gross Income Test For Snap

ALERT: Many of the rules in the SNAPAdvocacy Guide do NOT apply during the pandemic. Please go to the following COVID-19 & DTA benefits page: until further notice for more information about changes.

Yes! Most SNAP households need to have gross income under 200% of the federal poverty level. Gross income is your monthly income before any taxes or deductions. 106 C.M.R § 364.370, 106 C.M.R. § 365.180.

|

Household Size |

|

|

$6,607 |

*These numbers are effective as of January 15, 2020. For the most up to date numbers, go to: Masslegalservices.org/content/ma-snap-calculation-worksheet

Households that Pay Child Support

If a household member pays legally obligated child support to a child outside the home, the child support is not counted in the initial gross income test. 106 C.M.R. § 363.230. See Question 82.

Elder/Disabled Households above 200% FPL

There is no gross income test for households that include an elder or disabled member. However, to qualify for SNAP, the household must meet the asset test. See Question 67. These households must also have very high shelter and/or medical expenses to qualify for any SNAP benefit.

Sanctioned households and 130% FPL

Snapshot of the SNAP income and asset tests

| Household under sanction due to IPV | YES | 130% FPL |

* But households net income must be low enough to qualify for a benefit. Households above 200% FPL gross income do not receive the $16 minimum benefit.

You May Like: Where Can I Apply For Food Stamps In San Diego

Does Snap Check Your Bank Account

Your Department of Social Services or food stamp issuing office may request current bank statements as part of the application process. The Federal Government requires verification of citizenship, income, Social Security numbers and other qualifying information additional verification is a state option.

When Did The Program Begin

The Supplemental Nutrition Assistance Program traces its earliest origins back to the Food Stamp Plan, which began in 1939 to help needy families in the Depression Era. The modern program began as a pilot project in 1961 and was authorized as a permanent program in 1964. Expansion of the program occurred most dramatically after 1974, when Congress required all states to offer food stamps to low-income households. The Food Stamp Act of 1977 made significant changes in program regulations, tightening eligibility requirements and administration, and removing the requirement that benefits be purchased by participants.

Don’t Miss: Kentucky Food Stamp Income Limit